UK Furniture & Flooring Sector Report summary

October 2025

Period covered: Period covered: 31 August - 04 October 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring – Retail Economics Index

Furniture and flooring sales rose by xx% year-on-year in September, maintaining a slight upward trajectory.

This compares favourably with the xx% fall recorded in September 2024 and sits above the three-month average of xx%.

Key trading themes and drivers

Retailers continued to benefit from consumers focusing on their immediate living environments rather than larger-scale housing moves.

Demand was supported by mid-season promotional events and financing incentives across big-ticket categories, particularly sofas, beds and dining furniture.

Buyers remained price-sensitive, leaning into value-led ranges and offers with deferred payment terms.

Flooring gained traction in line with seasonal routines. As temperatures dipped, shoppers resumed plans to replace carpets, vinyl and laminate ahead of winter.

Storage furniture and occasional pieces benefited from value positioning and broad appeal, especially among renters and younger households.

Retail parks with home anchors saw better traffic than most channels, particularly on weekends, emphasising their importance to the sector.

Housing Market Link

The property market offered limited support in September, but conditions remained broadly stable. Halifax reported average house prices at £xx, up just xx% year-on-year and -xx% month-on-month.

Transactions were subdued but not collapsing, with many buyers and sellers awaiting clarity from the Autumn Budget. Nationwide echoed this with annual price growth of xx%..

Mortgage rates have edged down from their mid-2024 peaks. This has eased pressure marginally for first-time buyers and remortgagers but has not yet unlocked a major shift in transaction volumes.

Encouragingly for furniture and flooring retailers, a 'stay-and-improve' mindset continues to influence home-related spending.

Households unwilling or unable to move are investing selectively in upgrades, particularly where product ranges and financing options align with tighter budgets.

Any further fall in mortgage rates could release pent-up demand in 2026, but in September, the market offered only a soft tailwind.

Footfall Patterns

Showroom visits followed the broader retail trend of weaker traffic. High street footfall dropped xx% YoY, and shopping centres slipped -xx%, according to MRI Software.

However, retail parks, home to many furniture and flooring specialists, saw footfall rise xx%, aided by their convenience and suitability for destination shopping. In-store performance was mixed with visits often purposeful, but conversion remained dependent on pricing and promotional triggers.

Retailers continued to lean on hybrid customer journeys. Shoppers increasingly researched online and used virtual room planning tools before visiting in person to assess texture, comfort, and finish.

Closing Outlook

Furniture and flooring enters the final quarter with cautious stability. Growth is small but positive, and the sector is in a stronger position than a year ago. Budget-conscious consumers are prepared to invest selectively, particularly when prompted by promotions, events, or seasonal milestones.

Retailers face a competitive environment with clear value communication, flexible payment options, and seamless online-to-store experiences key to driving growth. The sector’s link to the housing market remains important, but in the current climate, sentiment and spending power are the real swing factors.

Take out a FREE 30 day membership trial to read the full report.

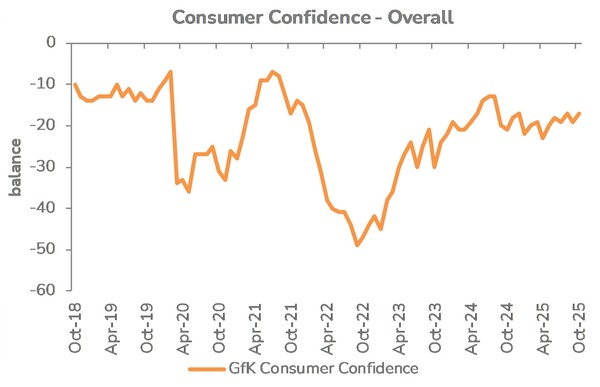

Consumer confidence increased by two points in October

Source: GFK, Retail Economics analysis

Source: GFK, Retail Economics analysis