RICS Residential Market Survey February 2021

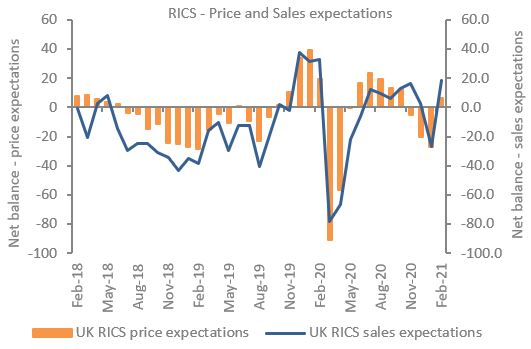

The RICS Residential Market Survey for February indicates another cooler month for sales activity, following a buoyant second half of 2020. National lockdown restrictions continue to deter potential buyers and vendors. However, the outlook appears to be more positive than in January, with forward-looking metrics around sales expectations showing improvement, reflecting greater clarity from the government around the lifting of Covid-19 restrictions.

Source: RICS

Softer sales activity

- RICS reported that a net balance of -9% of estate agents noted a drop in new buyer enquiries in February. While this is the second consecutive month of decline, the figure is considerably less downbeat than the -29% reading posted in January.

- The number of new property listings also fell for a second month in succession. A net balance of -29% of contributors reported a decline in February (compared to -40% in January).

- Following a dip in January as the country went back into lockdown, the indicator for newly agreed sales stabilised in February, with the net balance coming in broadly flat at +1%.

Prices inflation continues

- At a national level, a net balance of +52% of survey respondents saw an increase in house prices over February, signalling continued strong momentum in price inflation.

- All UK regions noted house prices rising to some degree over the month, with Wales and the North of England registering the strongest readings.

- Agents reported a marked improvement in house price growth in London, as the capital’s latest net balance figure rose to +20%, compared to -9% the previous month.

Outlook improving

- Looking ahead, near term sales expectations picked up in February, moving into marginally positive territory at +6% (up from -29% in January). There is also more optimism around the twelve-month outlook with +16% of respondents anticipating sales volumes to increase over year ahead – the strongest figure since the pandemic began.

- In terms of house prices, the proportion of agents anticipating prices will rise over the next twelve months climbed higher, with the net balance figure rising to 46% in February, from +30% in January.

- All UK regions are expected to see prices rise over the year ahead, with respondents in Wales and Northern Ireland appearing most confident.

Lack of rental supply (except in London)

- In the lettings market, a net balance of +26% of respondents reported a rise in tenant demand in the three months to February.

- Yet the number of landlord instructions fell over this period, according to a net balance of -28% of respondents. This indicator has been consistently negative since August 2020.

- Rental growth expectations are strengthening due to this imbalance between supply and demand. +37% of agents foresee rents increasing over the coming three months.

- Expectations are positive across all parts of the UK, apart from London, where respondents envisage a flat trend in rental growth over the year ahead. There is still an oversupply of unlet properties in the capital due to changes in tenants’ preferences as more people work remotely. It will take time to erode this excess supply before the rental market returns to growth, most likely in 2022.

Note: Over three-quarters of February’s survey sample was gathered prior to the Chancellor confirming that the Stamp Duty holiday would be extended until the end of June (and then tapered through to October) in the recent Budget. The full impact of the Budget announcements will be reflected in March’s figures.

Back to Retail Economic News