Ecommerce Delivery Benchmark Report 2023: Impact of inflation & consumer behaviour on online retail

10 minute read

Click here to view our eBrochure full of information on working with Retail Economics for publishing world class thought leadership research like this.

What can you learn from this report?

Retail Economics and Metapack asked over 8,000 consumers (in the UK, USA, Canada, Australia, Germany, France, Italy and Spain) about how they shop. We discovered a treasure trove of insights to help you with strategy. Insights like:

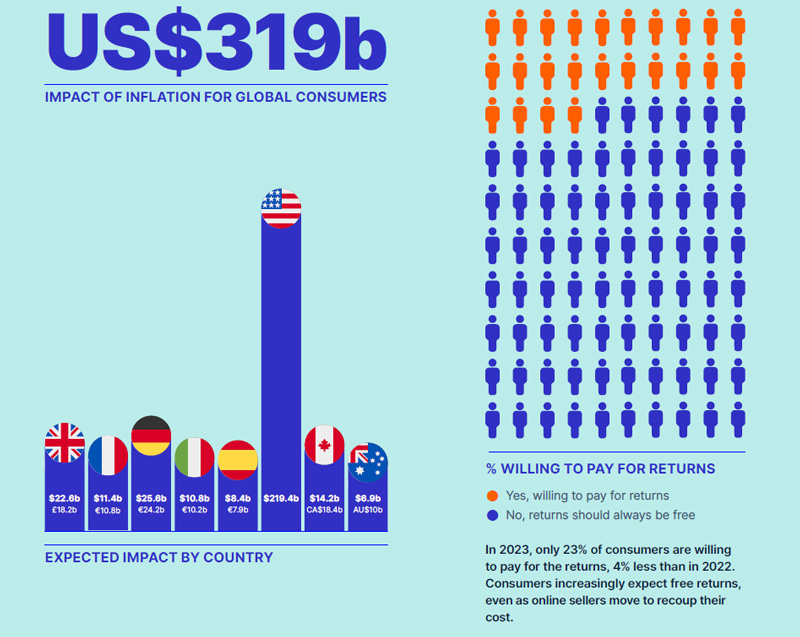

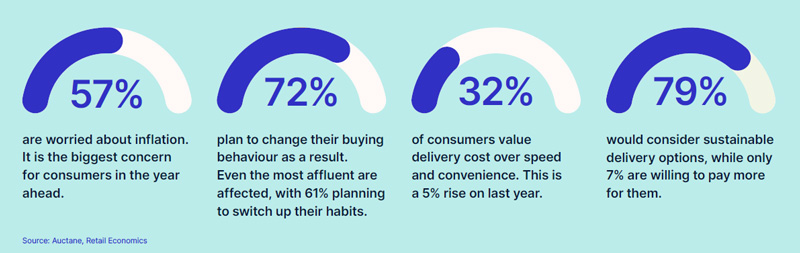

- In 2023, only 23% of consumers are willing to pay for the returns, 4% less than in 2022.

- 57% of consumers are worried about inflation, the biggest concern for consumers in 2023.

- 72% of shoppers plan to change their buying behaviour as a result. Even the most affluent are affected, with 61% planning to switch up their habits.

Our report looks at the impact of inflationary pressures and changing consumer behaviours in the year ahead. Also, it expresses the impact on specific retail markets, showing how opportunities and challenges vary by region, sector and individual shopper cohorts.

Download the full report to learn about:

- The latest global delivery and post-purchase preferences

- How inflation and the cost-of-living crisis will impact consumer spending in major international markets across core retail categories

- How retail brands are responding and what strategies are being implemented

- How to maintain business resilience in the face of ongoing disruption and economic recession

This report is divided into five main sections:

• Introduction

• Section 1: Global retail and consumer landscape

• Section 2: Key online delivery trends in 2023

• Section 3: Strategies for success in a downturn

• Conclusion

Introduction

For the retail industry at large, the challenges continue. Global economic uncertainty combined with ongoing geopolitical tension means that 2023 is set to be yet another tough year for the sector.

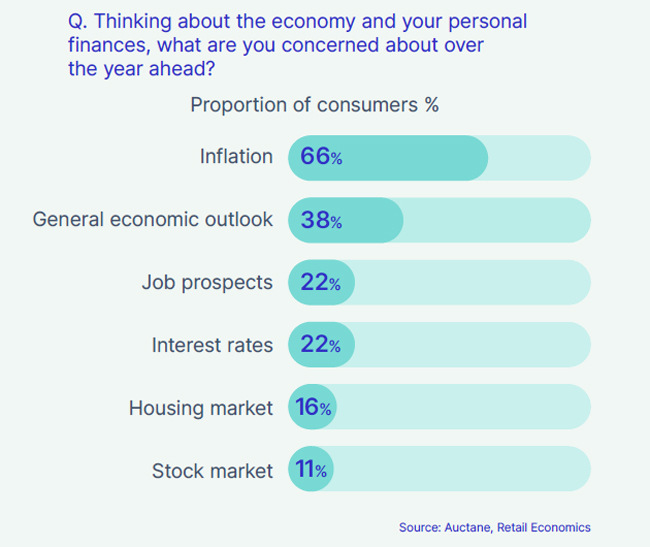

Faced with high inflation, interest rate hikes and rising living costs, consumer behaviour is being thrust under the spotlight as shoppers re-evaluate their priorities and become more value-focused, putting brand loyalties to the test. Indeed, 84% of consumers are concerned about the outlook for the economy and their personal finances over the year ahead, with inflation the top concern.

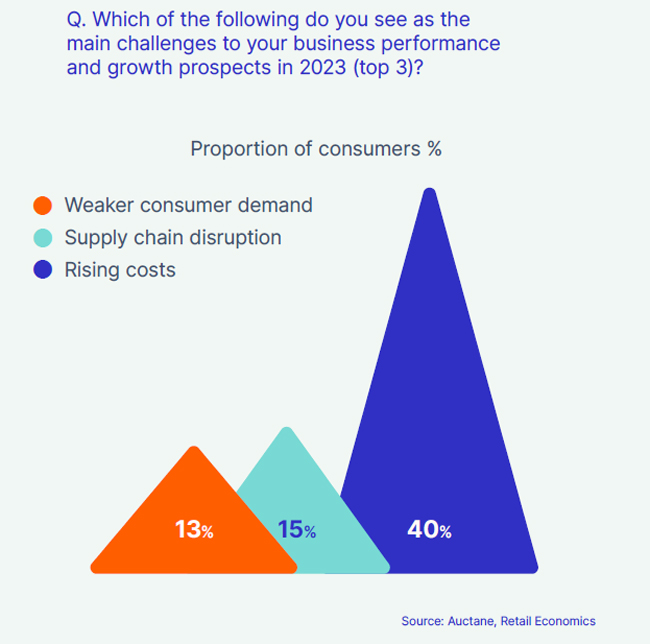

Demand-side pressures are only half the story for the retail sector, as rising borrowing costs, labour shortages, supply disruption and Environmental, Social and Governance (ESG) concerns collide with the constant need to innovate and provide exceptional customer experiences. Around 4 in 10 small retailers suggest that rising costs will be the main challenge throughout 2023 as ongoing supply chain pressures take their toll.

While storm clouds gather over the sector, the silver lining is that many retailers and brands are better prepared to respond to the obstacles that lie ahead. The tumultuous years of the pandemic forced companies to react quickly by pivoting business models; gain greater control over supply chains; and establish more direct and meaningful relationships with customers.

The research explores three key themes:

1. Global retail and consumer landscape - An overview of the macro forces and inflationary pressures facing consumers and how this will impact the performance of retail markets.

2. Key online delivery trends in 2023: Explores shifting shopper behaviours and five key trends that will shape ecommerce over the year ahead.

3. Strategies for success in a downturn: Key strategies for retailers to ‘recession-proof’ their business models and navigate the economic pressures that await in 2023.

Insights within this report are crucial for retail brands and retail related organisations to better understand and navigate the consumer crunch as it unfolds.

Key stats

Section 1: Global retail and consumer landscape

Economy at a tipping point

Many advanced economies worldwide are facing an economic tipping point. The combination of decade-highs in inflation, rising geopolitical tension and spiralling interest rates has hit consumer confidence hard. Households are facing an intense squeeze on personal finances as the rise in the cost of living outpaces earnings growth. This has forced many to cut back across all parts of their expenditure.

Central banks have tightened their grip on monetary policy with aggressive interest rate hikes being implemented by the Federal Reserve System (Fed), Bank of England (BoE) and European Central Bank (ECB) in a bid to temper rising prices and prioritise financial stability. While each market faces its own nuances, they all face a careful balancing act of dousing inflationary flames without extinguishing economic growth.

Across all the major markets included in the research, 4 in 5 (84%) consumers are concerned about the outlook for the economy and their personal finances over the year ahead, with inflation the top concern.

However, these concerns are not necessarily reflected by small retail businesses, many of which remain optimistic about trading prospects in 2023. Interestingly, more businesses hold a positive rather than negative view regarding the economy, and only 20% anticipate weaker consumer demand over the year ahead.

Many retailers have invested heavily in their online proposition and have integrated more flexible operational approaches which enables them to better cope with oncoming recessionary challenges. The feeling of robustness and increased control has injected much optimism into the equation, following an unprecedented period of disruption.

Fig 1: Consumers are concerned about the outlook for the economy

Supply-side pressures remain a concern. Faced with a triple threat of inflation, labour shortages and ongoing supply disruption, 40% of businesses see rising costs as the main challenge to their operations in 2023.

Fig 2: Retailers concerned by rising costs and supply side pressures

Regional Variations

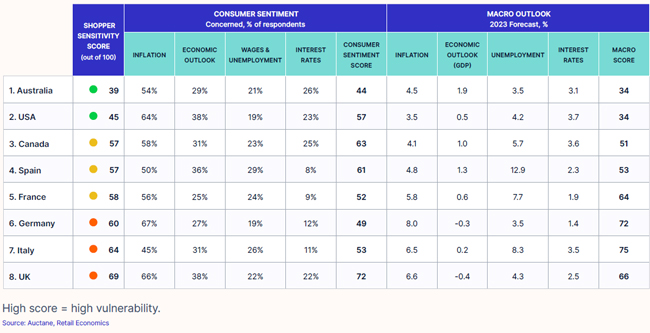

The economic outlook varies widely by country, impacting the likelihood and severity of any consumer downturn. Australia and the US are set to be the most resilient consumer markets in 2023, coming out on top in our Shopper Sensitivity Scorecard – a ranking of key developed markets based on a combination of consumer sentiment and official economic benchmarks

Fig 3: Europe most at risk of consumer downturn in 2023. Shopper Sensitivity Scorecard

Although growth is slowing, Australia and North America are better insulated from escalating energy costs and the economic aftershock from the Russia-Ukraine conflict, with inflationary pressures significantly lower than those in Europe. US households are also less affected by the rapid rise in mortgage rates due to the widespread prevalence of 30-year fixed rate loans.

The research shows that Europe will be hardest hit by a consumer downturn in 2023, as the cost-of-living crisis unfolds. Faced with escalating bills and rising interest rates, consumers are even more pessimistic about the economy and personal finances than at the height of the pandemic.

Three quarters of merchants in North America expect the same or better trading conditions in 2023 than 2022, compared to only 57% for those operating in Europe.

In 2023, coming out on top in our Shopper Sensitivity Scorecard – a ranking of key developed markets based on a combination of consumer sentiment and official economic benchmarks

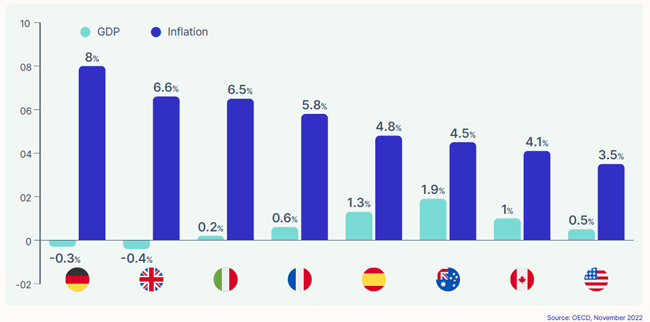

Growth prospects are especially gloomy in the UK, Italy, and Germany, where inflation remains stubbornly high, putting these markets at high risk of recession in 2023. Understanding these regional variations in consumer outlook is key to identifying pockets of growth and adapting strategies to suit specific market conditions.

Figure 4: Consumers are even more pessimistic than during the pandemic

Complete the form at the top of this page now to get all the insights!

Retail sales forecasts

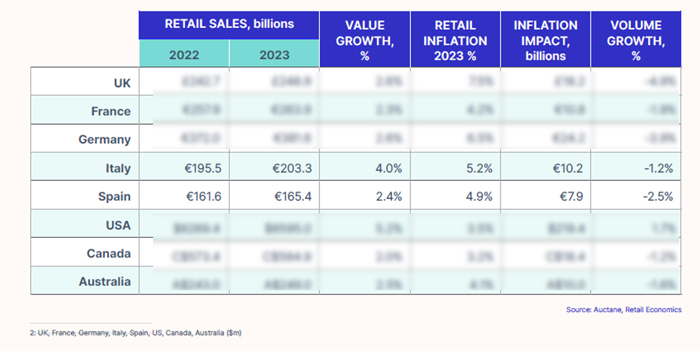

As high inflation impacts discretionary spending, growth prospects for the retail industry in 2023 will be characterised by the widening gap between sales values and volumes. In other words, consumers will be ‘spending more but getting less’.

Steep price rises will lift retail sales in value terms, flattering top-line performances, but will overlook the reality of fewer purchases as consumers cut back on non-essentials from squeezed budgets.

This will be most evident across European markets. Retail Economics forecasts non-food sales across major European markets to total US$1.38 trillion in 2023, up 2.7% in value terms.

However, this reflects higher prices rather than an actual increase in the quantity of goods people are buying. Almost 80% of small retail businesses surveyed plan to increase their prices in 2023, as they pass on higher costs to consumers.

Fig 6: 2023 retail sales forecasts and inflation impact

After stripping out the impact of inflation, European retail sales volumes will decline by 3.2% on average. In other words, households in the European markets we cover in the research will have to spend an additional €74bn compared with last year to acquire exactly the same quantity of goods.

Merchant sales expectations

Consumer sentiment and economic projections are generally at odds with small retailers’ expectations for the year ahead. Of those small enterprise retailers surveyed, 80% expect order volumes to be... [report extract]

Section 3: Key online delivery trends in 2023

This section explores five key themes that will shape the online retail and delivery sector in 2023.

