UK Furniture & Flooring Sector Report summary

June 2025

Period covered: Period covered: 04 May – 31 May 2025

3 minute read

Furniture & Flooring – Retail Economics Index

Furniture and flooring sales rose xx% in May, maintaining positive momentum. Quarterly growth slowed (+xx%) and the category is still in decline (-xx%) over the past 12 months, highlighting ongoing pressure from subdued consumer confidence, housing market stagnation, and tighter household budgets. Key factors affecting this performance included:

Muted spring refresh, yet furniture outperformed non-food peers

May typically sees a seasonal lift from home refresh projects, redecorations, and garden setups. But this year, much of that demand was pulled forward by April’s exceptional sunshine, which drove early spending on outdoor furniture, flooring, and seasonal décor.

Despite this, furniture and flooring still posted xx% growth in May, outperforming most non-food categories, a testament to lingering home improvement momentum from Q1’s housing activity.

While the Met Office confirmed May was the UK’s second sunniest on record, rain during the final week, including the second Bank Holiday, clipped footfall and disrupted planned home upgrades. This mismatch between early stockpiling and late-month weather instability helped explain the softer, but still positive, trading.

Post-stamp duty slump weighs on housing-linked demand

Housing transactions fell dramatically in April following the rollback of the temporary Stamp Duty relief. This decline continued to impact furniture and flooring in May, a category heavily reliant on housing churn.

According to HMRC data, the number of residential transactions in April fell to just xx, down xx% from March and xx% lower than April 2024. As a result, fewer consumers were furnishing newly purchased homes, normally a prime driver of furniture demand.

Falling house prices also weakened purchase motivation. Halifax reported a xx% drop in house prices in May, dragging the average home value down to £xx.

This cooling sentiment filtered directly into furniture and flooring, where spending typically mirrors new home occupancy and refurbishment activity.

Weakened consumer confidence in big-ticket spending

May saw continued caution around discretionary spending, particularly for major purchases. The GfK Major Purchase Index rose only slightly to -xx in May, still a historically low level that demonstrates consumer reluctance to commit to large outlays like sofas, beds, or carpets.

Consumers remain hesitant amid cost-of-living concerns and elevated borrowing costs, with many households opting to postpone or downscale home upgrade plans.

Retailers reported that footfall held relatively steady, dipping just xx% year-on-year, with sunny weekends and the half-term providing a modest lift, but conversion rates declined as shoppers remained cautious.

Leading furniture retailers flagged softness in store performance, requiring deeper promotional activity to clear stock. Even middle- and upper-income consumers are delaying large purchases and prioritising savings buffers amid economic uncertainty, a trend that’s weighing heavily on big-ticket retailers.

Promotional activity boosted short-term sales but pressured margins

While overall demand was weak, aggressive discounting during bank holiday promotions drove short-term sales gains.

Furniture stores leaned into “Bank Holiday Mega Sale” campaigns with offers like 50% off dining sets, 0% financing, and free installation, tactics more common to post-Christmas sales periods. These deals helped shift inventory but pressured profit margins, particularly for mid-market and premium retailers.

Furniture and household goods inflation rebounded to xx% in May from -xx% in April, the sharpest jump since December 2023, likely reflecting input cost pressures and a shift to shallower discounting after April’s clearance.

Meanwhile, household goods shop price inflation eased to -xx%, suggesting retailers struggled to maintain promotional intensity, making it harder to drive value-led footfall without eroding profitability.

Take out a FREE 30 day membership trial to read the full report.

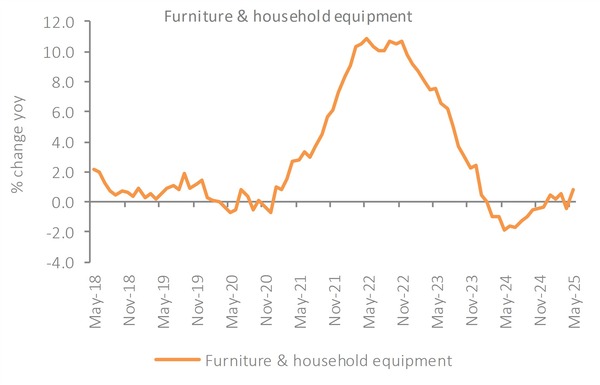

Furniture & Household Equipment inflation rose by 0.8% YoY in May from a 0.5% decline in April, the sharpest rise since December 2023

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis