The Cost of Retail Crime: Financial Impacts & Mitigation Strategies

10 Minute Read

Unlock valuable insights into employee theft, organised crime within the retail sector, and effective strategies to combat theft by downloading and exploring this essential report. A must-read for anyone involved in the retail industry, it provides a comprehensive understanding of the underlying factors driving theft and equips retailers with actionable solutions.

Click here to explore working with Retail Economics for publishing outstanding thought leadership research like this.

Contents:

-

Introduction

-

Section one: Quantifying theft across customers and employees

-

Section two: Understanding the drivers of retail employee theft

-

Section three: Proactive solutions to tackle growing employee theft

-

Conclusion

Introduction

In today’s vibrant retail tapestry, theft has evolved to become highly organised, but is being underreported and casts a constant shadow over retailers' profits.

Thruvision and Retail Economics research forecasts the value of retail theft will be an eyewatering £7.9bn in 2023. This report demonstrates the need for far more rigorous attention around the drivers of theft, including employees stealing, and more relentless enforcement to avoid theft spiralling into a widespread societal issue.

We forecast the value of retail theft will be an eyewatering £7.9bn in 2023

Up until now, much focus on retail crime has centred around consumer shoplifting. However, this overlooks a significant proportion of retail theft that’s driven by retail workers themselves. Crucially, our investigation reveals that 40% of the total value of theft is attributable to employees – the proverbial ‘elephant in the room’ lesser spoken of – with the main hub of criminal activity concentrated in warehouses and distribution centres (DCs). While these dishonest employees constitute a tiny minority, importantly they tend to steal more frequently and in larger amounts than shoplifters, with average losses from a dishonest employee four times the amount versus a shoplifter.

Motivations driving employee theft are primarily linked to cost of living pressures and labour market dynamics associated with a more transient and detached workforce. Meanwhile, opportunities to steal have increased in recent years due to more complex retail operations, a tight labour market and lower-paid workers being recruited into criminal gangs. Among retailers that have seen an increase in employee theft over the past year, a high 70% state they’ve seen an increase in organised crime in DCs, leaving retailers more exposed to widespread theft at scale.

These issues disproportionately impact larger retailers with increased vulnerabilities from handling greater volumes of stock, implementing complex multichannel operations, and relying on third party suppliers for upscaling capacity. In effect, large distribution centres are being targeted by organised criminals.

Low perception of risk is also becoming an issue following a legislative change in 2014, downgrading the stealing of goods worth less than £200 to a “summary” theft. This is leading retailers to prioritise internal disciplinary action over law enforcement and necessitating deterrence measures across operations. Accounts of police inaction over retail theft deters retailers from even reporting it. Here, our research shows more than half of retailers don’t even attempt to prosecute as “police do not take theft seriously enough”. This is leading to underestimates in national statistics on retail crime.

The risk of crime spiralling across societies has seen the largest names in retail become increasingly vocal about the rise in retail theft. John Lewis chair Dame Sharon White labels shoplifting “an epidemic”. Similarly, Asda chair Lord Stuart Rose believes that theft has been “decriminalised”. Meanwhile, the Co-op recently stated that retail crime is “disrupting communities” as it claims to be losing tens of millions of pounds to theft.

Our findings are presented using a framework (‘Motivation, Opportunity and Detection’) to discuss the changing motives behind crime, growing opportunities for retail theft, and detection policies that are arguably not fit for purpose. The research focuses on theft by employees (particularly in distribution centres) which is typically under-reported compared to shoplifting.

Section one: Quantifying theft across customers and employees

UK retailers are increasingly suffering from theft across warehouses, distribution centres and stores as cost-of-living pressures mount and more complex operations alter the dynamics of crime.

The level of theft can be defined as: the loss of stock (between actual and ordered inventory) as a proportion of total sales values, also known as ‘shrinkage’. Using forecasts for retail sales in 2023, our research reveals the value of retail theft is expected to be £7.9bn in 2023. In other words, this represents an average inventory shrinkage of 1.7%. This can be split across customers and employees; with customers accounting for 59.5% of the value of theft (£4.7bn in 2023), and employees working in retail warehouses, distribution and stores accounting for a substantial 40% (£3.2bn) (this includes organised crime).

