UK Retail Industry Outlook Report summary

February 2021

Period covered: Period covered: Q3 2020

Note: Reporting periods are either one month or two months behind the current month as standard.

Labour market

As much as a quarter of the UK’s workforce was put on the government’s Job Retention Scheme during lockdown. As the furlough scheme begins to unwind, the latest ONS labour market data shows an increase in unemployment is disproportionately hitting young people.

The unemployment rate in the quarter to July was 4.1% - 0.3% points higher than a year earlier.

The number of people unemployed aged 16 to 24 years increased by 76,000 on the last year to 563,000, while other age groups saw falls or little change.

The ONS’s experimental data shows the Claimant Count increased by 73,700 (2.8%) to 2.7 million between July 2020 and August 2020. Since March, the count has increased by 120.8%, or 1.5 million.

Disposable income

Pay has been under most pressure in industries where furloughing is prominent, many of these being the lowest-paid industries including accommodation and food services.

At an aggregate level, annual pay growth on a total basis remained negative in the three months to July, as bonuses fell by an average of 21.4% in the period.

The uneven impact of the pandemic on jobs and personal finances means that the knock-on effect to disposable incomes will vary across households and industries.

Retail Economics’ research shows that about 60% of consumers have cut back their spending and display more cautionary behaviour.

Housing market

Housing market data would suggest the residential market is strong, which has continued to pick up since estate agents reopened in May.

RICS data for August shows that for properties listed below £500k, 78% of estate agents report that sale prices are coming in at least level with the asking price (from +63% in January). Meanwhile Halifax data shows that house prices surged 7.3% in September, boosted by pent up demand and the temporary reduction in stamp duty until the end of March.

But restricted supply has driven up house prices. House inflation is based on actual sales, so if buyers cannot afford to purchase, they are excluded from house price statistics.

The ‘new normal’

The impact of Covid-19 has led to both temporary and long-term shifts in shopping behaviour. The golden quarter will see certain consumer habits cemented as the UK enters a ‘second wave’ of the virus.

Three trends that have emerged since the pandemic will underline this, including:

- Channel shift – the shift to online, as well as more localised shopping and open-air retail destinations such as retail parks.

- Transference of spending – shifting from going out to staying in, including restaurant spend going to grocery, as well as cancelled holidays. Households are also saving money on commuting, leading to increased saving.

- Lifestyle changes – more time spent at home, including working from home, cooking from scratch, new hobbies, and improving home environments.

Channel shift

The shift in spending online will be exacerbated by Christmas shoppers over the next quarter.

Online sales accounted for a third of overall retail sales in mid-June, and while this dipped back over the summer months as Covid restrictions eased, fears of crowded environments will see the proportion ramp up again around Black Friday and in the run up to Christmas.

Operating costs

The government has worked hard to ease the pressure on costs for retailers during the pandemic. The most popular support package has been the Coronavirus Job Retention Scheme, which supported a 2.0% fall in retail labour costs in Q2 2020, but other significant measures were the deferral of VAT repayments and the business rates holiday.

Such support saw Retail Economics’ cost base index drop by 1.5% and 2.0% respectively among food and non-food retailers in Q2 2020.

Usual festive trading is expected to be highly disrupted as more than half (56%) of shoppers expect to do a higher proportion of Christmas shopping online this year.

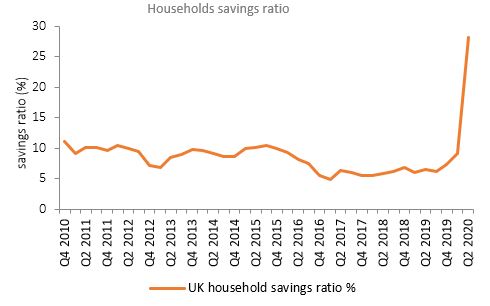

Record high level of savings

Source: Source: ONS, Retail Economics analysis

Source: Source: ONS, Retail Economics analysis