Delivery Lockers: Unlocking the Final Mile

5 Minute Read

Our report, 'Delivery Lockers - Unlocking the Final Mile',published by Retail Economics in partnership with InPost delivers crucial insights into the evolving use of delivery lockers in the UK retail landscape, consumer delivery preferences, and the integration of sustainable urban logistics. Essential for retailers aiming to refine strategic operations and adapt to ongoing market transformations.

Below are some exerts from the report, download the full report to access even more insights and data.

Click here to explore working with Retail Economics for creating thought leadership papers like this.

What can you get from this report?

-

Discover how delivery lockers are revolutionizing the final mile in UK's retail landscape in 2024.

-

Gain insights into consumer preferences for delivery options, highlighting the rising popularity and efficiency of delivery lockers.

-

Understand the economic implications of delivery choices in the current UK retail environment, including impacts of inflation and interest rates.

-

Explore the strategic role of delivery lockers in reducing last-mile delivery emissions, supporting the shift towards sustainability in retail logistics.

-

Learn about the "15-minute city" concept and its potential to integrate delivery lockers into urban planning for enhanced consumer convenience.

Contents:

-

Introduction

-

Section 1: The Delivery Landscaoe & Omnichannel Journey

-

Section 2: Delivery Expectations and the Cost of Friction

-

Section 3: Evolving Consumer Behaviour and '15-minute cities'

-

Conclusion

Introduction

The retail landscape is rapidly evolving and delivery lockers are becoming integral to its evolution. This ongoing transition reflects developments in technology, operational capabilities and shifts in consumer behaviour.

Consequently, today’s customer journeys have become highly complex with online and in-store experiences requiring flexible and adaptable approaches to meet customer needs across various touchpoints and platforms. By integrating digital technologies and enhancing online experiences, retailers aim to provide a seamless and cohesive journey for consumers across all channels.

However, despite this digitalisation, physical touchpoints such as stores, delivery lockers, and pick-up-drop-off locations remain integral to the omnichannel journey. These physical touchpoints offer convenience, immediacy, and tactile experiences that complement the digital shopping experience, enriching the overall customer journey and enhancing engagement. When considering the current macroeconomic climate and retail trends, it becomes immediately apparent as to how and why out-of-home delivery is highly popular, necessary, and demand is rising.

This research looks at the rise of delivery lockers in a more complex environment (‘delivery’ lockers also referred to as parcel-, automated-, or self-service lockers). It explores various issues around online delivery, and consumer sentiments about the current state of play.

Our research indicates that over half of consumers have already embraced delivery lockers, particularly appealing to younger, affluent, and frequent online shoppers. This trend highlights the growing demand for hassle-free and efficient delivery solutions that cater to diverse consumer needs.

Over half of consumers have already embraced delivery lockers

From an economic perspective, the outlook for UK retail remains uncertain. Consumers are grappling with tough economic conditions amidst a cost-of-living crisis which is entering a second phase, where inflation rate hikes have transitioned to elevated interest rates (climbing to over 5% impacting 4.4 million households exiting fixed-rate mortgages) (Source: Bank of England, Retail Economics analysis).

This shift has impacted more income brackets, and consumers are still focussed on value and reducing costs. Despite inflation cooling entering 2024, the recovery is being slowed by geopolitical tension and energy price increases, with consumer confidence remaining subdued. Also, pandemic-induced impacts are still being felt.

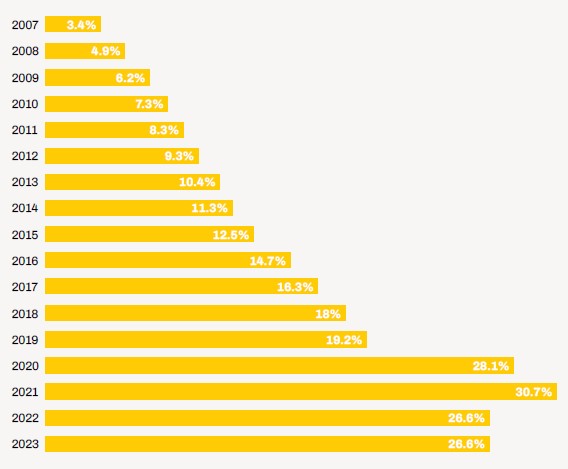

During the pandemic, consumer behaviour and preferences were altered greatly. Online penetration tipped above 30% of total retail sales in 2021 (Fig. 1), and new cohorts of consumers experienced shopping online for the first time for many products. Interestingly, our research shows that today, at least half of consumers’ pre-purchase activity is now online; so, although there’s been a return to physical stores, consumers are well versed in online shopping processes and tactics.

Fig. 1: Internet sales as % of total retail sales

Source: ONS

The Delivery Landscape & Omnichannel Journey

Advances within the delivery landscape, combined with advances within omnichannel retailing are reshaping many parts of the industry. Consumers are demanding seamless experiences, and delivery expectations have soared to new heights. As such, the stakes are high. Retailers offering inadequate delivery options run the risk of consumers abandoning carts, underlining the importance of flexible delivery solutions for sales growth.

Today’s consumers demand delivery choices tailored to their preferences and busy lifestyles. From same-day delivery to click-and-collect, retailers must cater to varying needs to remain relevant. Consequently, brands are pivoting towards ‘unified commerce’ where online, off-line, supply chain insight and a single customer view, operate in concert to deliver seamless and cohesive shopping experiences.

By quantifying shoppers’ delivery preferences, valuable insight can be gained into consumer behaviour and driving motivations, enabling retailers to tailor their delivery strategies effectively to increase conversion and market share.

In the UK, the perception that Royal Mail leads the delivery service sector persists, even though other courier networks collectively handle the majority of online shopping deliveries. Yet, as online shopping and its resultant returns have surged over the past decade, delivery lockers have gained prominence. InPost manages a considerable share of these returns, signifying a critical phase within the customer journey where many consumers may first encounter the brand.

Fig. 3 - UK consumers are particularly familiar with Royal Mail and Inpost for sending or returning items

Source: InPost, Retail Economics

Lockers increasingly the choice for Gen Z and Millennials

The research revealed that more than half (52.8%) of all consumers have used a delivery locker at least once; this rises to 71% for Gen Z, and 68% for Millennials (Fig. 5). One in three consumers used a delivery locker within the last three months of being surveyed (January 2024), rising to two in five consumers who used them in the last six months.

Fig. 5 - Locker users tend to be younger more affluent consumers

Source: InPost, Retail Economics

(Download the full report for the rest of this section)

Delivery Expectations and the Cost of Friction

In this section, we look at consumer preferences and expectations regarding delivery options offered by retailers. The research found that consumers are seeking diversity of options and cost effectiveness. This stems not only from the fact that individual preferences vary widely in general, but also because preferences change depending on a shopper’s circumstances at time of purchase (e.g. the shopping mission, physical location). The section also looks at typical delivery problems experienced by consumers, online basket abandonment, boycotting due to delivery, and preferences towards parcel lockers versus parcel shops.

Importance of delivery options for frequent online shoppers -

Our research highlights the critical role that a diverse array of delivery options plays in the online shopping experience. As consumers complete varied shopping missions, they require a wide range of delivery options to fulfil a multitude of needs. This section looks at why having a broad range of delivery options available at online checkout is important.

The work reveals that 90% of Gen Zs and Millennial consumers feel that having a range of delivery options is important to them (Fig. 10). A third of shoppers (35.5%) from these consumer groups said having options to meet their need for delivery speed was most important – and that they were happy to pay more for it.

The second most important reason, as stated by another third of shoppers from these cohorts, was cost (33.3%); indicating that they need options to alter the delivery mode and speed to save money.

Lastly, flexibility to deliver to different locations was considered most important by one in four (24.2%). For comparison, almost half (48.5%) of consumers aged over 65 years old feel that being offered a broad range of delivery options is unimportant.

Fig. 10: Why diverse delivery options are important for Gen Z and Millennials

Source: InPost, Retail Economics

Convenience and the shoppper mission

Convenience is hugely important for all types of shopper missions. Be it a considered purchase, an impulse buy, a gift, a distress purchase, or a top up buy, offering convenience within delivery helps to ensure customer satisfaction. However, there are different aspects or attributes of ‘convenience’, including:

The following graphic (Fig. 11) represents the importance of several crucial factors that come into play during the shopper mission.

The relative area of the rectangles which make up the mosaics in Figure 11 (and percentage values), indicate the proportion of consumers stating their most important aspect of convenience.

Fig. 11: The relative importance of convenience aspects for different shopper missions

Question: Which delivery factor is most important to you for the different shopping scenarios?

Source: InPost, Retail Economics

Considered purchases: Occur when consumers are searching for a specific item and want to compare options to ensure they make the right choice. They are typically associated with higher-value items and often involve longer pre-purchase research.

Here, consumers most value reliability, which increases in importance with age and within lower-income households. This likely reflects the significant investment in time taken during the research phase of the customer journey before committing to a purchase. Ensuring that orders are received when expected is particularly crucial for higher-value items. Free delivery also ranks as a close second since considered purchases are not often needed immediately.

(Download the full report for the rest of this section)