Employees working in retail warehouses, distribution and stores accounting for a substantial 40% (£3.2bn)

Fig 1: Allocation of retail theft across customers and employees

Source: Thruvision and Retail Economics

For retailers, increasing theft exacerbates operating and input costs that have already stepped up in recent years, squeezing profitability and stifling re-investment.

Beyond the financial impact, retailers also face downstream problems such as inventory inaccuracies and dissatisfied shoppers. Effective retailing relies on accurate inventory levels for effective supply chain management, replenishment, and demand forecasting. Here, shrinkage results in jolted operations and inaccurate data collection, leading to incorrect records, lost sales and stockouts. Such losses are likely to be indirectly passed onto customers through price increases, exerting further pressure on already high levels of inflation across retail.

The retail industry is particularly vulnerable to employee theft which is commonly under-reported within mainstream media. Employees steal in different ways, either in isolation, small groups, or in organised gangs and theft rings. The consequences can be significant: profit loss, low morale, a ‘culture of suspicion’ in the workplace, and inventory inaccuracies.

Modes of theft can either be direct or indirect. Direct examples include handing over merchandise to friends in stores; and indirect could include the re-labelling of packages in warehouses to be delivered to ‘collection’ addresses. Theft in warehouses and distribution centres (DCs) is a particular crime hot spot where many incidents go unreported amid perceptions that police response is often inadequate.

While employee theft is committed by a small minority, incidents are more frequent and involve larger amounts from a single retailer, compared to typical shoplifters who steal lower value items from multiple locations, or even ‘grow out of stealing’ altogether. Data from the National Retail Federation suggests the average value of loss from a dishonest employee versus a shoplifter is four times the amount.

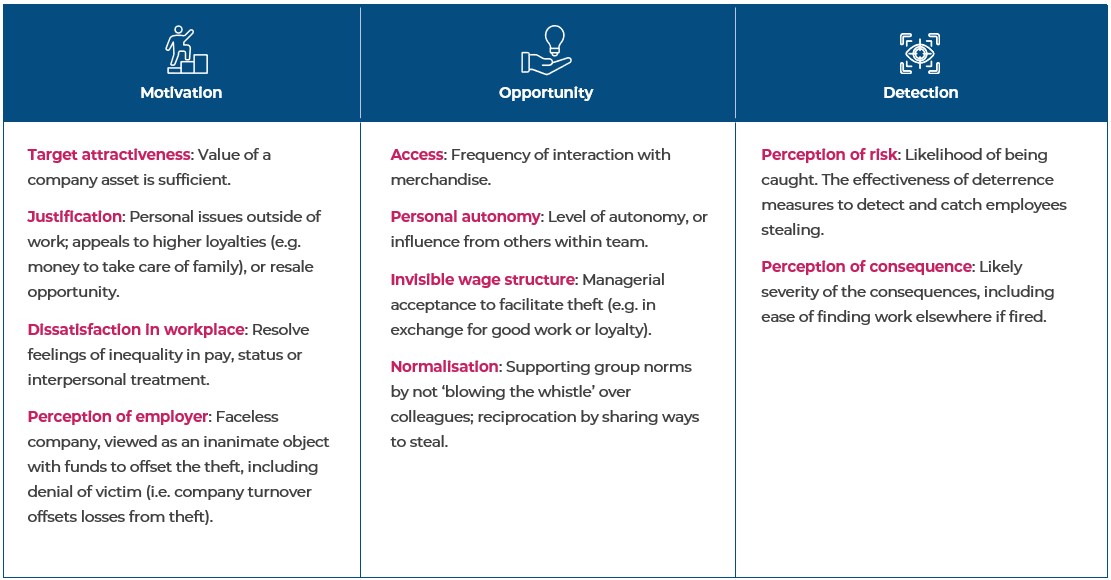

Other research posits that three conditions must co-exist for employee theft to occur, this framework includes: (1) motivation and justification for deviance; (2) the opportunity or access to steal; and (3) a low perception of risk. Subsequently, this framework has been adapted to align more closely with the retail industry and features the following three factors enabling employee theft:

(1) Motive to steal: potential gain from a given asset

(2) Opportunity to steal: the potential to remove an asset from its location

(3) Risk of detection: the probability and severity of punishment

However, theft is not only driven by material motives, but social motives too – this includes workplace culture.

