UK Online Retail Sales Report summary

October 2025

Period covered: Period covered: 31 August - 04 October 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online performance

Online retail sales rose by xx% year-on-year in September, below the xx% rise recorded in the same month last year.

Average weekly online sales reached £xxm, up from £xxm a year earlier, reflecting a sustained shift to digital across multiple categories.

Online accounted for xx% of all retail sales, marginally higher than the xx% share a year ago.

All but one category recorded growth in September. Department stores led the way with a robust xx% YoY increase, followed by Food (+xx%) and Clothing & Footwear (+xx%). Household goods saw a smaller rise of xx%, its second consecutive month of online growth.

Key drivers

September’s performance was supported by back-to-routine purchasing and early signs of festive preparation.

With footfall weakening across physical retail, down xx% YoY and xx% MoM, the channel benefitted from convenience, planning, and early-season gift buying. Storm Amy in the final week further skewed shopper behaviour towards online.

Price sensitivity continued to influence behaviour. Consumers took advantage of online tools to compare prices and seek discounts.

Promotional calendars were tightly aligned with payday windows and early festive preparation, with flash deals and personalised marketing helping to lift conversion.

Macroeconomic backdrop

September’s macroeconomic backdrop offered a mixed setting. Consumer confidence weakened, with GfK’s headline index slipping to -xx from -xx in August, as households grew anxious ahead of the Autumn Budget and the likelihood of tax increases.

Inflation held at xx%, offering some relief but leaving price pressures uneven. Goods inflation edged up to xx%, lifted by vehicle and transport costs, while services inflation remained high at xx% due to wage-driven costs in hospitality and housing. Food inflation eased to xx%, its first fall in six months, helped by easing supply costs and aggressive supermarket promotions.

Labour market data pointed to gradual softening. Unemployment rose to xx%, the highest since mid-2021, but vacancies slipped to around xx. and pay growth slowed to xx%, squeezing real incomes.

Mortgage rates eased slightly as gilt yields improved, though housing activity stayed subdued. But credit demand was steady, with borrowing contained and savings deposits rising.

Take out a FREE 30 day membership trial to read the full report.

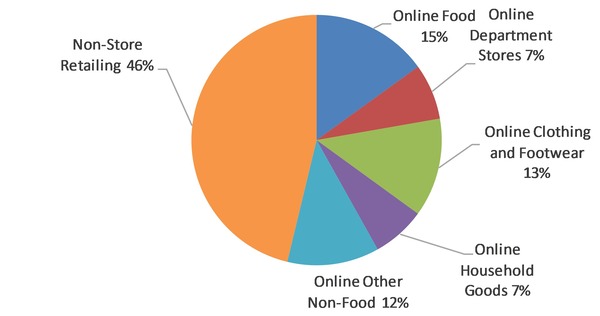

Proportion of online retail sales by category

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis