UK Retail Sales Report summary

July 2025

Period covered: Period covered: 01 June – 05 July 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30-day membership trial now.

Retail Sales Performance:

Retail sales rose by xx% year-on-year in June according to the Retail Economics Retail Sales Index.

Across the previous three months, sales rose xx%, compared to -xx% in 2024.

Factors impacting sales include the UK’s second-hottest June on record, event-led purchases, a strong focus on value, and experiential spending. Underlying caution still lingers, with certain areas for spending carefully prioritised.

Significant improvement

High temperatures and events such as Wimbledon, Father’s Day and upcoming school holidays combined to lift spend in June, with retailers seeing a significant improvement on last year’s trading when total sales fell by xx%.

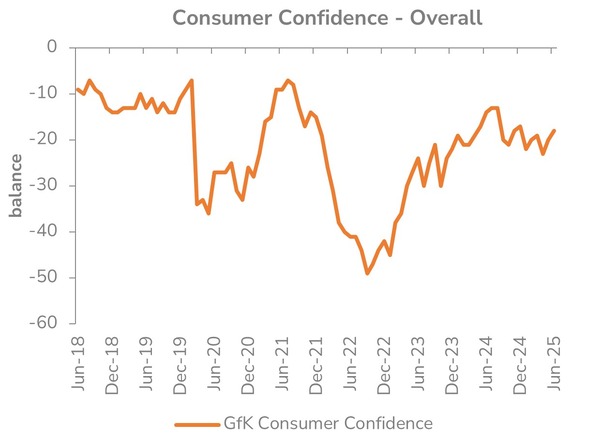

However, underlying conditions remain uncertain. Rising inflation is hitting consumer confidence, causing a one-point fall in July, and unemployment also rose.

Willing to spend

Consumers showed they were willing to spend in June, but only when something feels worth it. Seasonal products, social events and weather-sensitive categories saw a lift, while discretionary items without urgency remained a harder sell.

Some home-related spending continued to hold up, driven by March’s jump in housing purchases as first-time buyers raced to avoid new stamp duty charges introduced in April. Food spending was supported by warm weather socialising but remained heavily value-driven.

Clothing (+xx%) and Footwear (+xx%) enjoyed a resurgence after a poor May, as consumers shopped for upcoming holidays and social events.

DIY and gardening (-xx%), however, saw a fall in sales after April’s Easter-driven bout of productivity came to an end, and attention turned to socialising and events.

Food sales rose xx% YoY, with spend buoyed by sunny weather socialising. However, value-driven behaviour continues to dominate, with nearly 29% of grocery spend on promotion. Shoppers hunted for deals, traded down and prioritised own-brand items – a pattern that also carried into non-food categories such as clothing and electricals.

Home related categories including homewares (+xx%), electricals (+xx%), and furniture and flooring (+xx%) all remained in positive territory as March’s surge in housing purchases continued to drive demand for home improvements.

Shopper sentiment

Retail Economics’ most recent Shopper Sentiment survey finds that sentiment held steady in the last three months, with signs of financial strain easing slightly for some households. Fewer consumers said they just about manage, and expectations for worsening personal finances dipped slightly.

Confidence in the wider economy softened, but inflation remains the standout concern, alongside credit card debt and limited savings. Most households appear to be managing rather than struggling, with fewer planning to cut back on non-essential purchases.

Just under a half (xx%) of consumers expect the economy to weaken in the next three months, while just over a fifth expect it to strengthen (xx%), down from xx% in April.

Just under a third (xx%) of consumers expect their personal finances to weaken in the next three months, down from April 2025. xx% expect them to strengthen, slowing on the previous quarter.

Consumers view of their personal financial situation improved, with xx% suggesting they have just about managed, down from xx% in April.

Take out a FREE 30 day membership trial to read the full report.

Consumer confidence increases two points in June

Source: Retail Economics analysis, GFK

Source: Retail Economics analysis, GFK