Report Summary

Period covered: December 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Subscribe to access this data or take out a free 30-day subscription trial now.

Inflation

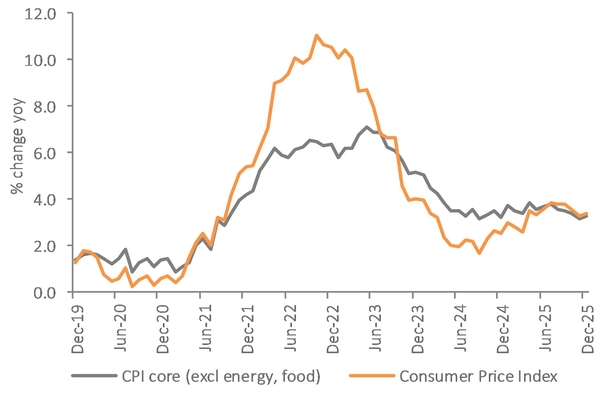

Headline CPI edges higher: CPI rose to xx% in December, from xx% in November, slightly ahead of the consensus view of a rise to xx%. Prices rose xx% on the month.

Core inflation steady, services firm: Core CPI held at xx%, while services inflation ticked up to xx%. Goods inflation also edged higher to xx%. Progress on domestically driven inflation remains uneven, with labour intensive categories still slow to cool.

Tobacco and air travel drive the rise: Alcohol and tobacco inflation jumped to xx% following the late November duty increase, providing the single largest boost to the index.

Transport inflation rose to xx%, led by a sharp seasonal lift in air fares, which climbed xx% over the month.

Food prices rose again, but pressures remain limited: Food inflation increased to xx% from xx%, with bread, cereals and vegetables accounting for most of the lift. The level remains below recent official forecasts, limiting the risk of a renewed squeeze on household inflation expectations.

Costs backdrop: Upstream pressures remain contained. Producer output price inflation held at xx% in December, while input inflation eased back to 0.8%.

Commodity benchmarks rose during January, but annual growth rates have continued to soften, limiting immediate pass through into factory gate prices.

Shipping costs remain elevated but stable, and oil prices have moved higher since December, lifting fuel related input costs at the margin.

Financial market reaction: Following the softer run of core and services inflation, markets have shifted firmly towards further easing in interest rates in 2026. A February move now looks unlikely, but expectations for cuts in the spring and second half of the year have strengthened.

Gilt yields have drifted lower, and sterling has remained under mild pressure as investors position for a slower growth backdrop and a gradual reduction in borrowing costs.

Inflation outlook: December's rise does little to alter the broader direction of inflation. The increase was narrow, driven by tobacco duty changes and seasonal pricing of air fares. Housing costs are easing, core goods inflation is subdued, and services inflation has stopped rising.

Food inflation remains elevated, but it is already below official forecasts. Supermarket pricing behaviour is competitive, and the scope for renewed acceleration is limited.

Services inflation will stay above target into early 2026, then move lower as rental growth continues to ease and private sector pay growth slows further.

From the second quarter, headline inflation should move closer to target as utility bills, water charges and regulated transport costs exert less upward pressure than a year earlier.

That stability supports a gradual recovery in retail spending, though purchasing decisions are likely to remain cautious.

Take out a free 30-day trial subscription to read the full report >

The headline Consumer Price Index (CPI) rose by 3.4% YoY in December, up from 3.2% in the previous month

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis