UK Homewares Sector Report summary

May 2025

Period covered: Period covered: 06 April – 03 May 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

Homewares grew by xx% in April 2025, comfortably above the 3-month average of xx% and the 6-month average of xx%, reflecting robust seasonal demand.

Smoothing for Easter timing, the March–April average sales growth stood at xx%, up from xx% in the same period last year.

This uplift was driven by a combination of home entertaining, seasonal refreshes, and demand from new homeowners, marking a healthy rebound for the category.

Several factors contributed to this performance, including:

Spring cleaning and home decor uplift

April’s record-breaking sunny weather sparked a widespread home refresh activity.

Consumers focused on affordable updates, driving strong sales in soft furnishings, cushions, throws, bedding, and decorative accessories.

Bright, seasonal colour palettes resonated well, offering a low-cost mood boost amid cautious discretionary spending.

Outdoor-indoor crossover

Favourable weather encouraged consumers to treat indoor and outdoor spaces as extensions of the home.

Retailers offering both garden and homeware saw significant basket crossover, with purchases of picnicware, BBQ accessories, and garden lighting complementing traditional homewares.

This contributed to broad category uplift tied to comfort, hosting, and leisure.

Easter hosting and entertaining

The late Easter in 2025 boosted seasonal demand. Households preparing for gatherings drove sales of table décor, Easter-themed linens, and kitchen gadgets.

Cookware and bakeware sales also rose as consumers invested in new pans and mixers for holiday meals. This mirrored trends in furniture, with Easter acting as a catalyst for previously postponed purchases.

Housing completions drove demand for essential homewares

A sharp xx% MoM rise in March property transactions, the third-highest on record, triggered by the 1 April SDLT threshold rollback, fed into strong homewares demand.

New homeowners stocked up on essentials including glassware, utensils, bedding, lighting, and bathroom accessories.

Retailer promotions boosted conversion and volume

Homewares benefited from a wave of Easter-timed promotions. Many retailers cleared older stock and launched new spring collections with modest introductory discounts.

These offers lifted conversion rates without deep margin erosion, appealing to value-conscious shoppers navigating inflationary pressures.

Improved sentiment and a low base for comparison

GfK’s consumer confidence index rose three points to -xx in May, with all sub-indices improving, signalling growing consumer readiness to spend on non-essentials.

Easing inflation on essentials further encouraged discretionary spending on comfort items like bedding, often linked to hosting needs.

Take out a FREE 30 day membership trial to read the full report.

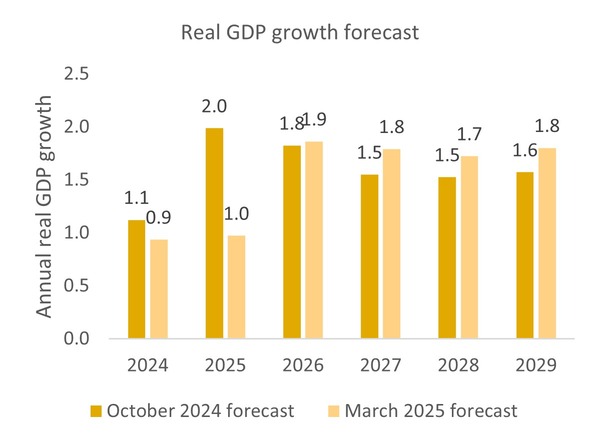

GDP forecast cut down to rise by 1.0% in 2025, down from 2.0% previously

Source: Office for Budget Responsibility, Retail Economics Analysis

Source: Office for Budget Responsibility, Retail Economics Analysis