UK Homewares Sector Report summary

May 2024

Period covered: Period covered: 31 March – 27 April 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

Homewares sales fell by xx% YoY in April, according to the Retail Economics Retail Sales Index.

Homewares was once again the top performing household goods sector in April, compared to figures of xx% for Furniture & Flooring and xx% for DIY & Gardening.

Improving macro backdrop

GfK’s consumer confidence index improved in April, rising by two points to -19. Although still firmly in negative territory, all measures were higher than a year ago.

This reflects a marginal improvement in living costs as headline CPI inflation increased by 2.3% in April, marking the lowest rate since xxxx (ONS).

This was driven by easing energy prices, with the cost of an average annual energy bill dropping by £238 to £1,690 under the latest Ofgem price cap from the beginning of April, the lowest for two years.

Meanwhile, further easing was seen in the furniture and household equipment category, which recorded inflation of xx% in April, with downward pressure from the furniture, furnishings and carpets component (ONS).

On the other hand, both GfK’s measure of consumers’ attitudes about the general economic situation over the next 12 months and its Major Purchase Index, although improving, remained below -20.

A key driver of these more pessimistic indicators is on-going uncertainty regarding the onward trajectory of interest rates, which remained at a xx high of xxxx% in May.

This suggests sustained reluctance to make large, big-ticket purchases for the home, with preference being given to cheaper homewares products compared with furniture products and home improvements projects.

Outlook

Although a cut in interest rates was initially expected as early as June, market expectations are now pointing towards a reduction in the second half of the year. Headline CPI inflation is now close to the Bank of England’s target, but higher than expected price rises in the services sector have prompted further caution.

Consumers will therefore continue to be careful with their discretionary spending, particularly when it comes to the home. In the near-term, spending on both essential and lower-cost homewares will remain robust as the housing market regains momentum and continues to adjust to higher rates.

Reactive, post-pandemic spending patterns also remain at play, however, with consumers prioritising spending on hospitality and leisure over household goods, with Barclays reporting a xx% increase in spend growth for the former compared to xx% for the latter in April.

Homewares retailers therefore need to continue to entice consumers to prioritise household goods over competing sectors by offering both value and convenience.

Take out a FREE 30 day membership trial to read the full report.

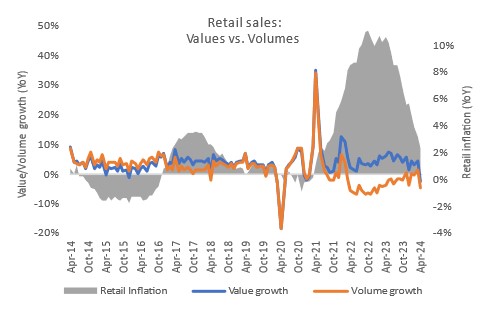

Inflation has eased substantially but volumes remain in decline

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis