RICS Residential Market Survey October 2024

Key Takeaways

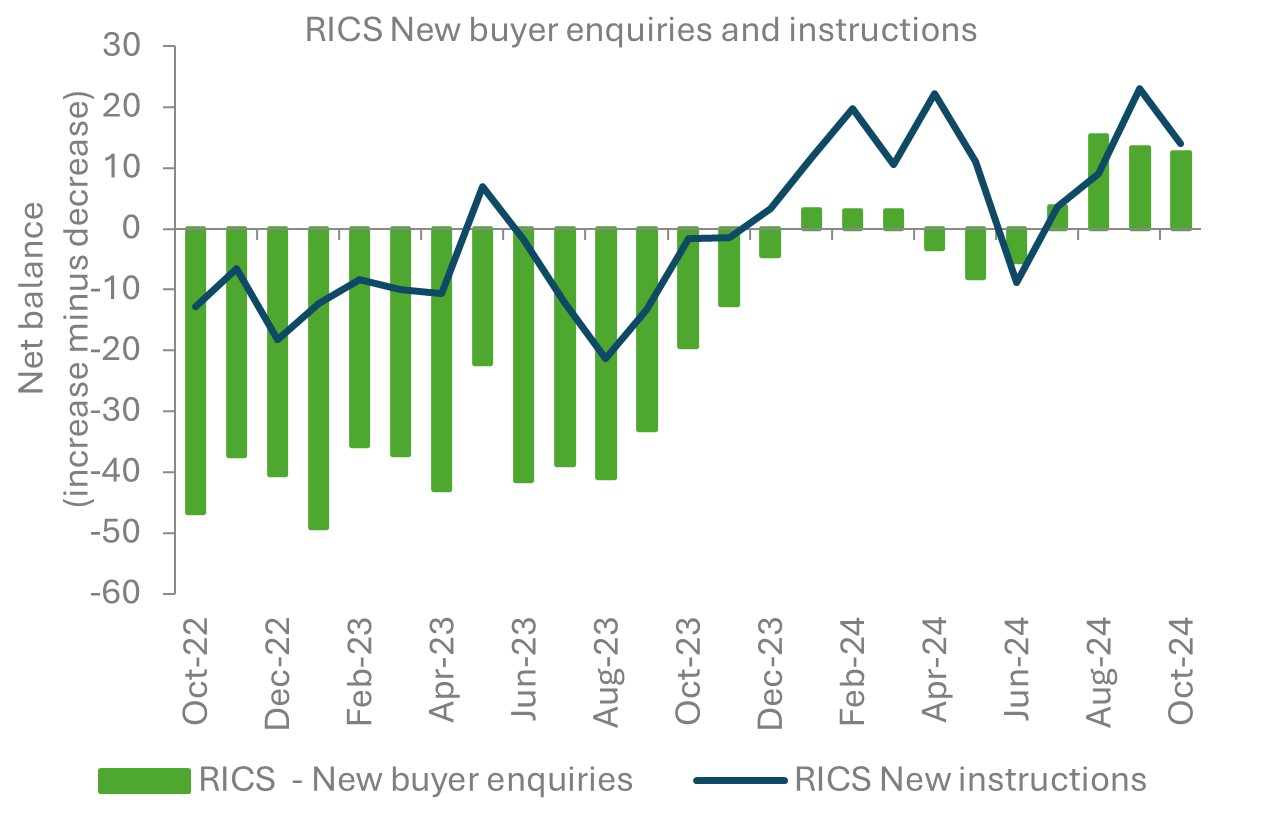

Buyer enquiries and agreed sales stabilise

- The October RICS Residential Survey indicates continued improvement in the sales market activity, with positive trends in demand, sales, and instructions.

- New buyer enquiries posted a net balance of +12% of agents registering an increase, consistent with the previous month, extending a four-month streak of positive growth.

- Agreed sales registered a net balance of +9% reporting a rise, up from +5% in September, marking the third consecutive month of growth in sales volumes.

- Near-term sales expectations increased to a net balance of +34%, with a balance of +36% of contributors expecting sales volumes to rise over the next 12 months.

New instructions rise

- New instructions indicator returned a net balance of +14% recording an increase, maintaining its fourth consecutive month of growth.

- Respondents noted a rise in market appraisals compared to the previous year, suggesting a strong pipeline of new listings.

House prices rising at the national level

- The national house price indicator showed a net balance of +16%, up from +11% in September and zero in August, reflecting steady price growth.

- Near-term price expectations rose to +20%, while a net balance of +36% of respondents anticipate house prices to increase over the next 12 months.

- Northern Ireland, Scotland, and London were among the regions with the strongest house price growth.

Rental market

- Tenant demand rose by a net balance of +19%, as recorded in the three months to October.

- New landlord instructions declined sharply, with a net balance of -29% of agents reporting a decrease, the lowest level since late 2021, exacerbating supply shortages.

- Near-term rental price expectations remained high, with a net balance of +33% expecting rents to increase over the coming three months.

Housing Market picks up in October 2024- RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%). Source: RICS

Back to Retail Economic News