RICS Residential Market Survey October 2021

Cooling sales activity

- The RICS UK Residential Survey for October points to another dip in sales activity, as the lack of available properties presents would-be buyers with limited choice.

- Agreed sales fell for the fourth month in a row, evidenced by a net balance of -9% of respondents reporting a decline in October (compared to -13% in September).

- Cooler sales activity in recent months follows extremely strongly growth earlier in the year before the Stamp Duty tax holiday was phased out.

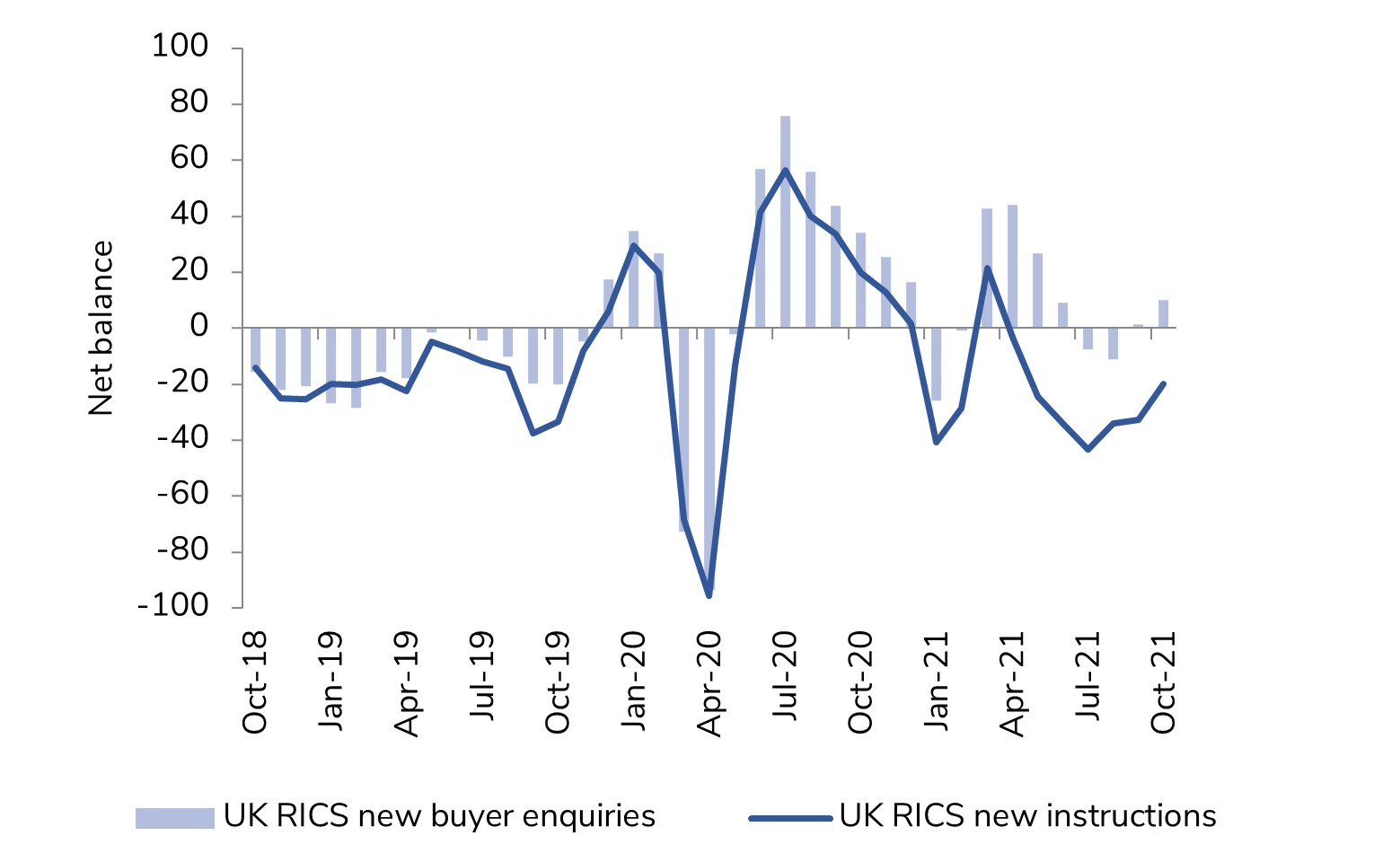

- That said, new buyer enquiries picked up, with a net balance of +10% of agents noting a rise in October. This is up from +1% previously and signals the first monthly rise in buyer demand since June.

Lack of supply

- The depressed flow of new instructions coming on to the market of late remains widely referenced as a factor holding back market activity.

- October’s measure for new listings came in at -20% and has now been in negative territory for seven consecutive months.

- Average stock levels on estate agents’ books have fallen from 42 in March to just 37 according to the latest feedback.

Price growth solid

- The lack of supply available on the market is not only holding back sales momentum, but it also a major factor behind house price growth being sustained at a strong rate.

- At a national level, a net balance of +70% of survey respondents noted a rise in house prices in October. Price growth has remained broadly consistent over the past three months in net balance terms.

- In terms of the outlook for prices, a net share of +69% of respondents anticipate prices will continue to increase over the year ahead, with this measure showing no sign of easing.

Lack of supply the issue as buyer demand picks up in October

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Sales still positive

- Near term sales expectations remain slightly positive, with a net share of +10% of agents expecting sales activity to rise over the next three months (little change from +12% previously).

- This suggests a steady picture for residential transactions through the rest of 2021, albeit not at the same levels of activity seen over the last eighteen months.

- Looking further ahead, the twelve-month sales expectations net balance of +4% is indicative of a flat to marginally positive trend.

- When disaggregated, the North of England, London, and Scotland all displaying a more upbeat twelve-month outlook than the national average.

Rents being driven higher

- In the lettings market, tenant demand remains firm. A net share of +49% of respondents reported a rise in rental enquiries in October.

- Conversely, landlord instructions continue to weaken, with the latest reading falling to -31%, from an already negative -20% previously.

- This mismatch between supply and demand is set to drive rents higher going forward. A net balance of +54% of agents anticipate headline rents to be higher in three months’ time.

- Interestingly, London now displays amongst the strongest expectations on this measure (+74%).

- This represents a substantial turnaround considering rental expectations were firmly planted in negative territory across the capital between Q2 2020 and Q2 2021.

Back to Retail Economic News