ONS Labour Market January 2026

Payrolled Employees

- Payrolled employees fell by 155,000 (0.5%) between November 2024 and November 2025.

- In three months to November 2025, payrolled employees fell by 135,000 (0.4%) year-on-year and 43,000 (0.1%) quarter-on-quarter.

- The early estimate for December 2025 suggests a further fall of 43,000 on the month and 184,000 (0.6%) on the year, taking the total number of payrolled employees to 30.2 million (provisional and subject to revision).

Employment and Unemployment

- The employment rate (aged 16-64) was 75.1% in September-November 2025, unchanged on the quarter but higher than a year earlier.

- The unemployment rate (aged 16+) rose to 5.1%, increasing on both the quarter and the year.

Economic Inactivity and Claimants

- The economic inactivity rate (aged 16-64) stood at 20.8%, down on the quarter and lower than a year ago.

- The Claimant Count increased on the month in December 2025 but fell on the year, reaching 1.677 million (provisional).

Vacancies

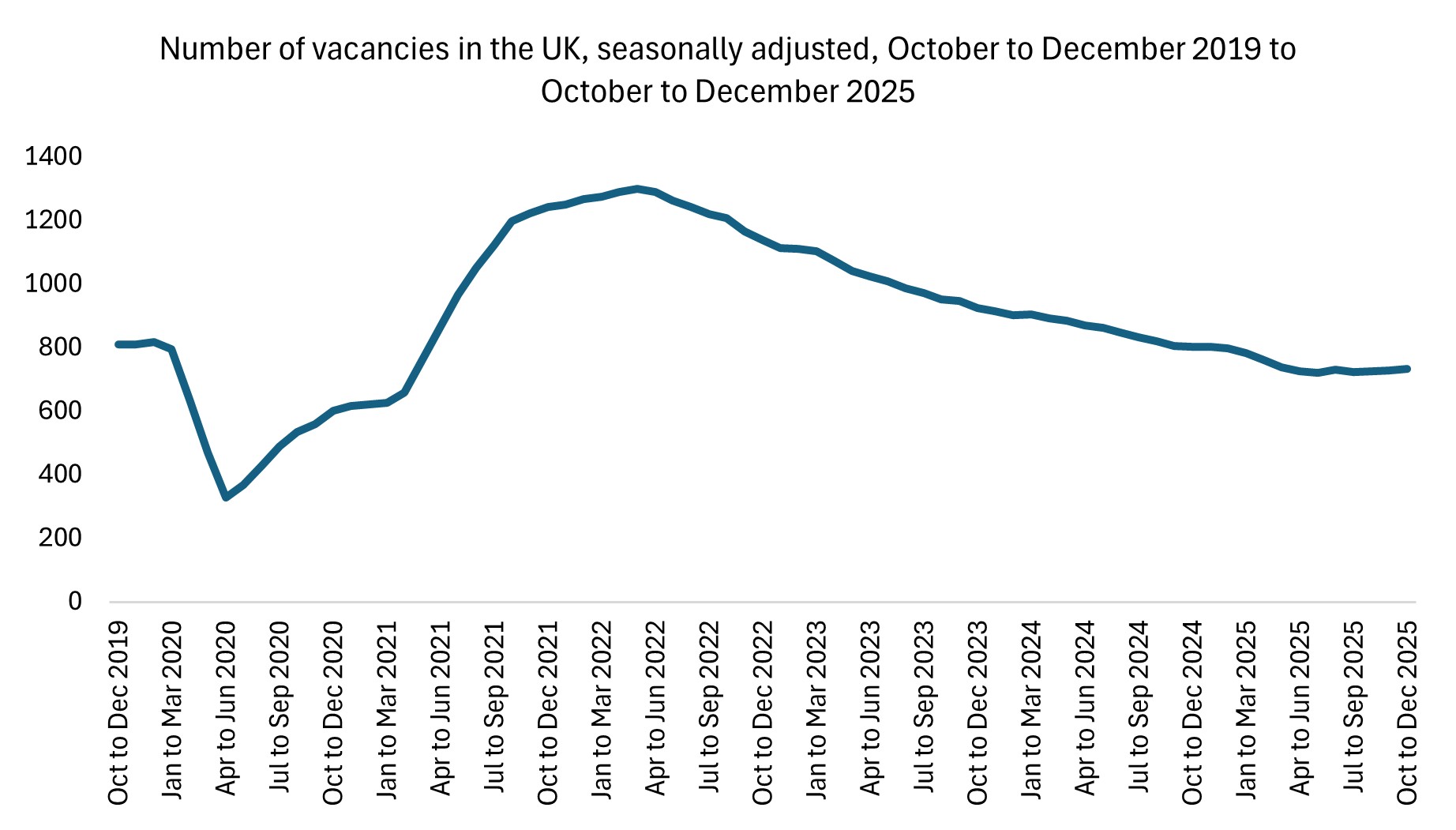

- Early estimates for October-December 2025 suggest vacancies rose slightly by 10,000 (1.3%) on the quarter to 734,000, following a prolonged period of decline and indicating stabilisation in labour demand.

Earnings Growth

- Regular earnings (excluding bonuses) increased by 4.5% year-on-year, while total earnings (including bonuses) rose by 4.7% in September-November 2025.

- Public sector regular pay grew by 7.9%, compared with 3.6% in the private sector, reflecting the timing of 2025 public sector pay settlements.

- In real terms:

- CPIH-adjusted earnings rose by 0.6% for regular pay and 0.8% for total pay.

- CPI-adjusted earnings increased by 0.9% for regular pay and 1.1% for total pay.

- Average weekly earnings (AWE) were estimated at £741 for total earnings and £689 for regular earnings in November 2025.

Labour Disputes

- An estimated 155,000 working days were lost to labour disputes in November 2025, the highest monthly total since January 2024, with more than half attributable to strike action in the health and social work sector.

The estimated number of vacancies has been broadly flat over the last six periods, after 39 consecutive quarterly declines since April to June 2022

Source: ONS

Back to Retail Economic News