As such, our research presents a more developed framework which combines elements of aforementioned models, and captures motivational, material and social motives. We call this our ‘Motivation Opportunity Detection Employee Theft Framework’ (MODETF) (Figure 2). While these factors are driven by a range of external and internal influences, effective internal detection shapes opportunities to steal by ultimately increasing the risk of being caught stealing, deterring theft.

Fig 2: ‘Motivation Opportunity Detection Employee Theft Framework’ - outlines key drivers of employee theft

Source: Thruvision and Retail Economics

Section two: Understanding the drivers of retail employee theft

Employee theft is a continual battleground for loss prevention managers. And with greater sophistication and technology available to both sides (retailer and thief), the battle can become exceptionally challenging.

To deeply understand the underlying dynamics here, we conducted a business-to-business survey, targeting large UK retailers to analyse the critical factors shaping retail theft among employees. Our analysis (framed by our 'Motivation Opportunity Detection Employee Theft Framework' model) shines light on the challenges facing retailers and provides a foundation for strategic considerations.

Crucially, the following section shows that a combination of the cost-of-living crisis, the shift online over the past decade, and austerity policies reducing police budgets have cumulatively shifted motives, opportunities and risk related to theft. Naturally, this has come to the detriment of retailers. In addition, a growing trend of more organised crime leaves retailers more exposed to widespread theft at scale.

With few signs indicating this backdrop will improve in the short term, retailers must consider the following trends to better inform loss prevention strategies going forward.

Motivation: Current motives of rising theft

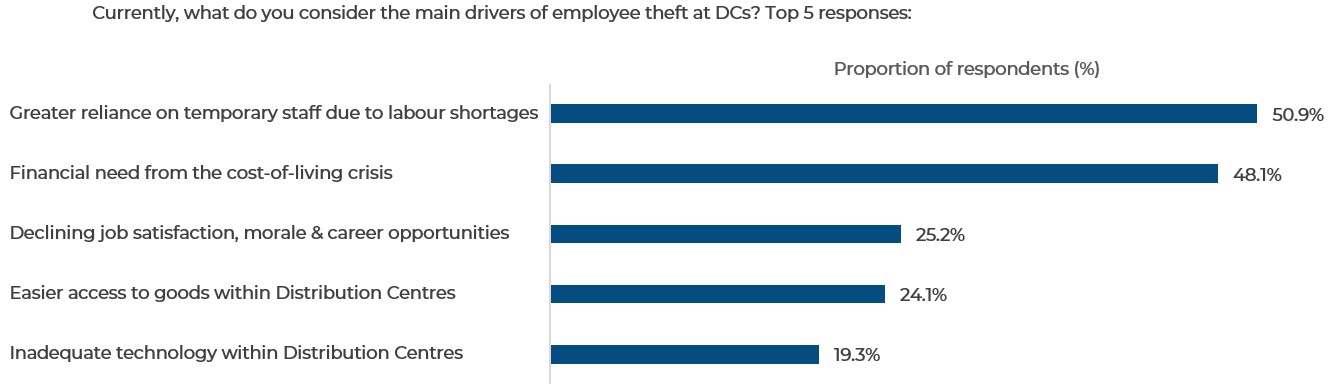

Motives behind rising theft in the retail sector are diverse, but our research clearly demonstrates that both the ongoing cost-of-living crisis and evolving dynamics of the labour market are critical influences.

Among a survey of managers and directors responsible for loss prevention at large UK retailers, a net balance of a fifth (20.9%) have experienced increases in employee theft over the past year. A balance of a quarter (26.4%) believe that the type of products being stolen in distribution centres (DCs) has changed over the past year (e.g. shifting towards smaller items and valuable electrical products for easy resell).

