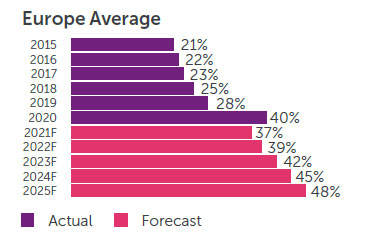

Pandemic-induced shift to online

Apparel markets have witnessed a step-change in the proportion of online sales due to lockdowns and enforced store closures. Across key European markets, Retail Economics forecasts online to account for almost half (48%) of apparel sales by 2025, compared to pre-pandemic levels of 28% in 2019.

The UK is set to be the most highly penetrated market, with 60% of apparel sales projected to occur online by 2025.

The UK is set to be the most highly penetrated market, with 60% of apparel sales projected to occur online by 2025. However, all European markets are poised to see a significant rise in online penetration rates for apparel over a five-year forecast period (Fig 9).

Fig 9 - Online penetration rates for apparel by European market

Purple = actual, Pink = forecast. Countries include the UK, France, Germany and the Netherlands. Source: Retail Economics

Download the full report here to view online penetration charts for individual countries: UK, France, Netherlands and Germany.

Behavioural change will lead to fewer store visits

Footfall at apparel stores will continue to face downward pressure over coming years, struggling to return to pre-crisis levels. This is partially due to consumer behaviour changes becoming embedded (more online but also increased remote working) as the pandemic turbocharges digital relevancy.

Our research found a strong correlation between consumers who said the pandemic has permanently changed their shopping behaviour, and their intention to visit stores going forward.

For example, in the UK, more than a third of consumers said Covid-19 caused a permanent change in the way they shop for apparel, with a similar proportion (35%) intending to visit stores less frequently than before the pandemic (Fig 10 – download full report here to view chart).

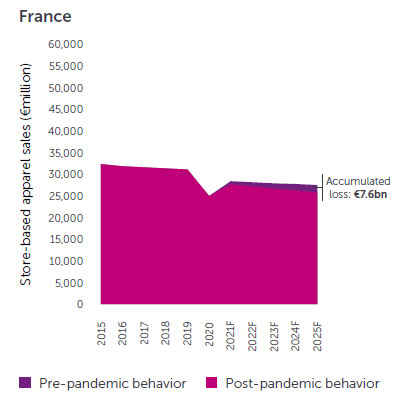

As a result of the shift to online and fewer store visits, Retail Economics estimates that across the four European countries combined, apparel stores will lose €8 billion in sales per year on average, over the forecast period – compared with a scenario where Covid-19 does not impact consumer behaviour.

Across the four European countries combined, apparel stores will lose €8 billion in sales per year on average.

Aggregated across the five-year forecast period, this amounts to c.€40billion in reduced store-based sales at apparel retailers across the key European markets. In line with the findings from the consumer panel research, the UK will be most affected, with stores projected to lose over €17 billion (£14.5bn) in apparel sales as a direct impact of Covid-19 (Fig 11).

Fig 11 - Accumulated loss in store-based apparel sales due to permanent changes in consumer behaviour caused by the pandemic

[Download the full report to view more additional charts for: the UK, Germany and the Netherlands]

Source: Retail Economics

Download the full report here to discover more insights into how the erosion of store-based sales will likely evolve over the next five years as a direct consequence of Covid-19.

Things to do now

Explore the next article in this series here which looks at five ways that the role of stores are evolving in a digital-first environment.

Download the full report here

Found this

short article interesting?

This article forms part of a thought leadership report entitled “A seamless fit - Evolution of stores in a digital-centric customer journey” produced by Retail Economics in partnership with Eversheds Sutherland. It is the second of a three part article series which explores the future of the European apparel industry and the role of physical stores. For retailers and brands seeking insight into the impact of the crisis across Europe, the full report provides data-driven insights and guidance for action.

View Full

Report Here