Cautious consumers polarised shopper behaviour

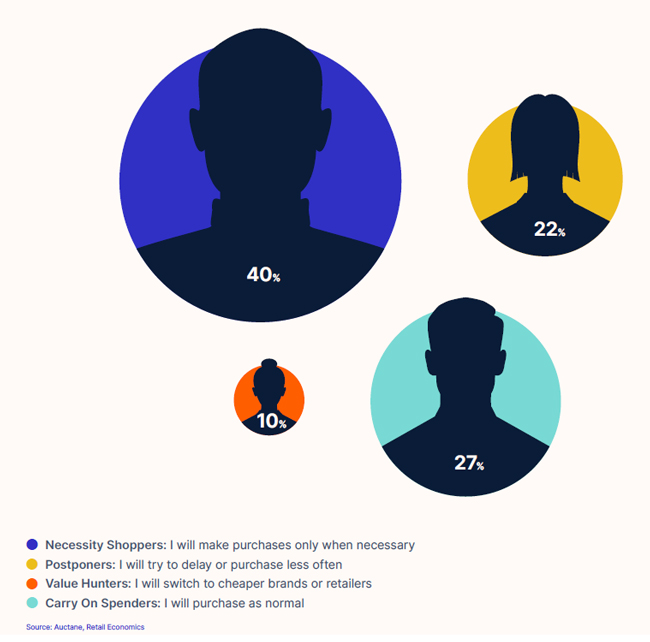

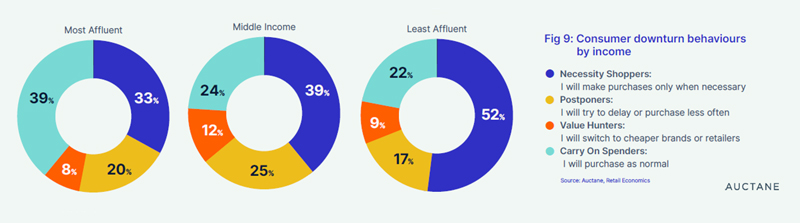

As the global economy slows and personal finances come under strain, almost three in four (73%) consumers say they will change their shopping habits in 2023. Just a quarter (27%) intend to continue spending as normal over the year ahead. Economic turbulence will impact consumer behaviour in different ways. Some will postpone or curtail discretionary purchases, while others will seek to save by trading down and switching to cheaper brands or retailers (Fig. 8).

Fig 8: Four main types of consumer behaviour in 2023

Income: Two-track spending

Shopping behaviour will diverge across income groups. Cushioned by savings and greater job security, high-income consumers are almost twice as likely to carry on spending as normal compared to the least affluent shoppers, where over three quarters will be trading down, delaying or only making purchases when necessary. This will create two-track spending.

As such, luxury brands and discounters are likely to outperform at opposite ends of the market, leaving squeezed mid-tier retailers vulnerable. But even for the most affluent, 61% still plan to tighten or cut discretionary spending over the year ahead, as the prospect of an economic downturn exerts a psychological toll on consumers.

Fig 9: Consumer downturn behaviours by income

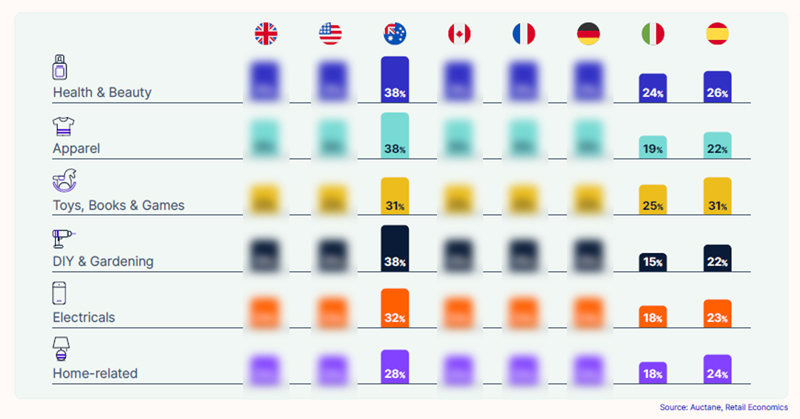

Beauty is renowned for its resilience in times of economic difficulty owing to the ‘lipstick effect’. Cosmetics and fragrances represent small, feel-good purchases that can be a morale booster in tough times, while skincare is an essential part of a daily beauty regime for many.

“I sell a lot of gift products, and I've already noticed starting last month a huge decline compared to previous years. I foresee this continuing and affecting us even more than other ecommerce businesses because people are spending less on others - Tabletop Monthly”

Fig 12: Health & Beauty, the most resilient category due to the ‘lipstick effect’

Channel shifts: Online bounce back shift to hybrid retail

The demise of ecommerce throughout 2022 has been greatly exaggerated. After an unparalleled boom catalysed by global Covid-19 impacts, online sales growth and penetration was always going to soften in comparison.

