UK Retail Inflation Report summary

June 2025

Period covered: Period covered: May 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Subscribe to access this data or take out a free 30 day subscription trial now.

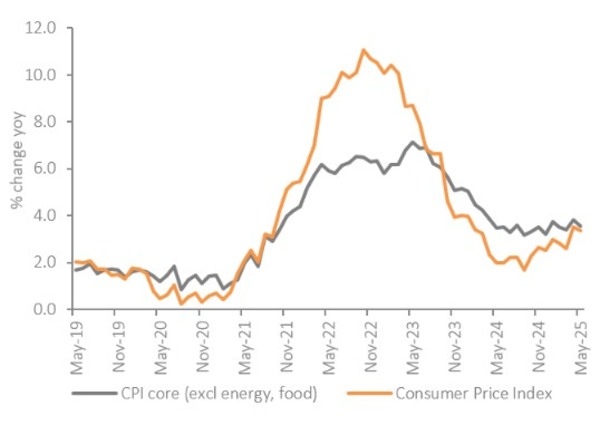

Inflation

Headline inflation slows: CPI inflation eased to xx% in May, down from the reported xx% rise in April. On a monthly basis, CPI rose by xx%, reflecting subdued price movements.

The small fall was driven by lower transport costs and softer rises in housing-related prices, partially offset by rising food and household goods inflation.

ONS data error: Earlier this month the ONS confirmed an error in Vehicle Excise Duty data, which overstated April’s inflation data. While the corrected figures were used for May’s release, the April CPI rate will not be revised. Without the error, April’s inflation would have been around xx percentage points lower.

Core inflation eases: Core CPI, which excludes energy, food, alcohol, and tobacco, slowed to xx%, from xx% in April, in line with expectations.

Goods and services inflation: Goods inflation rose to xx% (from xx%), driven by stronger food and household goods prices.

Services inflation eased to xx%, with downward pressure from housing costs and transport fares, though still elevated due to persistent wage growth and rental costs.

Transport prices fall: Transport provided the largest downward contribution as air fares fell xx% between April and May, a reversal from last year’s sharp rise, while fuel prices continued to fall.

Petrol prices fell xx pence per litre between April and May, with diesel prices falling by a similar amount however, upward pressure from the recent surge in oil prices could push prices higher.

Food inflation surges: Food and non-alcoholic beverage inflation rose to xx%, up from xx% in April, the sharpest rise since February 2024. Chocolate, confectionery, ice cream and meat contributed the most to the rise. This is likely to add further strain on household budgets in the short term.

Furniture and household goods inflation up: Inflation within the category rose to xx% from -xx% in April, the sharpest rise since December 2023. The increase was driven by household appliances and bedroom furniture, with prices impacted by the timing of sales as well as some general price rises.

Supply chain and cost backdrop: While producer price data remains paused, other signs point to renewed cost pressures. Crude oil prices have risen sharply since mid-May, triggered by Middle East tensions. Some key agricultural commodities remain elevated and new regulations and wage cost increases are adding to manufacturing strain.

Financial market reaction: Markets remain cautious. At the time of writing, the probability of an August rate cut stands at xx%, with traders now pricing in two quarter-point cuts by the end of the year, though neither are guaranteed.

Inflation outlook: May’s data confirms that inflation remains stubborn. While headline and core rates edged lower, price pressures are reemerging in food and household goods, and services inflation remains high. Rising energy prices, geopolitical instability, and sustained wage growth are feeding into the cost base, particularly in labour-heavy sectors.

The Bank of England is expected to hold rates steady tomorrow, keeping a close eye on indicators of domestic inflation persistence, including unit labour costs, vacancy rates, and the pace of services disinflation.

The rate path now looks more drawn out and conditional, with any future cuts shaped by wage trends, geopolitical tensions, and how effectively firms manage rising input costs.

Take out a free 30-day trial subscription to read the full report >

CPI inflation eased to 3.4% in May, down from the reported 3.5% rise in April

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis