UK Homewares Sector Report summary

July 2025

Period covered: Period covered: 01 June – 05 July 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

UK homewares recorded xx% YoY growth in June, placing it in sixth position in the monthly sector growth rankings.

This result marked a softening compared to the 3-month (xx%) and 6-month (xx%) averages. Key drivers that affected this performance include:

Housing completions & home setup demand: Recent home movers continued to drive demand for functional homewares such as kitchenware, storage, and bathroom essentials, sustaining baseline growth after Q1's spike in property transactions.

Prior seasonal pull-forward: Unseasonably warm weather and heavy promotional activity in April and May front-loaded seasonal spending on garden and spring decor, reducing urgency in June.

Selective spend on practicality: Consumers remained discerning, focusing on utility-driven purchases. Discretionary décor items were deprioritised as shoppers sought affordability, durability, and everyday functionality.

Online channel weakness: The online channel contracted by xx% YoY in June, as tactile, mid-ticket homewares categories continued to underperform online.

Margin & input cost pressures: Rising costs across labour, utilities, and rates pressured retailer margins. Limited promotional scope and cautious pricing strategies constrained volume growth, particularly in non-core categories.

Experience-led consumer behaviour: Consumers increasingly prioritised experiences over products, especially in younger demographics. Spend shifted toward travel, hospitality, and events, with homewares purchases becoming more need-based and less emotionally indulgent.

Prior seasonal pull-forward

June’s softer trading reflected demand that was brought forward by unseasonably warm weather in April and May, contributing to the warmest UK spring on record (Met Office).

These conditions prompted early purchases of picnicware, and seasonal textiles, much of which were driven by heavy Easter and bank holiday promotions.

June itself was the second warmest since 1884, with mean temperatures of 16.9°C and over 192 sunshine hours, alongside two notable heat spikes (16–21 and 27–30 June).

But many shoppers had already fulfilled their summer needs. Footfall rose +xx% YoY in the final week of the month (MRI Software), likely linked to end-of-month missions and event preparation, but overall activity outside of these peaks remained subdued.

Economic backdrop

The UK economy continued its modest recovery heading into H2, with GDP up xx% in the three months to May and xx% higher YoY. Growth in consumer-facing services and retail supported momentum, despite persistent inflation and weak construction output.

Headline inflation edged up to xx%, driven by rising services and housing-related costs. Meanwhile, furniture and household goods inflation reversed to +xx%, adding price pressure back into the category.

Households faced sustained cost-of-living pressures, including +xx% energy price increases and +xx% higher water bills.

Although real wages grew xx% YoY, unemployment ticked up to xx%, and consumer confidence remained fragile. This macro backdrop reinforced cautious, value-led spending in discretionary categories.

Take out a FREE 30 day membership trial to read the full report.

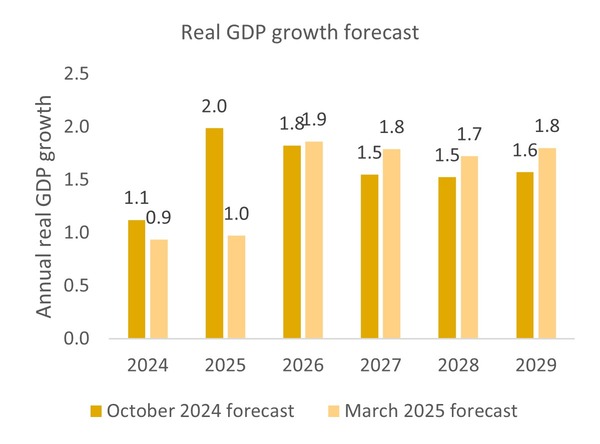

GDP forecast cut down to rise by 1.0% in 2025, down from 2.0% previously

Source: Office for Budget Responsibility, Retail Economics Analysis

Source: Office for Budget Responsibility, Retail Economics Analysis