Navigating the Cost-of-Living Crisis: Understanding Consumer Cutback Behaviours in Retail and Leisure

This article is part three of our four-part mini-series, derived from our report in partnership with Grant Thornton 'The Cut Back Economy,' which explores the impact of the cost-of-living crisis on the UK retail, leisure, and consumer sectors. Our research shows that nearly 90% of UK consumers will need to reduce their spending on non-essentials. Check out the other three parts of the series at the bottom of this page.

2 minute read

As consumers become more cost-conscious, they will approach their retail and leisure experiences in a more considered and complex manner. This may include scaling back spending, switching brands, and searching for deals. Retailers and leisure operators must understand these changing behaviours in order to take advantage of new opportunities.

Substitution

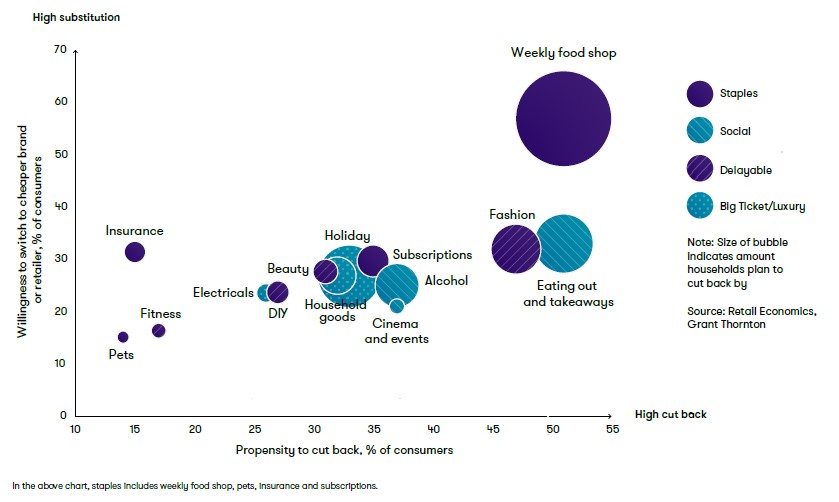

The most common strategy used by consumers to save money is substitution by switching to cheaper brands, retailers, or service providers. However, the willingness to trade down to cheaper alternatives varies depending on the retail or leisure category. For example, more flexible areas of expenditure, such as food and restaurants, are at higher risk of substitution than areas where trade-down options are more limited or brand loyalty is higher (e.g. electricals, pet supplies).

Fig 1: Pets/pet supplies are one of the least likely to be substituted

Source: Retail Economics & Grant Thornton

Scale Back

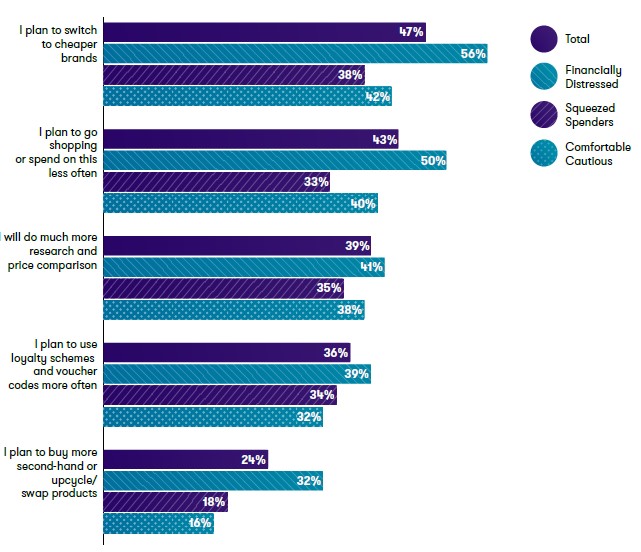

Our research found that 43% of UK consumers plan to reduce the frequency of their shopping trips as a result of the cost-of-living crisis. This has significant implications for retailers and leisure operators who will need to provide stronger incentives for consumers to visit their stores or pay for their services. Interestingly, the financially distressed households are the most likely to reduce their shopping trips, while the Comfortable Cautious cohort intends to scale back on shopping trips and trade down more frequently than Squeezed Spenders, despite being more financially stable. This suggests that the cost-of-living crisis is having a psychological impact on consumers, with emotional concerns driving intentions to cut back.

In addition, the research shows that a quarter of UK consumers plan to buy second-hand or upcycled items more often. This indicates that the cost-of-living crisis may inadvertently help accelerate the shift towards a circular economy. The resale or 'pre-loved' market offers an affordable shopping option for cash-strapped shoppers, but also meets growing desires from consumers to minimise their impact on the environment as they become more conscious of issues around overconsumption.

Fig 2: 24% of consumers plan to buy more second hand/upcycled products

Source: Retail Economics & Grant Thornton