UK Retail Sales Report summary

June 2025

Period covered: Period covered: 04 May – 31 May 2025

3 minute read

Retail Sales Performance:

Retail sales rose by xx% year-on-year in May according to the Retail Economics Retail Sales Index.

In the three months to May, total sales rose xx%, compared to xx% in May 2024.

Factors impacting the headline performance in the month include:

- Sunny weather: The UK’s warm spring continued, with generally sunny, dry weather continuing for the first three weeks of the month. While rainfall increased in the final week, much of the country remained dry, giving the month an early-summer feel.

- Bank Holidays: May’s two bank holidays supported spend, with the first long weekend seeing warm weather and an uptick in pub trade and picnic food sales. However, more mixed weather for the second weekend limited footfall boosts.

- Travel focus: Those with spare cash channelled it into late-May holidays, while cutting back on high street trips and restaurants.

- Bills increases: Consumers spent May acclimatising to higher energy, water and council tax bills, making them careful to splash out on non-essentials.

- Retailer costs: Retailers also dealt with increased costs as they adapted to the April introduction of higher minimum wage rates and increased employers’ National Insurance. May discounting was shallow as they worked to protect margins.

Category performances

Clothing (-xx%) and footwear (-xx%) performed poorly, impacted by shoppers having refreshed their summer wardrobes in April.

Food sales (+xx%) were driven by increased warm weather social gatherings, with picnics and BBQs driving demand. Consumer behaviour remained highly value-conscious with discounters Lidl and Aldi reaching new market share highs as shoppers continued to flock to lower-priced options.

Grocery price inflation jumped to xx% in the four weeks to 18 May, according to Kantar, putting further strain on household budgets.

Health and beauty(+xx%) was the strongest category performer, benefitting from the good weather and the seasonal shift as consumers stocked up on essentials such as sun cream.

Furniture and flooring (+xx%) and homewares (+xx%) benefited from the surge in Q1 housing transactions, as first-time buyers raced to take advantage of lower stamp duty rates that ended in March.

Polarised backdrop

Retail sales fell behind retail inflation in March (+xx% retail sales deflator exc. fuel). While the sunny weather helped to boost the mood, this failed to translate into sales for most non-food retailers.

Increased bills, a post-cost-of-living crisis environment, and wider geopolitical uncertainty combined to put the brakes on spending.

Consumers also cut back after April’s splurges, with footfall down by xx% YoY in May (MRI Software).

Food spending benefited from continued socialising driven by sunny weather. While food performed better than non-food, behaviour remained value-driven as shoppers sought savings - xx% of food spending was on promotion, according to Nielsen, slightly down from April’s five-year high.

Headline inflation eased slightly to xx% in May, down from xx% in April, but prices remain under increased upward pressure compared to earlier in 2025, putting further strain on household budgets.

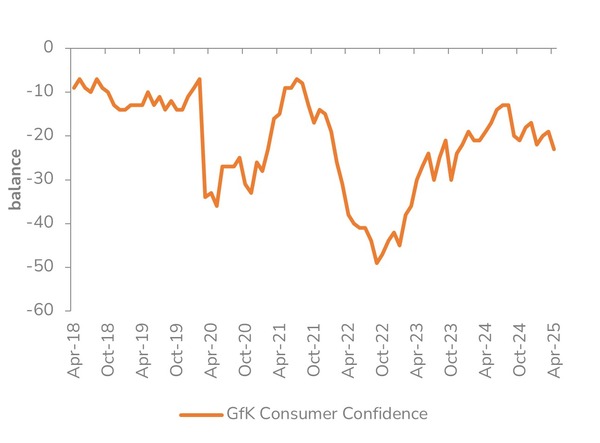

Confidence in May increased by three points to -xx, with all five measures up. However, expectations for the general economic situation is, at -xx, xx points lower than this time last year.

Rising costs and uncertainty continue to impact the labour market, with unemployment rising to 4.6%, its highest level since mid-2021.

After a month of moderation driven by earlier spending, increased living costs, and retailers resisting the temptation to discount too heavily, retailers will be on the lookout for opportunities to persuade shoppers to spend as the summer months unfold.

A more selective, tactical and cost-aware consumer means retailers will need to be ready to capitalise on opportunities as they arise and make a strong case for inclusion in household budgets.

Take out a FREE 30 day membership trial to read the full report.

Consumer confidence rose three points in May

Source: Retail Economics analysis, GFK

Source: Retail Economics analysis, GFK