UK Furniture & Flooring Sector Report summary

July 2025

Period covered: Period covered: 01 June – 05 July 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring – Retail Economics Index

Furniture and flooring sales grew xx% year-on-year in June 2025, ranking third behind clothing (xx%) and health & beauty (xx%).

Although slightly below the 3-month average (xx%), June’s growth was a clear step up from May (xx%) and well above the 6-month (xx%) and 12-month (-xx%) trends.

Several factors affected this performance, including:

Housing market momentum from Q1: The sharp rise in housing transactions in Q1, particularly March, carried through into furniture purchases in June. Outdoor, living room, and bedroom categories benefited as new homeowners furnished their properties.

Weather-driven seasonal spend: June was the second hottest on record, with two major heatwaves prompting consumers to invest in indoor comfort and outdoor living setups. Promotions tied to seasonal events such as Father’s Day and Wimbledon successfully captured spend.

Value-focused consumer behaviour: Despite inflationary pressure, shoppers demonstrated willingness to buy when offers aligned with value and urgency. Bundled offers and free fitting encouraged flooring purchases from budget-conscious households.

Selective discretionary spending and confidence: June spending patterns showed increased consumer confidence in making considered large purchases, with the GfK Major Purchase Index rising marginally. However, caution lingers as households juggle elevated mortgage costs and ongoing economic uncertainty.

Weather-driven seasonal spend

June was the UK’s second hottest June on record, with two heatwaves (mid and late June) and temperatures in London peaking at 32.2°C, according to the Met Office.

This spurred sales of outdoor furniture, fans, and other heat-sensitive home items, creating a surge in discretionary but purposeful purchases.

Retail parks, where furniture stores are often concentrated, saw +xx% YoY footfall, outperforming high streets (-xx%) and shopping centres (-xx%) (MRI software).

Event-based triggers - Wimbledon, Father’s Day, upcoming school holidays, drove additional interest in practical, entertaining-focused furniture purchases, such as seating, dining sets, and modular units.

Retailers with early seasonal promotions and weather-relevant merchandising (e.g., fast-access garden furniture) capitalised best.

Economic backdrop and structural pressures

Though furniture and flooring enjoyed growth in June, structural macroeconomic headwinds continued to cast shadows over the category:

Inflation rose to xx% (CPI) in June, the highest level since February 2024. Food inflation hit xx%, with core inflation also sticky at xx%. This limited discretionary income.

Unemployment rose to xx%, the highest rate since mid-2021, with payroll employment declining by xx YoY in June.

Retail faced pressure from April’s national minimum wage hike and higher employer National Insurance contributions.

Real earnings grew by xx% YoY (CPIH-adjusted), supporting some consumer resilience - but momentum is slowing, particularly in private-sector income.

Consumer confidence dipped; the GfK Index fell to -xx in July, with expectations for the general economy at -xx, xx points lower than last year.

While planned purchases still occurred, impulse and aspirational spending stayed muted.

These dynamics create a dual-speed economy: cautious middle-class consumers still furnish new homes and make upgrades - but increasingly demand value, flexibility, and efficiency in how their money is spent.

Take out a FREE 30 day membership trial to read the full report.

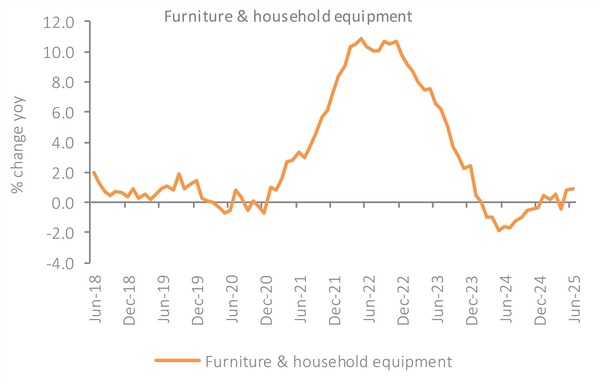

Furniture & Household Equipment inflation rose by 0.9% YoY in June from a 0.8% rise in the previous month.

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis