Battling Basket Abandonment Report: No Margin for Error in Zero Tolerance Era

5 Minute Read

Our report, 'Battling Basket Abandonment 2024', developed in partnership with GFS, delivers crucial insights into the staggering £34.4 billion annual loss UK retailers face due to basket abandonment. It addresses the essential strategies for optimising delivery and returns services to enhance customer satisfaction and retention amidst rising economic pressures and technological advancements.

Below are some exerts from the report, download the full report to access even more insights and data.

Click here to explore working with Retail Economics for creating thought leadership papers like this.

What can you get from this report?

-

Uncover the substantial economic impact of basket abandonment on UK retailers, costing an astounding £34.4 billion annually

-

Dive into the key drivers of online shopping basket abandonment, including consumer expectations and delivery-related challenges

-

Explore effective strategies for reducing basket abandonment through optimised delivery and returns services

-

Gain insights into consumer behaviour, highlighting the importance of delivery choice and speed over cost, especially among younger and affluent shoppers

-

Learn how implementing diverse delivery options can significantly decrease basket abandonment and enhance customer loyalty

-

Understand the critical role of technological advancements in shaping consumer expectations and improving the online shopping experience

Contents:

-

Introduction

-

Section 1: The true cost of basket abandonment

-

Section 2: Unpacking basket abandonment

-

Trend 1: Abandonment pressure across categories

-

Trend 2: Delivery priorities for shoppers

-

Trend 3: Consumers' attitudes towards paid delivery and returns

-

Section 3: Strategies for tackling basket abandonment

-

Conclusion

Introduction

Abandoned online shopping baskets continue to haunt retail sales performances.

Nearly every abandoned cart tells a frustrating story of a lost sales opportunity where customer needs are unmet. In this sequel to our first report (Battling Basket Abandonment: Mastering Delivery Choice & Convenience for Frictionless Shopping), we decode these stories to better understand the psychological and situational triggers that lead consumers to abandon their online purchases at that ‘critical click’.

In today's volatile retail landscape, basket abandonment costs UK retailers a staggering £34.4 billion annually, up £2.9 billion from last year, underscoring persistent challenges in meeting consumer expectations. Consequently, many retail brands still struggle to nail this vital point of the customer journey. Unsatisfactory delivery and returns services risk basket abandonment - no matter how good a retailer or product is.

Ultimately, there’s heightened risk compared to last year. Economic pressures in 2024 are shifting to heighten the risk of deliver-related basket abandonment among commercially significant younger, middle-aged and higher-income individuals. This means the stakes for retailers have become even greater, especially against a backdrop of zero tolerance for sub-standard offerings. However, the report demonstrates there’s opportunity for retailers to monetise through premium services, as younger and affluent consumers remain most willing to pay for convenient delivery and returns.

For many consumers, purchasing decisions have become subject to greater deliberation and caution. This comes amidst more fragile consumer confidence and higher borrowing rates, coupled with rapid technological advancement, particularly in AI. Consequently, consumers are intensely assessing the value of their purchases as household budgets are squeezed. They seek more meaningful experiences and tangible benefits that align with more cautious spending habits. In this context, delivery and returns services have transitioned from conveniences to necessities. Importantly, they now play a more crucial role in either ‘sealing the deal’ or leading to basket abandonment. This is not just limited to initial purchases, but acts as a trigger for customer retention and repeat purchases.

This report not only uncovers fresh challenges and opportunities in delivery services, but also equips brands with actionable strategies to satisfy customer expectations for choice and convenience and increase sales conversion at the checkout. We spotlight notable trends among key consumer segments—younger, middle-aged, and affluent shoppers—who demand exceptional flexibility in delivery options to support their lifestyle choices in non-food categories. Their readiness to pay for premium, bespoke delivery and returns solutions also underscores the importance of adaptability and customer-focused strategies in securing sales at online checkout.

This report is divided into three main sections:

-

The true cost of basket abandonment

-

Unpacking basket abandonment

-

Strategies for tackling basket abandonment

Section 1: The true cost of basket abandonment

In the dynamic online retail environment, successful conversions from “browsing to purchase” heavily rely on anticipated post-purchase experiences, emphasising the importance of customer-centric delivery and returns services.

We define ‘basket abandonment’ as the proportion of intended online transactions that are not completed due to delivery-related factors. Today, online basket abandonment costs a staggering £34.4 billion in lost sales lost sales left at checkout annually due to multiple delivery-related factors.

Basket abandonment results in £34.4 billion loss

Concerningly, abandonment has edged up over the past year. Now, 26.4% of attempted online purchases are abandoned by UK shoppers, specifically due to a lack of preferred delivery options at checkout, up from less than a quarter in 2023.

Drivers of abandonment

Our research identifies three principal drivers of basket abandonment, these include:

Technology: In an era of rapid technological advancement, consumers expect seamless, friction-free experiences across all touchpoints. The growth of digital platforms has raised consumer expectations, demanding exceptional user experiences. Friction or inconvenience, like limited delivery options, opaque lead times, or clunky checkouts, can lead to frustration and risk abandonment.

Suppliers: Greater competitions among third-party logistics providers (3PL) has driven greater choice in delivery options for consumers, which has amplified customer expectations around delivery experiences, convenience and choice. But increased use of 3PLs has introduced greater variability in the quality of delivery experiences among providers, adding challenges with retailers grappling to maintain consistency and reliability across their delivery networks.

