UK Health & Beauty Sector Report summary

July 2025

Period covered: Period covered: 01 June – 05 July 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health and Beauty sales

Health & Beauty sales rose by xx% YoY in June, against a tough comparative of xx% growth in June 2024, according to the Retail Economics Retail Sales Index.

Several key factors influenced performance:

Sunny weather: The UK saw its second warmest June on record, with two heatwaves mid and late month. Sunshine lifted footfall and supported seasonal categories like suncare, fragrance and hydration products.

Event-led purchases: Wimbledon, Father’s Day, festivals and upcoming school holidays gave people a reason to buy - from grooming kits and SPF to travel-sized toiletries and makeup. Health & beauty often benefits when experience-led spending rises, with consumers topping up travel essentials.

Seasonal health: Pharmacies saw strong sales of hay fever tablets, nasal sprays and eye drops as high pollen counts persisted. Warmer weather also lifted demand for seasonal treatments like insect bite and sting relief.

Inflation and tax fears: Headline inflation rose to xx% in June (up from xx%), with food inflation hitting xx%. Rising costs and speculation around Autumn tax hikes weighed on consumer confidence and discretionary spend.

Value front and centre: Nearly xx% of grocery spend was on promotion. Shoppers hunted deals, traded down, and prioritised own-brand - a pattern mirrored in health & beauty, where multibuys, discounters and loyalty offers continued to resonate.

Solid growth driven by self-care and sunshine

Health & Beauty continued its strong run in June, lifted by seasonal needs, event-driven demand and a growing appetite for self-care.

Allergy treatments, sun protection and hydration products saw strong demand during June’s heatwave, supported by record temperatures and yellow health alerts.

Health & Beauty card spending rose xx% year-on-year in June, boosted by hay fever and sun care sales (Barclays).

Fragrance, grooming and cosmetics also benefitted from a full calendar of weddings, festivals and summer holidays, as consumers prepared for social occasions.

While overall footfall remained broadly flat (+xx%), retail parks saw growth (+xx%) and Thursday trading picked up as shoppers stocked up ahead of sunny weekends.

Shoppers continued to spend in areas they’re choosing to prioritise – and Health & Beauty remained one of them.

Online channels also contributed, with non-food internet sales returning to growth in June. Online retail sales rose xx% year-on-year, supported by seasonal promotions and top-up purchasing, particularly in replenishment categories like skincare and personal care (ONS).

Beauty continued to benefit from the “treat factor,” with lip colour, skincare and premium haircare holding up as shoppers prioritised self-care and affordable indulgence.

Wellness also grew, led by supplements and sports nutrition. Basket sizes edged up as impulse buys were added to everyday essentials – reinforcing Health & Beauty’s balance of function and feel-good.

Mixed signals on economy

The UK economy showed signs of resilience in early summer. GDP grew xx% in the three months to May supported by retail and accommodation, despite month-on-month declines in April and May.

Real wage growth continued to support spending power. Average weekly earnings rose xx% YoY between March and May, outpacing inflation and delivering a xx% real-terms gain - with pay growth strongest in consumer-facing sectors like retail and hospitality.

Inflation, however, remains stubborn. Headline CPI rose to xx% in June (up from xx%), driven by food, transport and core services. Sticky price pressures and elevated wage growth could delay further interest rate cuts, despite markets expecting one in August. A second cut remains priced in by year-end, though this is data-dependent.

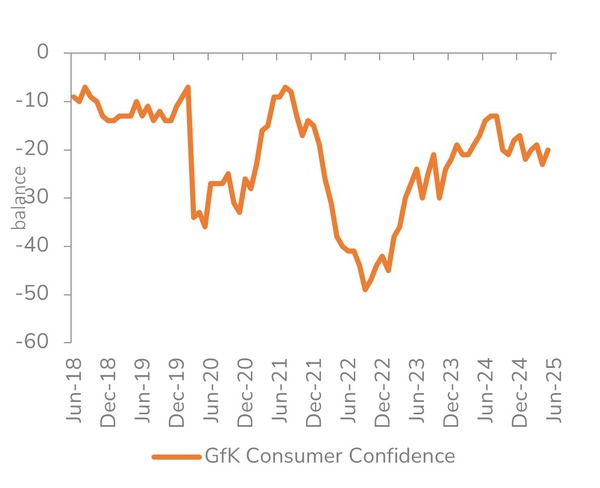

Consumer confidence remains fragile. GfK’s index dipped slightly in July to -xx, reflecting greater concern about the economy and personal finances. Even so, the major purchase index edged up, suggesting consumers are still willing to spend when the value is clear.

Take out a FREE 30 day membership trial to read the full report.

Consumer confidence improved in June as optimism for the economy improved

Source: Retail Economics, GFK

Source: Retail Economics, GFK