UK Retail Sales Report summary

March 2025

Period covered: Period covered: 02 February – 01 March 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30-day membership trial now.

Retail sales

Retail sales rose by xx% year-on-year in February according to the Retail Economics Retail Sales Index. Factors impacting the headline performance in the month include:

Discounting: Retailers extended New Year clearance into early February, particularly in apparel and home goods, supporting volumes but likely at the expense of margins.

Evolving financial pressures: Inflation dropped to xx%, sustaining real wage growth and supporting a gradual recovery in discretionary budgets.

Strong demand for innovation: February saw strong demand for Electricals, as households begin to replenish electricals bought in the pandemic. This is being underlined by new product launches, including AI-backed products.

Valentine’s day boost: Fragrances and beauty products experienced a notable uplift, driven by gifting trends.

February spending

In February, Valentine’s Day offered a lift to traditional gifting categories such as fragrances in Health & Beauty (+xx%).

However, Clothing (+xx%) and Footwear (-xx%) – which bridges essentials and non-essential purchases – disappointed in a heavily promotional environment. Clothing & Footwear prices fell by xx% YoY in February, marking the lowest rate since October 2021, driven by unseasonal discounting in women’s clothing.

Food sales (+xx%) were also weak in February, impacted by intensifying price wars among major grocers, and half term getaways among affluent spenders. The number of flights abroad hit the highest level for February since 2019 (ONS). Passenger levels at Manchester and Stansted airports both hit record highs, contributing to a decline in domestic essential spending. Additionally, Barclays reported a xx% drop in dining out spend.

There were wide disparity across different measures, including Nielsen reporting a xx% uplift in the four weeks to 22 February and BRC-KPMG recording a xx% rise in the four weeks to 1 March, while the ONS reported volume declines deepened to -xx% (non-seasonally adjusted).

More importantly than monthly sales figures in isolation are evolving behaviours. As grocery shoppers flock to promotions facilitated by price investment, items bought on offer accounted for xx% of food sales, up xxpp from last year (Kantar, four weeks to 23 February).

Importantly in non-food, Electricals is beginning to rebound, as the cycle of refreshing devices following pandemic purchases begins to come through. This is being underlined by innovation, with a wave of new AI-driven products, including launches such as the iPhone 16E.

There are expected structural tailwinds further out. Although the Spring Statement in March did not introduce any further tax increases for retail following the Autumn Budget, the Budget reaffirmed commitments to house building. This, with its potential to drive house purchases and home ownership, could support home-related categories further out.

Polarised backdrop

Retailers are navigating a transitional period with cautious optimism. Real earnings remain positive in early 2025, helping ease the squeeze from a £xx drop in household spending power during the cost-of-living crisis.

But recovery is uneven. Affluent households, most willing to make major purchases, continue precautionary saving. In contrast, low- and mid-income households face lingering cost pressures.

Take out a FREE 30 day membership trial to read the full report.

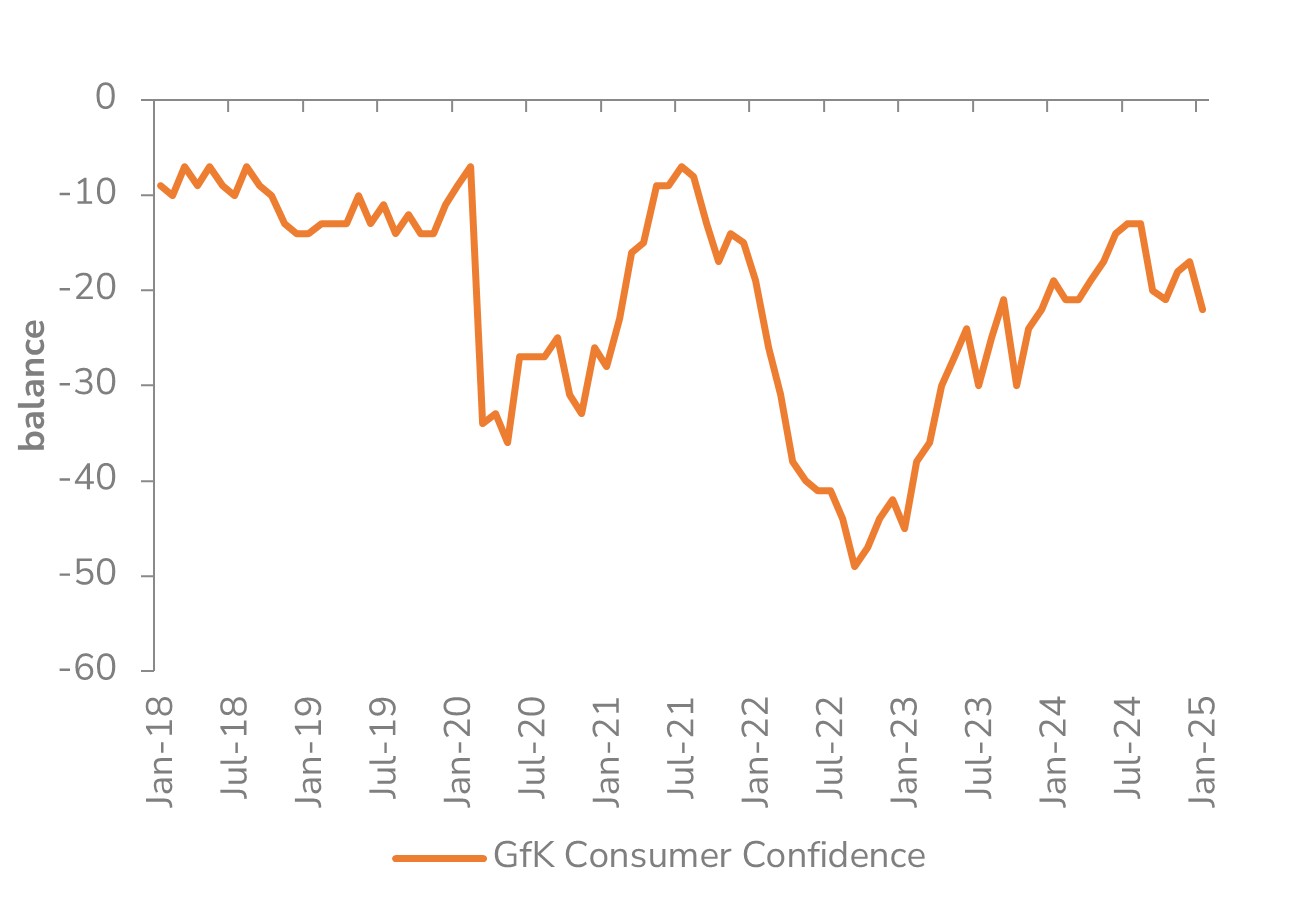

Confidence up a little in February

Source: Retail Economics analysis, GFK

Source: Retail Economics analysis, GFK