UK Online Retail Sales Report summary

July 2024

Period covered: Period covered: 26 May – 29 June 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online performance

Online retail sales growth experienced a moderate increase of xx% YoY in June (value and non-seasonally adjusted), against a xx% rise a year ago.

Weather impact: June's cool and damp start, followed by a brief warm spell, resulted in a slightly below-average temperature overall, affecting consumer spending habits with xx% spending less on retail goods over the past three months due to the weather (Retail Economics Consumer Panel).

UEFA Euro 2024: The football tournament boosted retail sales, with beer sales rising by xx% on days England played and no and low-alcohol beer sales increasing by xx%. About xx% of consumers spent more on food and drink, and xx% spent more on electricals, though food and grocery sales growth edged into negative territory at xx% YoY due to strong annual comparison and easing food inflation (Retail Economics Consumer Panel).

General Election: The announcement of a general election at the end of May led to cautious spending among consumers, with the GfK consumer confidence index rising only xx point in July to xx. Despite this, the Major Purchase Index increased by seven points to xx, indicating improved sentiment towards major purchases, though it remains to be seen if this will lead to stronger sales growth.

Underlying environment

Headline Inflation: Inflation remained at xx% in June, maintaining the Bank of England's target but exceeding economists' expectations of xx%. The stronger-than-expected inflation rate decreased expectations for an August rate cut, with the Bank of England looking for more evidence of sustained inflation reduction. Market expectations have since improved, deciding to reduce rates a close call.

Mortgage Arrears: Mortgage arrears hit an almost xx-year high in Q1 due to elevated borrowing costs. This is expected to rise as three million mortgage holders with rates under xx% face higher rates and expenses when their deals end by the end of 2026.

Social commerce to hit £16bn by 2028

The social commerce industry in the UK is projected to more than double from £7.3 billion to nearly £16 billion by 2028, according to a thought leadership report in partnership with TikTok.

This growth will see social commerce account for xx% of the total online commerce market, up from the current xx%, growing xx times faster than overall e-commerce sales.

Over xx (xx%) of UK users have made a purchase directly through social media, with this figure rising to xx% among those under 45, particularly driven by TikTok users.

Take out a FREE 30 day membership trial to read the full report.

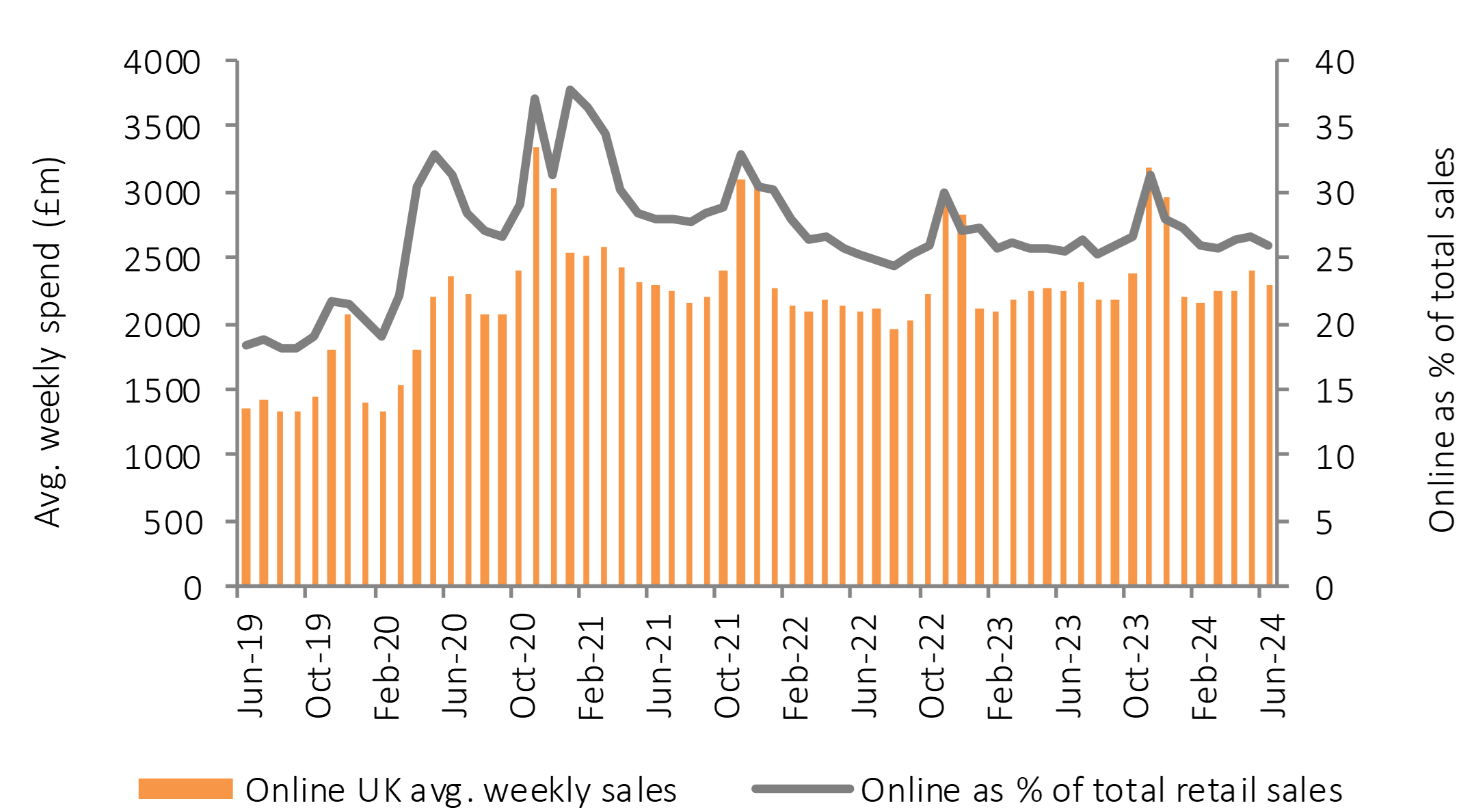

Online penetration eases

Source: ONS, Retail Economics Analysis

Source: ONS, Retail Economics Analysis