Report Summary

Period covered: 30 November - 03 January 2026

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health & Beauty - Retail Economics Sales Index

-

Health and beauty sales rose by xx% year-on-year in December, marking the strongest performance among non-food categories.

-

This followed a particularly strong November, bringing the two month growth rate to xx%.

-

Although this was slightly below the xx% rise recorded over the same period in 2024, the category maintained a consistent position of strength across the peak trading season.

Key trading themes and drivers

-

Performance was supported by gifting, seasonal self care spending and consistent demand for personal care staples.

-

Fragrance, cosmetics and bath gifting lines remained central to December trading, with a solid uptake in both value and mid tier ranges.

-

Own brand gift sets and exclusive seasonal promotions proved popular, particularly in the week leading up to Christmas.

-

Skincare and wellness continued to see engagement, aided by colder weather and a consumer focus on self care.

-

While price sensitivity remained a factor, the category benefited from relatively low inflation compared with other discretionary areas.

-

Retailers were able to drive volume through selective offers rather than broad based discounting.

Macroeconomic backdrop

-

The economic environment remained tight but stable through December.

-

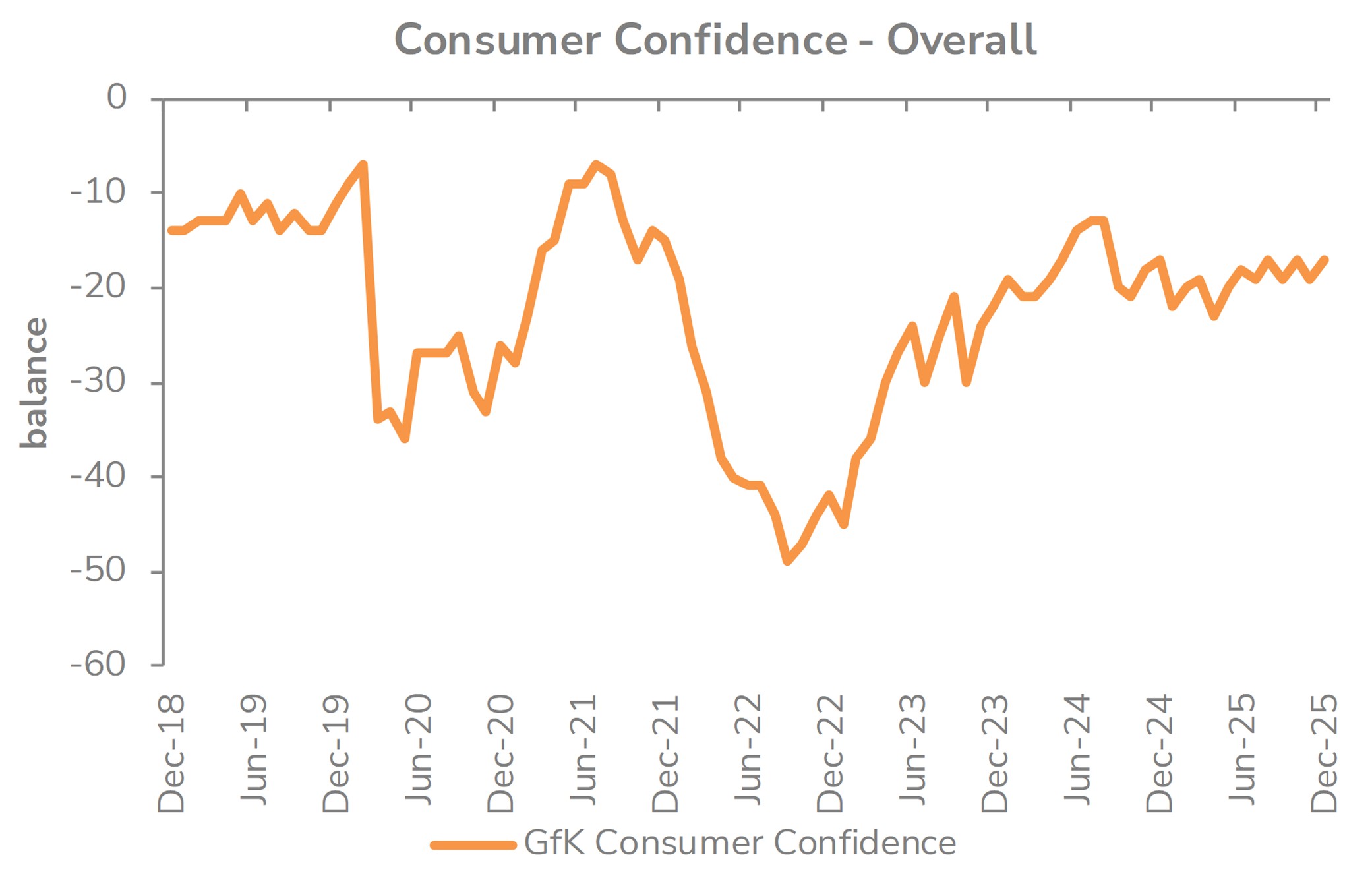

Consumer sentiment was little changed on the year, with the GfK index at xx as households continued to navigate elevated costs.

-

Inflation ticked higher to xx%, driven by seasonal factors and a rise in tobacco and air travel prices.

-

The Bank of England cut the base rate by xx% to xx% in December, its fourth reduction of the year, offering modest relief to borrowers.

-

Household finances remained divided. Some consumers leaned heavily on unsecured credit to finance festive spending. Bank of England data showed credit card balances rose over xx% year-on-year, the fastest pace since January 2024.

-

At the same time, others added to savings, contributing to uneven patterns of discretionary spending.

Closing outlook

-

Health and beauty retailers can enter the new year with optimism.

-

While December marked a seasonal high point, early 2026 trading is likely to see a reset, with gifting demand falling away and shoppers focusing more on core health, wellness and personal care needs.

-

Promotional activity will remain central to sustaining engagement, particularly as households rebalance after Christmas spending.

Take out a FREE 30 day membership trial to read the full report.

Confidence rises in December

Source: GFK, Retail Economics analysis

Source: GFK, Retail Economics analysis