UK Furniture & Flooring Sector Report summary

July 2024

Period covered: 26 May – 29 June 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring – Retail Economics Index

Furniture & Flooring sales fell xx% YoY in June, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted). Key factors impacted this performance:

Weak housing market

High interest rates have made consumers cautious about making moves or taking up big projects, squeezing affordability that impacts Furniture & Flooring sales. Residential property transactions have improved following a recent dip (up xx% YoY in May, ONS), but are ultimately lower than the pre-pandemic average. Sales were down xx% compared to the xx-year average for May to 2019 (ONS).

Building savings amid cautiousness

However, consumer confidence saw just a xx increase in July versus June, as high borrowing costs and delayed interest rate cuts continue to influence shopper behaviour. The Major Purchase Index rose by xx points from June to xx in July. While recovering, it ultimately still reflects consumer hesitancy towards making significant purchases. By comparison, the Savings Index climbed by five points to xx, highlighting a growing preference for savings.

Deflated prices & Red Sea challenges

However, promotions and price cuts have helped ease declines. Annual inflation in the Furniture & Household Equipment category decreased by xx% in June, marking the sixth consecutive month of deflation. This trend contributed to the overall CPI inflation rate of 2xx% for the month (ONS).

Major retailers, such as IKEA, have been reducing prices to boost spending, though disruptions in the Red Sea region challenge these efforts.

In the first four months of 2024, the average distance each container was shipped globally increased by xx%. This extended transportation distance impacts logistics and supply chains, adding complexity to cost management for retailers (Xeneta).

Retail resilience

Elevated borrowing costs, cautious consumer spending on big-ticket items, and delayed house moves have put serious pressure on the balance sheets of Furniture & Flooring retailers.

Carpetright, with over 270 stores and more than 1,850 employees, was on the brink of collapse in July, before rival Tapi saved 54 stores and 308 jobs. A reduction in consumer spending, fewer house moves, intense competition and a cyber-attack in April which compromised trading led to its downfall.

Such issues are not unique to Carpetright, including the risk of cyber security issues disrupting cash flow – including ransomware, malware attacks, network security or fraudulent attempts to obtain sensitive information.

More than xx (xx%) of retailers consider cyber and data security a top three risk for the year ahead according to our latest research with Barclays, with a xx pinning cyber security as a primary risk. Although attacks remain rare, the potential for severe disruption among retailers is high. Retailers are having to invest in technology, employee training, strengthening supply chains, and diversifying product offerings to build resilience and safeguard operations.

Take out a FREE 30 day membership trial to read the full report.

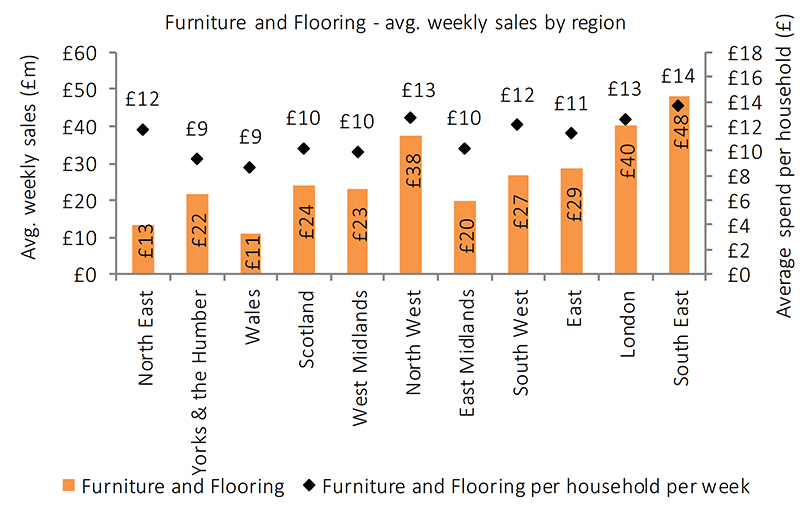

Furniture and Flooring- avg. weekly sales by region

Source: Retail Economics, ONS, seasonally adjusted

Source: Retail Economics, ONS, seasonally adjusted