RICS Residential Market Survey December 2021

Enquiries up, sales down

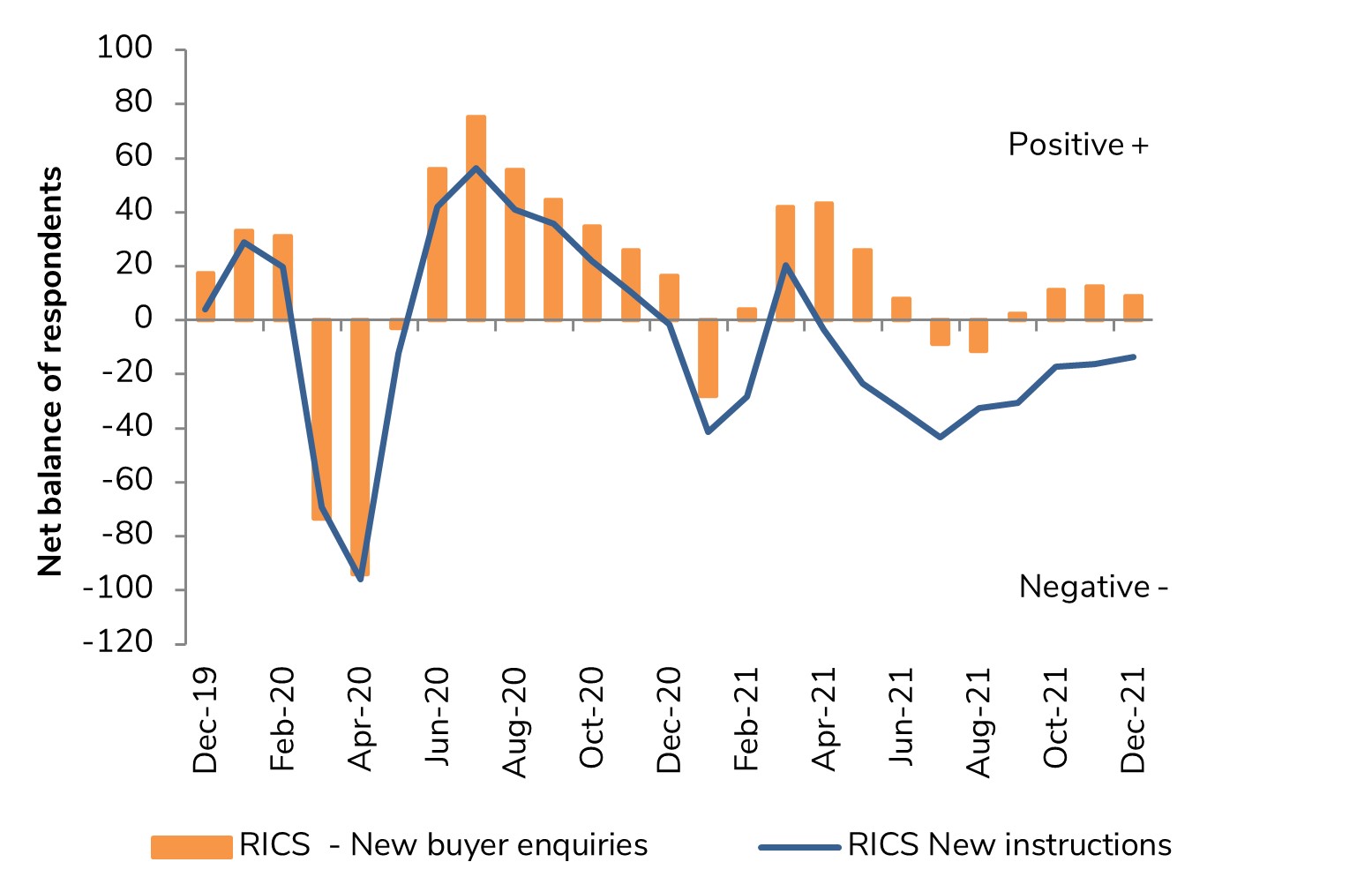

- The RICS UK Residential Survey for December shows new buyer enquiries picked up in December, with a net balance of +9% of agents noting an increase.

- This is the fourth successive positive monthly reading for enquiries, albeit feedback points to only marginal growth in the final quarter of 2021 which is not surprising in the wake of the ending of the stamp duty break.

- Despite the slightly positive buyer demand trends in recent months, agreed sales dipped again, with the latest net balance standing at -13% (from -9% in November).

Shortage of stock

- A lack of stock is holding back market activity, with new instructions either falling or remaining stagnant across all parts of the UK.

- December’s measure for new instructions came in at -14%, the ninth consecutive negative monthly reading.

- The shortage of properties available is sustaining competition amongst would-be buyers, with house prices continuing to head higher as a result

Prices to rise further in 2022

- At a national level, a net balance of +69% of respondents noted a rise in house prices in December. This is virtually unchanged from November’s reading of +71%.

- In terms of the outlook for prices, a net share of +67% of respondents anticipate prices will continue to increase over 2022, with this measure showing little sign of easing.

- All parts of the UK are anticipated to see a further rise in house prices over the year ahead, with expectations highest in the South West and Scotland

Shortage of new listings weighing on housing market

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Steady outlook

- A net share of +14% of agents foresee sales volumes returning to growth over the next three months.

- At the twelve-month horizon, a net balance of 16% of respondents expect sales to increase (up from +12% in November).

- This suggests a steady picture for residential transactions in 2022, albeit not at the same levels of activity seen over the last eighteen months.

Rental market

- In the lettings market, tenant demand remains solid across the UK.

- But landlord instructions remain thin on the ground, with more agents noting a decline than those citing an increase (net balance of -27%).

- This mismatch between supply and demand is set to drive rents upwards. A net balance of +57% of agents anticipate headline rents to be higher in three months’ time.

Back to Retail Economic News