UK Retail Inflation Report summary

August 2024

Period covered: Period covered: July 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Subscribe to access this data or take out a free 30 day subscription trial now.

Inflation

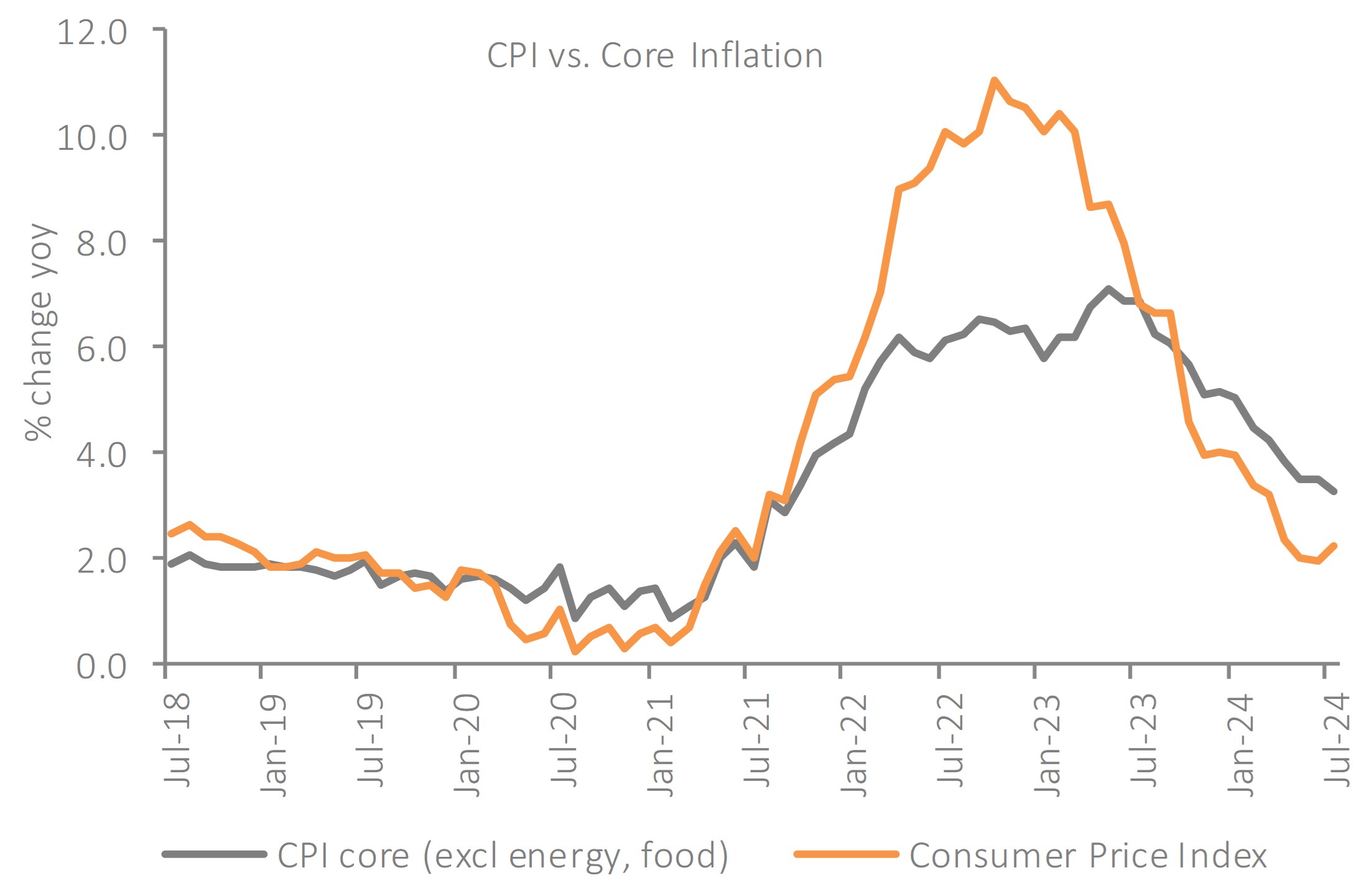

Inflation rises: Headline CPI rose by xx% in July YoY, up from xx% in June and slightly below economists' expectations of xx%. CPIH (which includes owner occupiers' housing costs) also increased, rising to xx% from xx% in June.

Core CPI falls: Core CPI, which excludes volatile items like energy, food, alcohol, and tobacco, eased to xx% in July from xx% in June, reflecting some moderation in underlying inflation pressures. This was the lowest level since September 2021.

Surprise fall in services inflation: Services inflation, a key focus for the Bank of England (BoE), fell significantly from 5.7% in June to 5.2% in July, well below the BoE’s forecast of 5.6%. This sharp decline is notable and could indicate easing domestic price pressures. Goods inflation remained in negative territory although rose to -0.5% from -1.4% in June.

Market Reaction: The pound dropped slightly following the inflation data release, reflecting increased expectations of a September rate cut. Market bets on a September rate cut have risen to 41%, up from 36% before the data was released.

Energy Prices: Despite falling energy prices, they contributed to the rise in overall inflation as the declines were less steep than those seen a year ago.

Restaurant and Hotel Prices: Prices for restaurants and hotels saw a notable decline, with the annual rate falling to xx% in July from xx% in June. This drop was largely driven by a significant decrease in hotel prices, linked to the absence of the ‘Taylor Swift effect’ this month, which contributed to a surge in prices in June.

Food Prices: Annual food and non-alcoholic beverages inflation remained at xx% in July, unchanged from June. Downward pressure came from breads and cereals, fish, vegetables, mineral waters and soft drinks which offset rises in the milk, cheese and eggs, fruit, sugar, jam and honey components.

Supply chain pressures: Encouragingly, factory gate inflation eased, increasing by xx% in July, down from xx% in June. However, input prices edged up by xx%, indicating some upward pressure on production costs.

Take out a FREE 30 day membership trial to read the full report.

Inflation rose by 2.2%

Source: ONS

Source: ONS