Report Summary

Period covered: 30 November - 03 January 2026

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring - Retail Economics Index

-

Furniture and flooring sales declined by xx% year-on-year in December, marking one of the weakest performances across retail.

-

This continued the challenging trend observed in other big ticket categories, where consumers showed reluctance to commit to high value purchases.

-

However, analysis over a two month period provides a more stable reading of seasonal performance.

-

Across November and December combined, sales were up xx% year-on-year, a notable improvement on the xx% decline recorded during the same period in 2024.

-

This suggests that demand was skewed toward periods of concentrated promotional activity.

Key trading themes and drivers

-

December's year-on-year decline was expected given the exclusion of Black Friday from the comparison base.

-

High promotional intensity in November drew forward demand, and the subsequent lull in early December was only partially offset by Boxing Day sales.

-

Large ticket items such as sofas, beds and wardrobes saw subdued interest until late in the month, when clearance events brought renewed activity.

-

The traditional January sales started early for many retailers, with discounts live from Christmas Day.

-

Smaller scale purchases fared better. Home accessories, storage items and seasonal decor performed steadily, benefitting from gifting and home preparation missions.

-

These categories were more responsive to price signals and less impacted by economic hesitation.

Macroeconomic backdrop

-

Economic conditions remained a headwind. Inflation edged higher to xx%, while core pressures persisted in services and food.

-

Though real wage growth remained positive, sentiment remained cautious, as households faced higher energy bills and the impact of prior mortgage resets.

-

The housing market continued to weigh on home related spending. Prices were broadly flat year-on-year, with limited transaction activity and weak mortgage approvals.

-

Halifax reported a second consecutive monthly price decline in December, highlighting the fragility in housing confidence.

-

Meanwhile, consumer credit data indicated increasing reliance on borrowing.

-

Credit card balances rose by over xx% year-on-year in November, the fastest pace since early 2024, suggesting that a share of Christmas related spending was debt financed.

-

This highlights the ongoing squeeze on disposable incomes and the importance of affordability in purchase decisions.

Outlook

-

The sector enters 2026 with constrained momentum. Although promotional periods in November and late December unlocked some demand, underlying appetite for big ticket furniture remains tempered by macroeconomic pressures.

-

The absence of a strong housing tailwind further limits growth opportunities.

-

Seasonal categories may see a brief lift in early January, but the sector's performance is likely to remain patchy.

-

Sustained recovery will depend on improved housing turnover, falling inflation and greater consumer confidence in the months ahead.

Take out a FREE 30 day membership trial to read the full report.

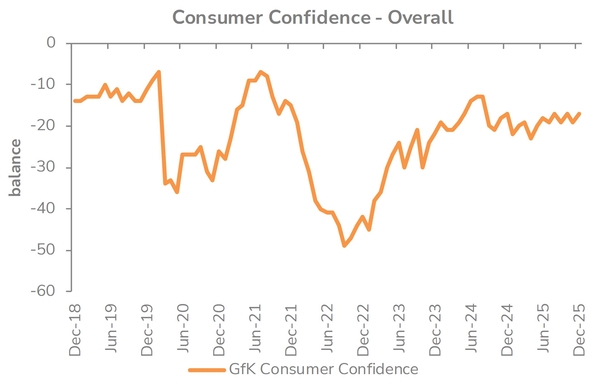

Confidence rises in December

Source: GFK, Retail Economics analysis

Source: GFK, Retail Economics analysis