UK Furniture & Flooring Sector Report summary

August 2025

Period covered: Period covered: 06 July – 02 August 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring – Retail Economics Index

Furniture and flooring sales rose by xx% year-on-year in July. This was below June’s stronger showing but a clear improvement on the xx% decline a year earlier.

Performance also sat just under the three-month average of xx%. Growth was steady rather than spectacular, reflecting cautious but ongoing recovery in big-ticket spending.

Several factors affected this performance, including:

Sunny weather: A warm sunny start to the month helped boost spending on essentials. Across the month, the UK recorded a mean temperature of xx °C,xx °C above the long-term average, making it the fifth warmest July on record. Minimum temperatures were especially notable, ranking as the second highest on record.

Housing activity as a driver: Stabilising mortgage rates and steadier house prices encouraged a lift in moves and associated furnishing spend. New homeowners were particularly active in entry-level furniture and essential flooring.

Planned replacement: Many households finally replaced worn sofas, beds, and flooring after delaying purchases during the cost-of-living squeeze. Finance options and targeted summer clearance sales helped unlock demand.

Selective spending: Consumers remain focused on value and practicality. Big outlays are still weighed carefully, but items that balance affordability with quality drew attention.

Channel performance: Retail parks and online channels captured most activity, benefiting from destination shopping and delivery options. High street independents continued to struggle with weaker passing trade.

Category performance

Living room and bedroom furniture: Sofas, beds, and wardrobes were the core growth drivers, supported by clearance promotions and finance deals. Mid-market retailers reported steady orders, while high-end pieces remained slow.

Flooring: Laminate and vinyl gained traction as cost-effective alternatives to more expensive renovations. Carpets showed modest recovery, with demand centred on budget ranges.

Accessories and storage: Ready-to-assemble storage solutions, small decorative pieces, and functional home accessories sold steadily, giving retailers a volume boost without stretching household budgets.

Footfall

Retail park stores performed best, lifted by larger format shopping and ease of access. July’s warm weather supported weekend visits, though some of that traffic drifted toward leisure destinations once the school holidays began.

City-centre independents saw lower footfall, relying on loyal or local shoppers rather than casual visitors. Online activity remained strong, with visualisation tools and home delivery continuing to shape purchasing habits.

Outlook

Furniture and flooring continues a gradual recovery, with July marking another month of growth. The sector remains highly sensitive to housing activity, interest rates, and consumer confidence.

Retailers with strong value propositions, accessible finance, and efficient supply chains are best placed to capture cautious but genuine demand.

Late-summer clearance and autumn campaign preparations will shape the months ahead, with growth hinging on whether housing stabilisation lifts household confidence.

Take out a FREE 30 day membership trial to read the full report.

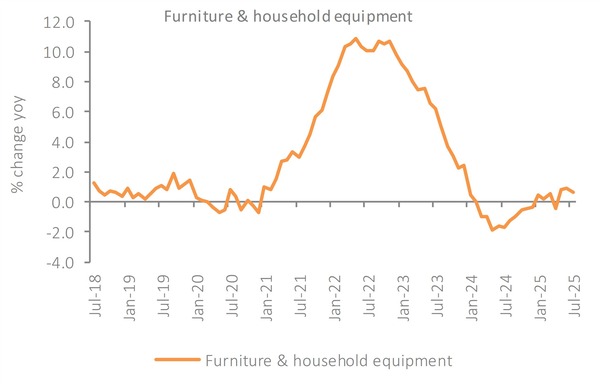

Furniture & Household Equipment inflation rose by 0.7% YoY in July from a 0.9% rise in the previous month

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis