UK Health & Beauty Sector Report summary

May 2024

Period covered: Period covered: 31 March – 27 April 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health & Beauty Sales

Health & Beauty sales rose by xx% YoY in April, against a rise of xx% in April 2023 according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

The category remained the strongest performing non-food category, and was the only category to record positive growth during the month.

However, month-on-month sales declined by xx%, down from xx% growth in March, suggesting that even this category is suffering in a subdued consumer spending environment.

Performance was influenced by several key drivers:

Easter: Easter weekend fell in March this year, pulling forward sales and impacting April’s year on year comparisons. Health and beauty’s combined growth figure for March and April was xx%, against xx% last year.

Fragile environment: Consumer spending is still subdued, with consumers exercising caution and hesitating to spend.

Wet weather: April brought more unsettled weather – while the middle of the month saw some warm temperatures, it was a largely stormy and wet month with 55% more rain than normal.

Rail strikes: Nationwide rail strikes in early to mid April impacted footfall at retail destinations, while more localised overtime bans in some parts of the country later in the month added to the issue.

Basket abandonment

Retailers looking to protect their share of consumer spending need to do everything they can to stop consumers getting cold feet at the point of purchase.

However, basket abandonment cost retailers £34.4bn in 2023, up from £31.5bn the previous year (Retail Economics-GFS).

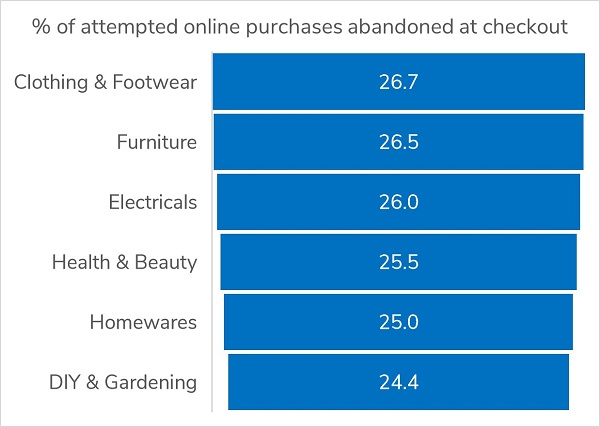

Basket abandonment in health and beauty in 2023 stood at 25.5% (proportion of intended online purchases abandoned at checkout).

Consumers value fast delivery and a wide range of options, such as next day, named day, or time slot deliveries to enable them to plan around other commitments.

Consumers in health and beauty also value environmentally friendly packaging and sustainable delivery, which play a significant role in purchasing decisions.

Abandonment is notably high among younger shoppers in health and beauty, reaching 37.3% for those aged 18-24 and 32.9 for those aged 25-34. These shoppers tend to be digitally savvy, and shop online more than others.

Take out a FREE 30 day membership trial to read the full report.

Online basket abandonment rate by retail sector

Source: Retail Economics, GFS

Source: Retail Economics, GFS