Report Summary

Period covered: 02 November - 29 November 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Electricals sales

Electricals sales surged xx% year on year in November, an acceleration driven largely by the inclusion of Black Friday in this year's reporting period, an event that fell outside November 2024's data window.

The category's performance was one of the strongest among non food segments, with promotional activity and timing effects heavily influencing the outcome.

Key drivers and category performance

The calendar shift meant that November 2025 captured Black Friday trading in full, producing a strong comparison with the prior year. Retailers front loaded promotions and extended deals into the final week of the month, transforming what would otherwise have been a steady trading period into a high volume promotional phase.

Heavy discounting encouraged shoppers to bring forward purchases they might otherwise have deferred.

Major retailers blended early November deals with peak Black Friday pricing, creating a layered discount narrative that kept digital channels busy throughout the month.

Households appeared to respond tactically to promotional messaging. Many shoppers delayed significant technology purchases until confirmed discount windows. This created a pronounced sales peak in the final fortnight of November.

Footfall patterns

In store footfall for electricals was closely tied to key promotional days. Shoppers were drawn by concentrated deals and experiential retail spaces that allowed hands on engagement with products.

But a significant portion of electricals demand remained online, where well executed digital campaigns and broader stock availability steered transactions.

Underlying environment

Electricals trading occurred against a macroeconomic environment that was defined by easing inflation and rising consumer caution.

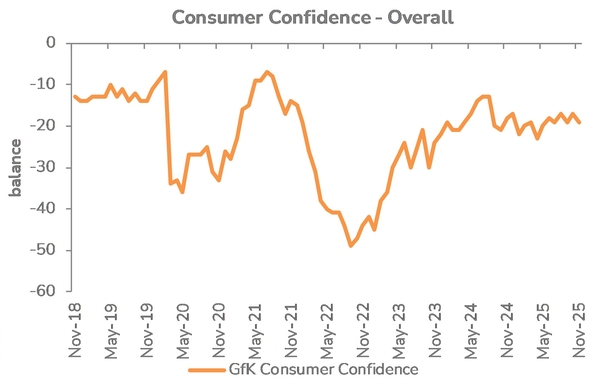

The GfK Consumer Confidence Index declined to xx, with households adopting a more defensive stance in the lead up to the Autumn Budget.

Wage growth slowed to xx% YoY, and unemployment rose to xx%, as the labour market continued to show signs of cooling.

Real wages remained under pressure despite a sharp drop in inflation, with CPI falling to xx%, its lowest level since March 2025.

The Bank of England responded in December by cutting interest rates to xx%, a move that should provide some relief to borrowing costs in the months ahead.

The backdrop of easing price pressure helped support consumer appetite for promotions, particularly in categories like health and beauty where gifting and affordable indulgence intersect.

Outlook

Electricals enters December on a promotional high, but with a notable caveat that much of November's growth was driven by timing effects rather than sustained underlying demand. The sector will need to convert the promotional momentum into continued engagement through the remainder of the festive season and into the new year.

If households maintain a cautious stance outside major promotional windows, electricals retailers may need to innovate around service, financing and digital convenience to sustain growth beyond event driven uplift.

Take out a FREE 30 day membership trial to read the full report.

Confidence slips as households brace ahead of budget

Source: GFK, Retail Economics analysis

Source: GFK, Retail Economics analysis