UK Online Retail Sales Report summary

June 2025

Period covered: Period covered: 4 – 31 May 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online performance

Online retail sales fell by xx% year-on-year in May, the weakest monthly performance since November 2024, following a xx% rise in the same month last year.

Weekly online sales averaged £xx, slightly below May 2024’s £xx while the online share of total retail sales eased to xx%, from xx% a year earlier.

Key drivers and category performance

May saw a sharp slowdown in online demand, following an artificially strong April driven by unseasonal heat and a late Easter. Much of the seasonal buying, gardening, outdoor gear, spring fashion, was pulled forward, creating a vacuum in May.

Footfall slipped xx% YoY (MRI Software), but this didn’t trigger a compensatory uplift online. Instead, cost-conscious households reined in discretionary spending altogether.

Weather trends contributed to the sluggishness. Despite being the fifth warmest and second sunniest May on record in the UK, many consumers had already made seasonal purchases in April. When cooler, unsettled weather arrived later in the month, it capped any late-spring bounce in online trade.

Promotional activity remained relatively subdued. Having cleared stock in April, many retailers scaled back discounts in May to protect margins.

For online shoppers, typically more price-sensitive, this restraint proved a key drag on conversion. Pureplay online retailers held up better than multichannel operators, but performance was negative across four out of six categories in May.

Online Food (+xx%) outperformed, buoyed by seasonal meal planning and promotional meal deals around the bank holidays and half-term. Gains were also supported by stronger convenience offerings and loyalty incentives. However, some of the uplift likely reflected higher prices rather than increased volumes, as grocery inflation edged up to a 15-month high.

Elsewhere, Household Goods (-xx%) underperformed, reflecting a combination of structural and cyclical pressures, while Clothing and Footwear (-xx%) saw a sharp decline following a strong trading period in April.

Macroeconomic backdrop

May’s trading sat on the fault line between cost fatigue and cautious optimism. Inflation remained sticky but eased to xx%, in line with expectations, remaining well above the Bank of England’s xx% target.

The small fall was driven by lower transport costs and softer rises in housing-related prices, which was partially offset by surging food inflation which recorded its sharpest rise since February 2024, adding stain on household budgets in the short term.

Despite GfK’s consumer confidence index rising three points to -xx in May, sentiment remained subdued, with major purchase intent stuck in negative territory, despite real wages remaining elevated.

There were some glimmers of long-term promise, with trade deals signed with India, the EU and the US, Ofgem announced a xx% cut the energy price cap, while the IMF lifted the UK’s 2025 growth forecast to 1.2%.

Outlook

June may bring better conversion opportunities, with major cultural events and paydays aligning. However, retail remains trapped in a holding pattern, stable employment and real wage growth give hope, but cost pressures and cautious sentiment limit upside.

Promotional triggers, weather, and experience-led consumption will dictate fortunes in the coming months. June could lift fashion, travel-related purchases and seasonal categories, but discretionary resilience is likely to remain patchy.

Take out a FREE 30 day membership trial to read the full report.

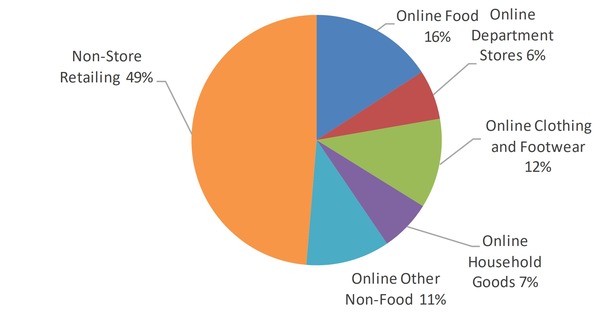

Proportion of online retail sales by category

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis