UK Homewares Sector Report summary

October 2025

Period covered: Period covered: 31 August - 04 October 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

Homewares sales rose by xx% year-on-year in September, a rise that outperformed the prior month but trailed the xx% growth recorded a year earlier.

Targeted seasonal spending and demand for functional home updates supported growth as it continues to benefit from ongoing resilience despite wider pressure on discretionary budgets.

Key trading themes and drivers

September trading was supported by early seasonal resets and pragmatic purchases. With households preparing for cooler months, demand tilted towards textiles, kitchenware and decorative accessories that delivered comfort and refreshment without straining budgets.

Autumn-focused merchandising began early, with retailers highlighting ‘cosy home’ themes that played to emotional and practical needs.

Price and practicality remained key. Promotions across key lines drove volume, particularly in value-led and own-label ranges.

Back-to-university also boosted demand. Student kit-outs for kitchen and bedroom supported sales of budget-friendly basics, with cookware one of the top sellers.

Category performance

Soft furnishings and textiles were September’s strong performers supported by term-time transitions and ongoing demand for home efficiency.

Decorative accessories remained an essential part of the category mix, serving as accessible ways to personalise interiors.

Macroeconomic backdrop

September’s economic data delivered little comfort to retailers. Consumer confidence slipped to -xx as households braced for possible tax rises in the November Budget. Inflation was unchanged at xx%, but the mix shifted: food inflation eased to xx%, while transport costs remained sticky. Real wages remained positive but the effect on spending was still cautious.

The labour market cooled further. Unemployment rose to xx%, the highest in over four years, and vacancies continued to fall. Despite this, households showed signs of greater financial control.

Homewares benefited from this pragmatism with shoppers redirecting small surpluses into their homes albeit with careful planning and a clear value lens.

Closing outlook

Homewares entered autumn on a steady footing. September’s performance highlighted the category’s resilience.

Early Christmas purchasing may lend support, particularly in gifting-friendly lines like candles, kitchen gadgets and textiles. But overall, the consumer mood remains cautious. Homewares remains a rare bright spot, not surging, but reliably in demand.

Take out a FREE 30 day membership trial to read the full report.

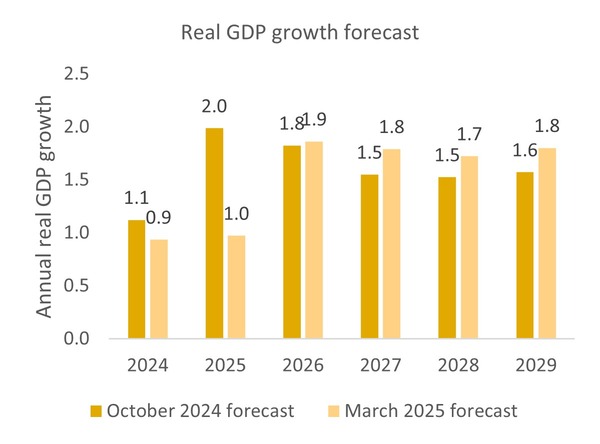

GDP forecast cut down to rise by 1.0% in 2025, down from 2.0% previously

Source: Office for Budget Responsibility, Retail Economics Analysis

Source: Office for Budget Responsibility, Retail Economics Analysis