ONS Retail Sales October 2021

- Retail sales (value, non-seasonally adjusted, exc. fuel) edged up 0.7% year-on-year (YoY) in October – level with last month, but against a strong 8.6% rise a year earlier according to the latest ONS data.

- In volume terms, retail sales declined by 1.9% in October on the previous year (seasonally adjusted, exc. fuel), but rose 1.6% compared to September.

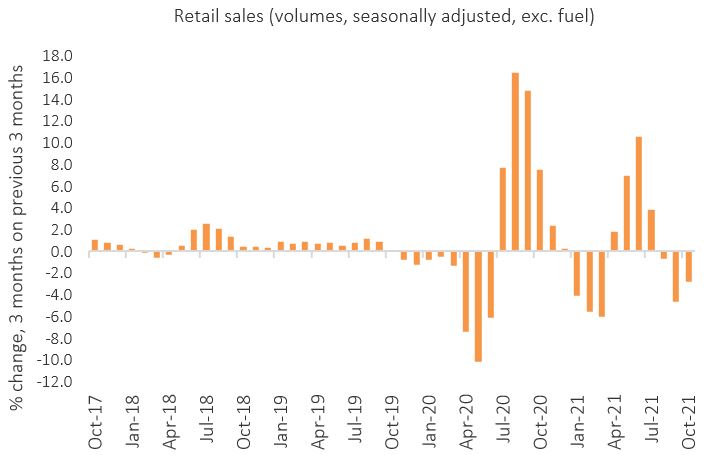

- Recent pressure on retail sales is being reflected in the quarterly sales trend, with the three-month-on-three-month growth rate declining by 2.8% in the quarter to October (volume, seasonally adjusted).

Retail sales (volume, seasonally adjusted) – 3-months on previous 3 - months

Source: ONS

Food and non-food

- Food store sales rose by just 0.8% YoY in October, but remain ahead of 2019 levels (value, non-seasonally adjusted).

- Clothing surged 18.0% YoY, albeit against a weak 13.6% decline a year earlier, but ahead of October 2019 levels (value, non-seasonally adjusted, all businesses).

- Home-related categories have come under pressure, in part from base effects of comparisons to strong sales last year, as well as stock challenges. This saw Household Goods decline by 6.3% and Furniture and Lighting stores down 6.7% YoY in October (value, non-seasonally adjusted).

Online

- Online sales (non-seasonally adjusted, excluding automotive fuel) declined by 8.4% YoY in October against a strong 65.0% rise a year earlier.

- The proportion of retail sales made online edged up to 26.3% in October from 26.0% in September – but was down from 29.0% a year earlier.

Retail sales price deflator

- The retail sales deflator (a measure of inflation specific to retail) excluding fuel jumped by 2.9% YoY in October against a flat rate in October 2020, and rose a substantial 4.3% when including fuel against soft -0.9% a year earlier.

- The implied price deflator among food stores rose by 2.0% YoY – its strongest rate in over three years – and rose by 3.3% among non-food stores.

Back to Retail Economic News