While the pace and magnitude of shift back to physical stores may be surprising to many, this should not be seen at the expense of online.

Online sales remain significantly higher than pre-pandemic levels, and narratives that pit online against physical retail often ignore the reality of how the consumer journey increasingly blends the two channels now, as retail becomes increasingly hybrid.

If anything, the continued migration online is set to resume in 2023. Across all non-food sectors, our research shows a net proportion of consumers plan to shop more online than they did last year (Fig. 13) [report extract]

Delivery priorities: Cost over convenience

Consumers’ online shopping priorities are changing rapidly as economic pressures mount, with an increasing focus on value over convenience (e.g. delivery speed, location).

Convenience emerged as a top priority for online shoppers during the pandemic. ‘Stuck at home’ consumers were keen to ensure they got what they wanted, when they wanted it, be it super-fast delivery, contactless pick-up, or choosing specific delivery slots – with many willing to pay for the privilege.

But with financial concerns now trumping Covid-19 fears, the cost of delivery is clearly the most important conversion factor, as speed and convenience become less of a priority for consumers (Fig. 15).

Fig 15: Cost of delivery rises in importance for online shoppers in 2023

Q: Thinking about when you’re shopping for products online, what’s most important to you?

While most retailers recognise the importance of keeping delivery costs low for customers, the tsunami of operating cost pressures facing businesses makes this a real challenge. In fact, over a quarter (28%) of retail businesses plan to increase the cost of delivery for their customers in 2023, with only 18% planning no increases to the price of products, delivery, or returns.

'Out of home' delivery continues to gain popularity

Over a third (34%) of consumers would happily switch to parcel lockers or click and collect ‘BOPIS’ – Buy Online Pick Up In Store) services for their online orders, compared to 25% when surveyed a year ago (previous edition of our Benchmark Report).

Over a third (34%) of consumers would happily switch to parcel lockers or click and collect (‘BOPIS’ – Buy Online Pick Up In Store) services for their online orders, compared to 25% when surveyed a year ago (previous edition of our Benchmark Report).

Appetite for ‘out of home’ delivery is unsurprisingly highest in continental Europe, where ‘click and collect’ is well established (Fig. 17). Over 80% of retailers in France, Spain and Italy offer pick-up services, compared to less than half in the... [report extract]

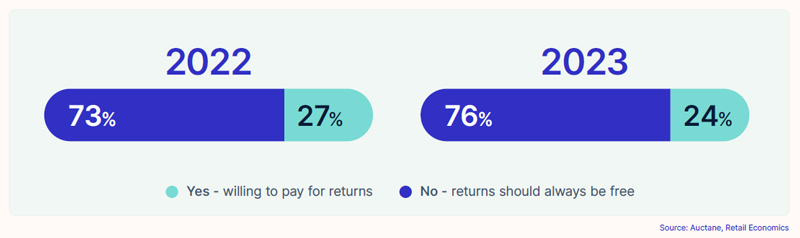

Online returns: tension over who foots the bill

Free online returns have become a consumer expectation and an industry standard, but this is set to become a much less common proposition as retailers attempt to recoup associated costs here.

Return rates are being driven higher by the shift to online and the worsening economic climate. Retail Economics research shows that the returns rate for online purchases can often be as high as 30%, compared to less than 10% in-store.

Our research shows that 10% of online merchants, made up mostly of small businesses, are planning to introduce (or increase) charges for returns in the year ahead.

Although free and lenient return practices can be leveraged to incentivise online sales, it also allows consumers to view purchases as ‘risk-free discoveries’, rather than final purchases, with ‘bracketing’ (ordering multiple versions of the same item) becoming common practice, particularly with apparel.

Fig 18: The willingness to pay for online returns is dropping just as retailers begin to pass on the cost

Q. Are you willing to pay for returns for products ordered online?

Other insights in this section

- Consumers unwillingness to pay

- Sustainability: Green delivery and 'recommerce'

- Recommerce going mainstream

Get these other insights and more by downloading your free copy of this report. Complete the form at the top of this page now.