Report Summary

Period covered: 30 November - 03 January 2026

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food and grocery sales rose by xx% year-on-year in December, ahead of the xx% increase recorded in the same month last year. The performance was driven largely by price effects, with volumes remaining broadly flat.

Against a backdrop of high living costs, consumers prioritised value and continued to adapt their shopping habits. While inflation remained elevated, the pressure eased compared to earlier months, providing some breathing room during the peak seasonal period.

Key drivers and category performance

Shoppers continued to make value a priority. Discounters saw strong growth, and own label ranges gained share, but premium lines also performed well as consumers traded up for Christmas Day and gatherings.

Worldpanel reported a xx% increase in premium private label sales, with total December grocery spend reaching a record GBP xxbn. Promotions played a larger role this year.

Around 33% of all spend was on deals, the highest share since 2019, helping retailers to support volumes. The return of Christmas vegetable price wars and loyalty pricing schemes supported shopper engagement.

In store visits increased as shoppers intensified deal hunting across supermarkets, supported by heavier promotional activity and more frequent trips. While trip frequency rose, spend per trip increased by just 1.1%.

Meanwhile, Ocado led growth at xx%, while Tesco and Sainsbury's also saw digital gains.

Festive results

Sainsbury's and Tesco led the Big Four in reported sales growth. Sainsbury's delivered a xx% rise in grocery sales over the six weeks to 6 January, citing strong loyalty uptake and own brand ranges. Tesco grew UK like for likes by xx% in its core food business.

Both credited Clubcard and Nectar pricing strategies for supporting engagement and volumes. Discounters also performed strongly. Lidl grew xx% YoY in December, reaching xx% market share, while Aldi maintained over xx% share with mid single digit growth.

The overall picture was one of slight volume recovery, improved promotional efficiency, and a clear divergence between value and premium tiers.

Macroeconomic backdrop

December's economic backdrop was characterised by persistent but stable inflation and slight improvements in real wage growth. Headline CPI rose to xx% in December, up from xx% in November, driven largely by seasonal movements in airfares and tobacco duty changes. Food inflation inched up to xx%, remaining a strain on household budgets but below earlier peaks.

Interest rates were cut to xx% by the Bank of England in mid December, in a widely anticipated move that signalled growing policy support. Real incomes improved modestly as wage growth outpaced inflation, though this was uneven across sectors.

Consumers also leaned more heavily on credit to fund seasonal purchases, with Bank of England data showing credit card borrowing up more than 12% year-on-year in November.

These pressures were felt particularly keenly in grocery, where shoppers increasingly looked for value, used loyalty schemes, and took advantage of deals.

Take out a FREE 30 day membership trial to read the full report.

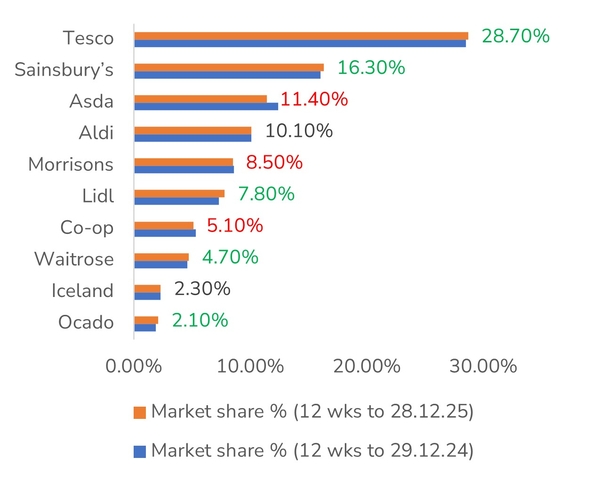

UK Grocery Market Share (12 weeks to 28 December)

Source: Kantar, Retail Economics

Source: Kantar, Retail Economics