UK Furniture & Flooring Sector Report summary

November 2024

Period covered: Period covered 29 September – 26 October 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring – Retail Economics Index

Furniture & Flooring recorded a deeper decline of -xx% YoY in October, worsening from -xx% in September and -xx% a year earlier, according to Retail Economics data.

Value-driven behaviour

In October, value-driven behaviour and unseasonably mild weather influenced Furniture & Flooring sales.

Purchasing patterns were shaped by the anticipation of Black Friday promotions, as consumers deferred large-ticket purchases for potential deals during the sales event.

Evolving inflationary dynamics

Inflation across the wider consumer basket rose to xx% in October, up from xx% in September, according to the ONS, with higher energy costs driving the increase.

Housing and household services inflation jumped to xx%, driven by Ofgem’s energy price cap rise, which added £xx annually to household energy bills on average.

Wages, Inflation, and the Tug of Consumer Confidence

The UK labour market continued to adjust to evolving economic conditions. According to the ONS, annual earnings growth of xx% YoY outpaced inflation, which stood at xx% in October.

This provided a measure of relief for households, particularly as wage growth for lower-income groups benefited from strong performance in sectors like food services (+xx%).

Gradual recovery in household budgets

Our Household Income Tracker highlights varied impacts across household finances heading into October. Disposable income for the least affluent households rose xx% YoY (+£xx) in September, but was still down xx% compared to three years ago.

Housing activity up despite pressures

The housing market, an important forward-looking indicator for the category, continued to strengthen, with agreed sales and new buyer enquiries both rising. The RICS Residential Market Survey reported a net balance of +xx% for house prices, indicating more surveyors observed price increases than not.

Take out a FREE 30 day membership trial to read the full report.

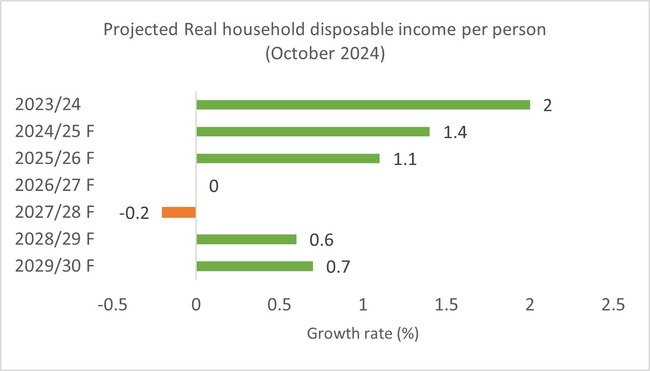

Projected Real household disposable income per person expected to decline in 2024-25

Source: OBR

Source: OBR