RICS Residential Market Survey April 2021

The RICS Residential Market Survey for April shows demand outstripping supply, with a lack of new instructions driving prices higher across all parts of the UK. The pandemic has led many people to re-evaluate their living requirements, with prospective movers encouraged by the extension to the Stamp Duty Holiday. The rental market is also regaining momentum, as lockdown restrictions ease and people begin to return to their place of work.

Source: RICS

Demand exceeds supply

- A net balance of +44% of estate agents cited an increase in new buyer enquiries in April, virtually unchanged from the previous month, signalling continued strong demand.

- This indicator for new buyer enquiries is positive, to a greater or lesser degree, across all areas of the UK.

- However, the number of fresh listings arriving on the market is insufficient to match the high levels of demand. The net balance for new instructions fell to -4% in April, down from +21% previously.

- Stock levels have dropped in recent months, with the average number of properties on estate agents’ books now at just 40, compared to 46 in December.

- Newly agreed sales rose in April, evidenced by a net balance of +34% of contributors noting an increase (a slight easing on +48% in March).

House prices surging

- At a national level, a net balance of +75% of survey respondents saw a rise in house prices over April. This is up from +62% in March and has risen consistently each month since the start of the year.

- House price inflation is evident across all UK regions, with the South West, Wales and Yorkshire & Humber reportedly seeing the strongest momentum.

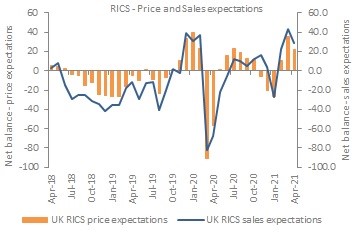

- Prices are expected to remain on a firmly upward trend over the near-term. A net balance of +47% of respondents expect prices to rise further over the next three months (compared to +43% previously)

Twelve-month outlook uncertain

- Near term sales expectations remain comfortably positive, with a net balance of +23% of respondents expecting sales activity to rise over the next three months.

- At the twelve-month horizon, agents anticipate a cooling in sales volumes, particularly once the stamp duty holiday comes to an end (headline net balance stands at just +12%).

- In terms of house prices, the proportion of agents anticipating prices will rise over the year ahead remains extremely positive, with the net balance figure rising to +68% in March, from +60% in March.

Lettings picking up

- In the lettings market, tenant demand is accelerating. A net balance of +60% of respondents cited a pick-up in rental enquiries in the three months to April. This is up from +14% at the start of the year, with the rise in activity boosted by the recent easing of lockdown restrictions.

- Yet the number of new landlord instructions were more or less stagnant in April, indicating a tight supply backdrop, notably outside of London. There is still an oversupply of unlet properties in the capital due to changes in tenants’ preferences as more people work remotely.

- Rental growth expectations are strengthening due to this demand-supply imbalance. +55% of agents foresee rents increasing over the next three months, compared to +15% in the previous quarter.

- Over the next twelve months, respondents envisage rents rising by 3% on average across the UK.

- Although near term expectations remain marginally negative across London, the twelve month view on rents moved slightly into positive territory for the first time since early 2020.

Back to Retail Economic News