Additionally, there has been a shift towards stealing essentials such as groceries and clothing as a harsher economic backdrop has resulted from higher inflation and interest rates. Two-thirds of respondents believe that financial pressures resulting from the cost-of-living crisis has, to some degree, driven an increase in theft by employees at DCs over the past year.

When retailers were asked to consider the current main drivers of employee theft (Figure 3), the cost-of-living remains a key factor for almost half (48.1%) of loss prevention managers.

Fig 3: Motivations to steal driven by cost-of-living crisis and transient nature of work

Source: Thruvision and Retail Economics

For more data from this section, download the report at the top of this page

Opportunity: Widening scope to steal

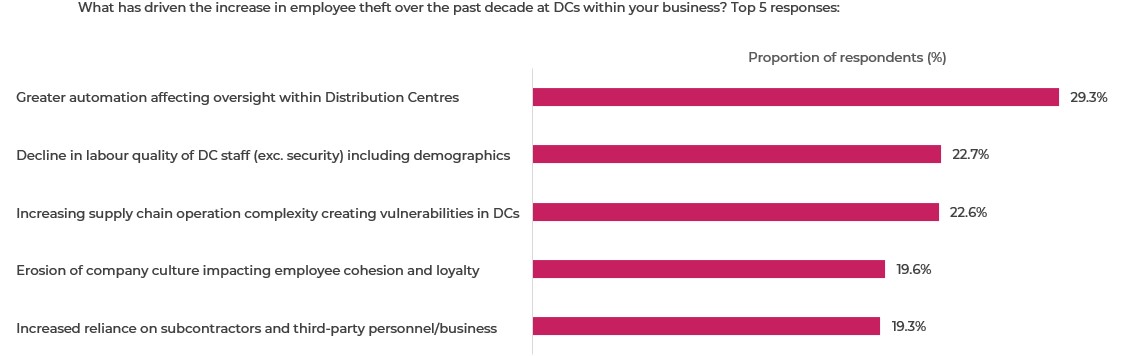

The growing scale of retail operations and rising complexity in omnichannel supply chains is creating fertile grounds for criminal activity.

Around two thirds (59.8%) of retailers believe that over the past decade the opportunity for crime in DCs has accelerated. Opportunities for crime are twice as likely to be prevalent among larger retailers (£1bn+ turnover) than smaller players. This can firstly be attributed to the scale of goods handled and expansive distribution networks making crime more possible; and secondly to employee attitudes towards larger companies. This includes the ‘denial of victim’ mentality (i.e. company turnover offsets losses from theft).

Opportunities for crime are twice as likely to be prevalent among larger retailers (£1bn+ turnover) than smaller players.

Size of company impacting crime has key implications in a retail market that has seen M&A activity at a five-year high. Consolidation and the growing scale of businesses necessitates a disproportionate response to loss prevention investment to manage heightened risks of theft.

When considering the main reasons behind increasing theft in DCs over the past decade (Figure 4), issues are concentrated around automation, complexity of operations, and reliance on subcontractors. These three factors have become more acute since the pandemic. Online sales accelerated during lockdowns, placing huge pressure on operations (including warehousing and picking), necessitating aggressive recruitment in a tight labour market.

Fig 4: Automation, complexity and staffing issues have driven longer term theft

Source: Thruvision and Retail Economics

The trend of organised crime widens the trap for retail employees as they are potentially recruited into criminal gangs. This makes it essential for retailers to invest in a suite of security measures that deters and detects coordinated behaviour; as well as coordinating with police to improve their visibility of organised activities, national or even international.

For more data from this section, download the report at the top of this page

Detection: Not fit for purpose

The evolving nature of theft poses significant risks to loss prevention policies that are ill-equipped to deal with the scale and complexity of crime at present. Retailers and police need to rethink loss prevention strategies to drive more effective detention around theft.