Economic: While the economic outlook is slowly improving, projections from the Bank of England and the Office for Budget Responsibility suggest only flat to modest growth in 2024. Also, household finances are not expected to rebound to pre-pandemic levels this year. Key consumer groups, especially aspirational spenders, struggle with earnings that do not keep up with rising housing costs. This financial strain, coupled with post-pandemic desires for leisure pursuits, has pointed retail spending towards value.

Abandonment drivers at a glance

Technology and suppliers: High expectations leading to abandonment

Technological advancements and a greater choice of suppliers have significantly raised consumer expectations for delivery services. Consumers increasingly switch to retailers who can seamlessly meet their demands, showing little tolerance for friction, sub-standard service, or limited delivery options.

Now, almost two-thirds (64.5%) of consumers expect more from retailers' delivery services than previously. Failing to meet these heightened expectations can be costly in today’s fiercely competitive online marketplace. Even minor discrepancies can cause consumers to abandon purchases or switch to rival brands.

Our research shows that consumers consider delivery options integral to decision-making when shopping with a non-food retailer. The majority (60.8%) of online shoppers believe a wide variety of delivery options at checkout matters, particularly among commercially significant 25- to 44-year-olds, upper-middle, and most affluent households.

Fig. 1: Younger and more affluent consumers at increased risk of basket abandonment

Q. Thinking about your online shopping habits for non-food retail products now compared to last year, how has the frequency of abandoning a shopping basket changed?

(Download the full report for the rest of this section)

Section 2: Unpacking basket abandonment

Although abandonment is increasing among economically significant groups, resolving these issues is possible by providing diverse delivery options through multiple providers. This solution, however, hinges on a detailed understanding of abandonment trends across different categories, the comparative value of choice versus cost, and consumer willingness to pay. We explore these aspects in this section, using three key trends.

Trend 1: Abandonment pressure across categories

Our research shows that basket abandonment due to delivery-related factors is widespread across non-food retail categories, with underlying delivery-related issues driving these trends (Fig. 4).

Fig. 4: Abandonment affects all categories similarly

Source: Retail Economics, GFS

Stark differences in abandonment by age

Abandonment appears to be directly correlated with age. However, one group constitute significant abandonment – the under-45s. These cohorts are digitally savvy and shop online more than others, exerting universal pressure on abandonment rates across all non-food categories. For instance, the under-25s are four times (40.6%) more likely to abandon clothing and footwear purchases than the over-65s (10.6%).

(Download the full report for the rest of this trend)

Trend 2: Delivery priorities for shoppers

Shoppers prioritise four components of delivery

Providing delivery options that match complex customer journeys and needs cannot be overstated. Preferences and priorities surrounding delivery involve four key factors for consumers:

-

Reliability

-

Cost

-

Choice

-

Speed

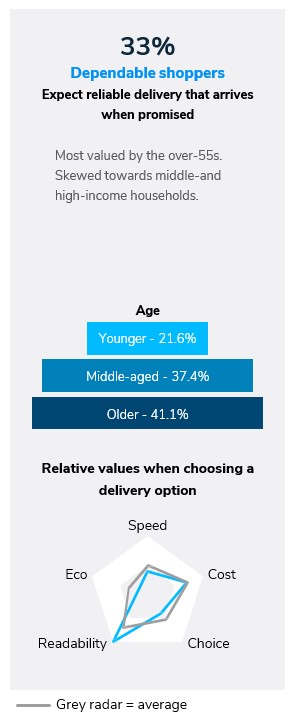

The research identifies four shopper types based on these key factors, with each cohort skewed towards shoppers of different age and affluence explored in more detail in Figure 8.

Fundamentally, consumers prioritise reliable deliveries. Service reliability matters across groups. Here, retailers must provide visibility to create assurances, meaning third-party providers must look to protect deliveries by pre-empting issues and refining delivery processes to build trust with consumers.

However, cost matters too. The competitive nature of delivery means that almost a third of consumers prioritise price. But even among cost-conscious consumers, the lowest price or free delivery option isn’t necessarily the best value option. Leveraging technology to deeply understand shoppers and personalise offerings is becoming critical to the value proposition.

Compared to their peers, younger, middle-aged, and more affluent consumers are the most likely to consider choice and speed as the most important factors, explored in greater detail in the table below.

Fig. 8: Shoppers' delivery priorities span four factors

Source: Retail Economic, GFS

(Download the full report for the rest of Fig.8)

Stark differences in abandonment by age

Essentially, value is derived from offering shoppers a range of delivery options, rather than just low-cost options. When shoppers have to consider what matters more between cost and choice, the majority of consumers (51%, on par with last year) ultimately want a variety of options that meet their needs, rather than fewer, low-cost options.

This is because Shopper Missions are dynamic, meaning needs vary depending on category, occasion, and time of purchase; they include:

Impluse: Browsing for inspiration and stumbling across something you'd like to purchase

Top-up: Buying a product you regularly use or need to stock up on

Considered: Looking for a specific item, comparing options, typically high value

Gifting: Shopping for gifts for family, friends or other loved ones

Distress: Shopping to replace a broken item or something you need urgently

This diversity underlines why offering a broad choice of delivery options to cover potential needs is critical, especially for consumers whose decisions are dictated by their circumstances at a point in time and income.

(Download the full report for the rest of Trend 2 and Trend 3)