UK Homewares Sector Report summary

February 2025

Period covered: 29 December 2024 – 01 February 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

Homewares experienced a solid xx% year-on-year growth in January, outperforming the three-month average of xx%.

Despite broader economic challenges, including inflationary pressures, homewares saw a boost from promotional activity, particularly in the New Year sales.

Consumers continued to focus on value, contributing to homewares’ outperformance compared to other discretionary categories. Several contributed to this performance including:

Value Focus Shopping

January brought more evidence that shoppers are prioritising value, particularly when it comes to essentials and supermarket spending. Promotional spending now accounts for xx% of total supermarket sales – the highest January level since 2021.

Consumer behaviour remained cautious, driven by inflationary pressures, particularly on essentials like food and energy. Research by Retail Economics and NatWest highlights that inflation remains the top concern for xx% of households.

Back-to-office Footfall

Footfall data for January indicates a positive trend in retail destinations, with overall footfall increasing by xx% YoY, marking the strongest rise outside the pandemic era since 2016. Shopping centres led the growth with a xx% rise, followed by retail parks (+xx%) and high streets (+xx%).

This growth was concentrated in specific regions, with Greater London seeing a xx% rise due to the continued return to the office, and the Southwest of England experiencing a xx% increase.

However, Scotland saw a sharp xx% YoY decline due to adverse weather conditions.

The return to office footfall post-Christmas contributed significantly to the growth in retail parks footfall, particularly benefiting sectors like homeware, which are typically located in these areas.

MRI Software highlighted that footfall in retail parks grew by xx% YoY in January, benefiting from the increase in office-based and commuter footfall, driving demand for home essentials.

Cold Weather and Storms

January’s mean temperature was xx°C, xx°C below the long-term average, with a colder first half of the month and a milder, stormy second half.

Storm Eowyn, the strongest UK storm in 10 years, hit Scotland and Northern Ireland on January 24, with winds of up to 100mph and over half a million homes losing power. On January 26, Storm Herminia brought heavy rains and strong winds to southern England and Wales.

Despite the colder weather, the high street benefited from the fifth sunniest January on record, with footfall recovering.

As a result, penetration of online retailers fell from xx% in December to xx% in January, making this the weakest month for online retailers since the disruption caused by postal strikes in December 2022.

Take out a FREE 30 day membership trial to read the full report.

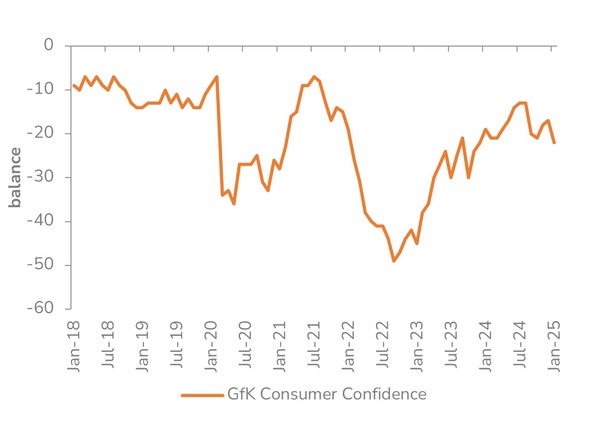

Confidence falls down

Source: GFK, Retail Economics Analysis

Source: GFK, Retail Economics Analysis