UK Furniture & Flooring Sector Report summary

April 2025

Period covered: Period covered: 02 March – 05 April 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring – Retail Economics Index

Furniture and Flooring continued its gradual recovery in March, with sales rising by xx% year-on-year, following stronger growth of xx% in February.

These back-to-back gains mark a notable shift after a prolonged period of decline, with the category having faced nearly ten consecutive months of negative year-on-year growth prior to February.

Key factors that affected this performance in March:

Gradual return in footfall and favourable weather

March brought a boost to physical retail, with footfall up xx% month-on-month and high street visits rising xx%, helped by Mother’s Day, payday timing, and early spring weather (MRI Software). Year-on-year, footfall increased by xx%, suggesting improving shopper engagement.

The Met Office reported the UK’s third sunniest March on record, with temperatures xx°C above average.

But for big-ticket categories, this didn’t translate into strong sales, as households remain hesitant to commit to large purchases.

Value-driven spending and big-ticket pressures

Consumers are increasingly favouring value, flexibility, and affordable upgrades, with spending shifting towards experiences and smaller home improvements.

Barclays reported just xx% year-on-year growth in card spending in March, with non-essential categories like travel (+xx%), DIY & Gardening (+xx%), and Electricals (+xx%) outperforming.

In contrast, essential spending fell xx%, and xx% of adults said they were cutting back ahead of rising April bills.

This trend continues to weigh on big-ticket categories like furniture and flooring, where shoppers remain cautious.

Operational costs are rising. Following the Autumn Budget, retailers face higher National Insurance and wage costs, prompting a major UK furniture manufacturer to announce a minimum xx% price rise from April.

In this climate, value-led propositions and clear pricing will be essential to support demand amid sustained consumer caution.

Confidence Undermined by Trade Tensions

While consumer confidence edged up one point to -xx in March, any signs of optimism were short-lived.

According to GfK, sentiment dropped by four points in April, following the announcement of new US tariffs by President Donald Trump, which reignited uncertainty around global trade.

At a domestic level, the UK government’s review of the Low Value Import Scheme which currently exempts goods under £xx from customs duties is aimed at levelling the playing field against low-cost overseas platforms such as Shein and Temu.

While the move may support domestic retailers, it risks driving up prices for consumers on lower-cost goods.

In contrast, the temporary suspension of tariffs on 89 product categories, including some household items, offers short-term relief until July 2027.

Still, the broader policy environment remains volatile, especially for retailers dependent on global supply chains. This uncertainty is influencing consumer attitudes.

Barclays data reveals that xx% of shoppers are concerned about the rising cost of imported goods, while xx% say they plan to buy more “Made in Britain” products.

Take out a FREE 30 day membership trial to read the full report.

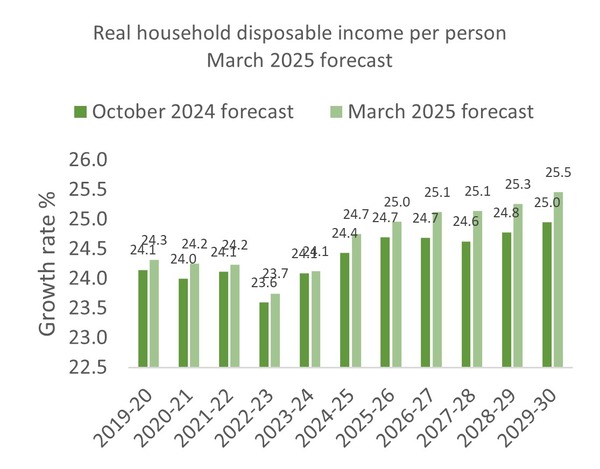

Real household disposable income per person to grow by just 0.5% annually over the next five years

Source: Office for Budget Responsibility, Retail Economics Analysis

Source: Office for Budget Responsibility, Retail Economics Analysis