RICS Residential Market Survey May 2022

Buyer demand in decline

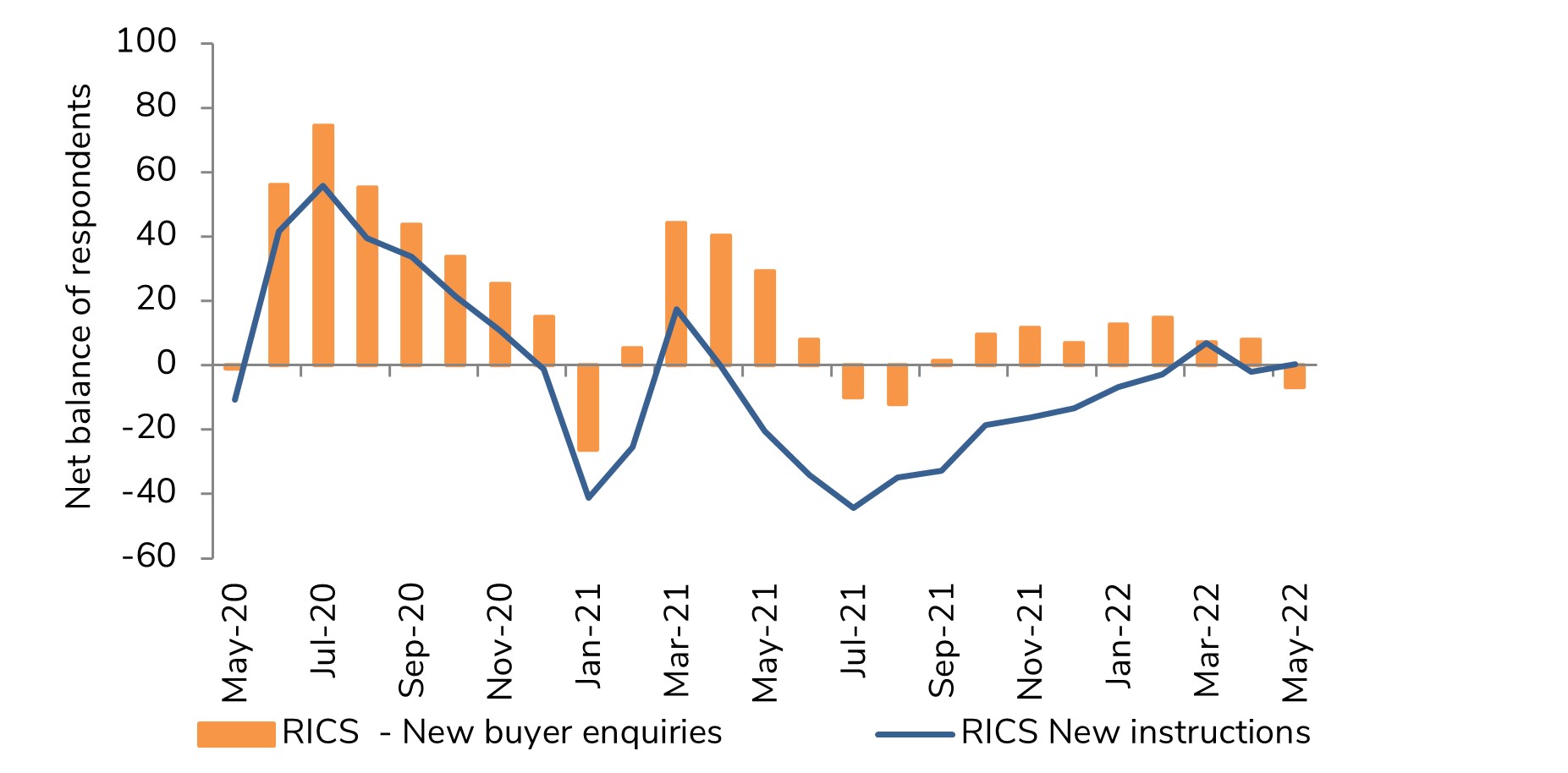

- The RICS UK Residential Survey for May shows the latest net balance for new buyer enquiries came in at -7%, down from +8% previously.

- This suggests a modest decline in buyer demand during May and ends a run of eight consecutive positive monthly readings beforehand.

- The volume of sales agreed was reportedly little changed for a second consecutive month, evidenced by a net balance reading of -2% being posted (compared with -3% last time)

New listings flat

- The volume of new instructions was flat in May, returning a net balance of zero following a figure of -2% last month

- In terms of market appraisals, the latest headline net balance of -5% suggests these are running at a broadly similar pace to that seen twelve months ago.

- Even so, this does represent the weakest reading since December 2021 and suggests there is little prospect of a meaningful uplift in the flow of supply coming onto the market in the immediate future.

Buyer demand dips into negative territory

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Prices still edging higher

- At a national level, a net balance of +73% of agents noted a rise in house prices in May.

- Although down slightly on a figure of +80% last time, it remains closely aligned with the average seen over the past six months.

- All parts of the UK continue to see house prices moving upwards, with growth still exceptionally strong in Northern Ireland, Northern England and Wales

Outlook

- Near term sales expectations moved into broadly neutral territory, as the latest net balance eased to just +1% from a reading of +10% back in April.

- The 12-month outlook for activity has deteriorated more noticeably, with the latest longer-term expectations net balance slipping to -24% from -4% previously.

- Although a net balance of +42% of survey participants still envisage house prices being higher in a year’s time, this is down from +78% in February and marks the most moderate reading since January 2021.

Rental market

- Tenant demand continues to rise firmly with a net balance of +48% of contributors noting an increase in May.

- At the same time, landlord instructions remain in decline, with the latest net balance coming in at -13% (from -16% previously).

- Rental growth expectations remain elevated. At the five year-time horizon, growth in rents is expected to outpace that for house prices, with the gap widening in recent months.

- Rents are now anticipated to rise by over 5% per annum at the headline level through to 2027, while price growth projections stand at 4% on the same basis.

Back to Retail Economic News