UK Food & Grocery Sector Report summary

November 2024

Period covered: Period covered 29 September – 26 October 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food & Grocery sales rose by a modest xx% rise in October, against xx% growth a year earlier, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Several factors impacted this performance:

- Lower inflation: Stabilising food inflation, compared to double-digit price rises a year ago, is contributing to tough annual comparisons and weaker sales in value terms.

- Half-term timing: A later-than-usual October half-term deferred associated retail spending, including days out and grocery purchases, into November.

- Halloween: Halloween and early Christmas shopping boosted confectionery and festive item sales.

- Budget jitters: Speculation around tax rises and fiscal measures in the Autumn Budget dampened consumer confidence, with GfK’s Consumer Confidence Index falling to -21, its lowest since March. Many shoppers held back spending in anticipation of Christmas and Black Friday promotions.

Food sales flatlined (+xx%), with growth driven by Halloween spending and early Christmas shopping, partially offset by consumer caution ahead of the Budget and a later half-term break compared to last year.

Halloween boosted sales, with xx million households buying pumpkins and confectionery sales reaching £525 million, driven by chocolates (+xx%) and sweets (+xx%) (Kantar).

Early signs of Christmas shopping emerged, with xx shoppers buying Christmas cakes and xx% of households purchasing mince pies (Kantar).

Food and non-alcoholic drink inflation remained stable at xx% in October, below 2% for the sixth consecutive month (ONS).

Loyalty pricing

- The Competition and Markets Authority (CMA) investigated loyalty pricing as part of its efforts to support consumers during the cost-of-living crisis, examining trustworthiness, price comparisons, and accessibility.

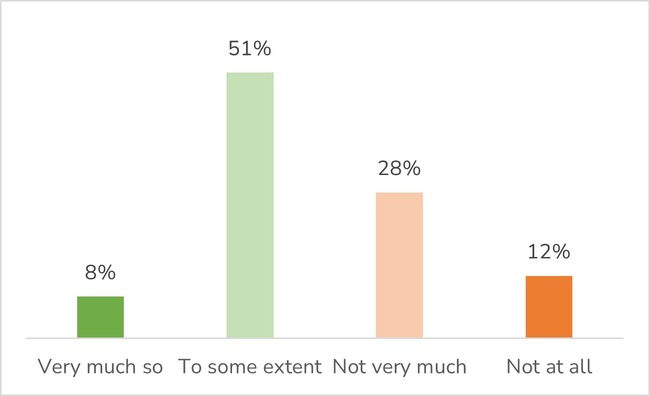

- Over xx (xx%) of UK consumers believe prices for non-members are inflated during loyalty price promotions.

- However, after analysing over 50,000 grocery products on loyalty price promotions, the CMA found little evidence of supermarkets inflating ‘usual’ prices, with xx% of cases offering "genuine" savings compared to the usual price at the same store.

- xx of UK shoppers are members of at least one supermarket loyalty scheme, holding an average of xx memberships, with xx% holding five or more.

Take out a FREE 30 day membership trial to read the full report.

The extent to which shoppers trust that the loyalty price for members is a genuine saving on the usual price

Source: Retail Economics, CMA

Source: Retail Economics, CMA