UK Food & Grocery Sector Report summary

July 2025

Period covered: Period covered: 01 June – 05 July 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food sales rose by xx% in June according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted). This is below the three-month average of xx%, despite higher inflation in June.

Adjusting for rising inflation, Food volumes declined (-xx% in June according to the ONS).

Several factors impacted this performance:

- Heatwave: The UK experienced its second warmest June since records began, with two heatwaves in mid and late June. The month was sunnier than average.

- Smaller baskets in-store: Shoppers adapted to the heat with smaller but more frequent store visits, which saw online experience double-digit growth.

- Budget concerns: Headline inflation rose to 3.6% in June, reinforcing caution as consumer confidence dipped into July.

- Value front and centre: Nearly xx% of grocery spend was on promotion. Shoppers hunted deals, traded down, and prioritised own-brand.

Multiple sources track UK Food & Grocery sales, each using different methodologies, sample sizes, and reporting periods. Retail Economics provides a consolidated view by aggregating data from key sources, supported by panel insights.

Inflationary pressures

Softening volumes reflect the continued tension between rising prices and evolving shopping behaviours. UK inflation rose to xx% in June, up from xx% in May, as Food inflation climbed to xx%.

This spring has been the sunniest and warmest on record (Met Office), stressing arable crops such as barley and wheat.

Over two thirds (68%) of shoppers reported becoming more cautious with their spending habits over the last three months (Retail Economics shopper sentiment survey).

Inflationary concerns are not only changing what consumers buy but also how meals are made, with simpler preparation becoming a cost saving measure. Almost seven in ten dinner plates now include fewer than six components (Worldpanel, four weeks to 13 July 2025).

Value driven behaviour continues to dominate the grocery sector. Nearly xx% of total grocery spend in June was made on promotion, as shoppers actively hunted for deals, traded down into value tiers and prioritised own brand lines. Own label sales grew by xx%, ahead of branded growth of xx% (Worldpanel).

The combined effect has seen the discounters’ Aldi and Lidl joint market share rise to xx% (Worldpanel). In response, the major grocers leaned heavily on loyalty linked pricing mechanics and value focused messaging to protect volumes and perception.

While inflation continues to shape the sector, the narrative is shifting compared with the urgency of the past two years. Rather than blanket frugality, there is evidence of polarisation in spending power.

For around two in five UK households, inflation at an 18-month high is still a defining pressure on budgets, while other segments are resuming selective discretionary spend.

Take out a FREE 30 day membership trial to read the full report.

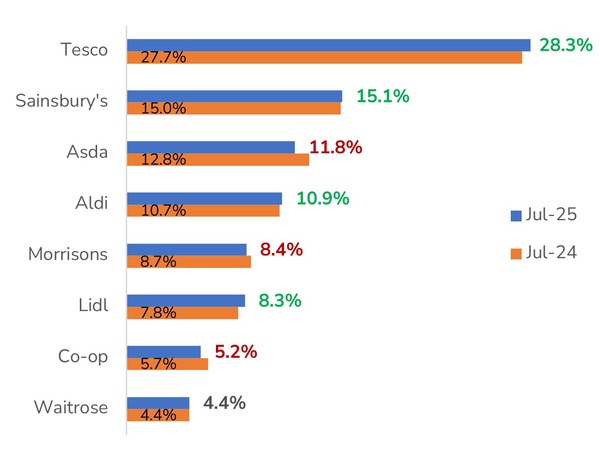

UK Grocery Market Share (12 weeks to 13 July)

Source: Kantar, Retail Economics

Source: Kantar, Retail Economics