RICS Residential Market Survey November 2023

Buyer enquiries and agreed remain in negative territory

- Buyer enquiries remain weak with a net balance of -14% in November. However, this is the least negative figure for the measure since April 2022.

- Agreed sales remained negative but also eased, with a net balance of -11%, less pessimistic than a figure of -23% in October.

New instructions stable

- New instructions in the market remained broadly stable in November, with a net balance of -5% recorded in both October and November.

- Respondents furthermore reported that the number of market appraisals undertaken in November was lower than in the previous year, with a net balance of -41%.

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Prices decline deep but easing

- The net balance for the headline house price metric for November was -43%, firmly in negative territory but significantly less pessimistic than October’s figure of -61%.

- The majority of UK regions saw house price declines ease in net balance terms, according to RICS. However, the South East and East Midlands continue to present significantly negative readings.

Outlook

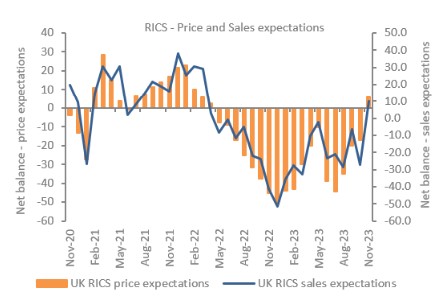

- Near-term sales recorded the first positive reading since early 2022 in November, with a net balance of +6% for sales expectations in November.

- For the year ahead, the net balance for sales expectations was +24%, the most optimistic reading since January 2022.

- Price expectations for the next twelve months were notably less pessimistic, with a net balance of -10% recorded, following a figure of -43% in October.

Rental market

- Tenant demand continues to rise, with a net balance of +33% of respondents citing an increase. Although firmly in positive territory, this is the most modest reading since January 2021.

- On the supply front, a net share of -18% of respondents noted a decline in new landlord instructions.

- Although long-term expectations have eased slightly, rental prices are still expected to rise by almost 4% at the headline level over the next year.

Back to Retail Economic News