Over a third (35.9%) of loss prevention personnel do not believe their equipment and internal policies are fit to deal with the level of theft at present. It comes as over a quarter (27.7%) say theft is not taken seriously by their employer.

This gap between existing tools and policies, and the real-world challenges of theft, can lead to reduced effectiveness in deterring, detecting and addressing theft. Retailers therefore must attempt to bridge this gap as a priority.

Retailers investing in loss prevention are overwhelmingly focused on better tracking of inventory (69.7%) and staff training such as code of conduct (58.6%). However, only two in five (39.7%) are focusing on information sharing (e.g. with law enforcement), and just 15.7% are looking at surveillance to capture criminal evidence. This overall picture is concerning. It risks leaving gaps in the overall strategy for dealing with theft if the fundamentals such as leveraging the latest surveillance technology are not explored.

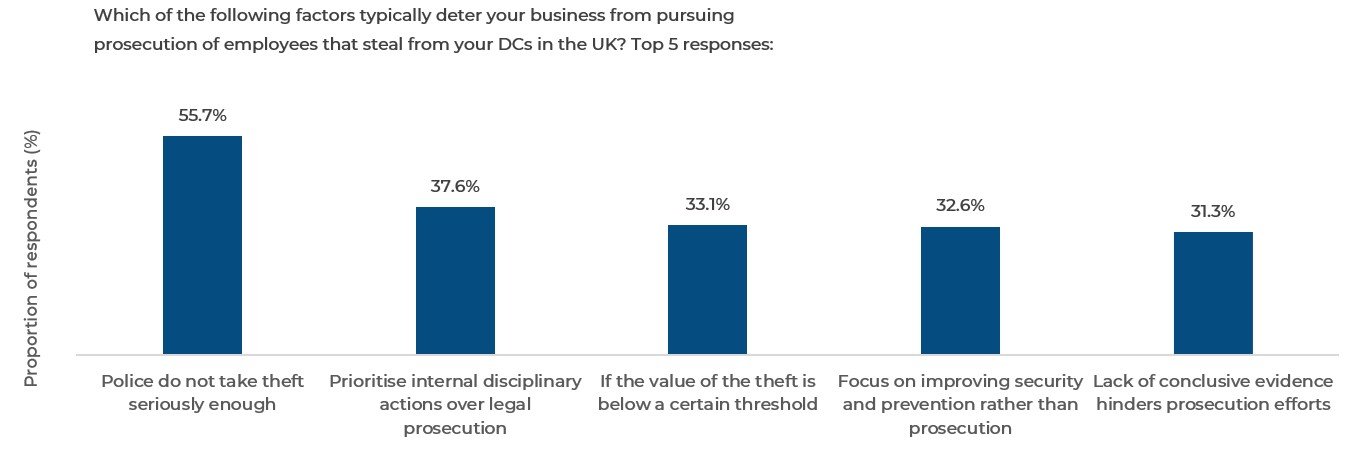

When it comes to prosecutions, a staggering 55.5% of firms do not routinely attempt to prosecute employees that steal from DCs. Retailers can face frustrating legal hurdles and a perception of law enforcement apathy, leading them to prioritise internal disciplinary actions. But doing so reduces the deterrence of prosecution.

Among reasons why retailers do not pursue prosecution, more than half (55.7%) believe “police do not take theft seriously enough”, which is leading to more than a third (37.6%) to take matters into their own hands, prioritising internal disciplinary over legal prosecution.

Fig 5: Over half of retailers doubt police responses to theft

Source: Thruvision and Retail Economics

For more data from this section, download the report at the top of this page

Section three: Proactive solutions to tackle growing employee theft

The dynamic nature of theft in retail means there’s no one size fits all solution. Loss prevention strategies need a suite of policies to detect, deter and prevent loss amid increasingly sophisticated crime.

In this section, the research identifies three strategic pillars that retailers must consider to effectively minimise employee theft. These pillars (Deterrence, Monitoring, and Collaboration) form the foundation of a comprehensive strategy to addresses the evolving nature of theft in this context.

To access this section download the report at the top of this page