UK Food & Grocery Sector Report summary

August 2025

Period covered: Period covered: 06 July – 02 August 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food sales rose by xx% year-on-year in July according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted), compared with a xx% rise a year ago.

The uplift was supported by seasonal trading at the start of the month, but volumes remain under pressure. Food prices climbed to xx% in July, meaning many households are still paying more for less.

Several factors impacted this performance:

Heatwave surge: The month opened with the hottest day of the year so far, at xx°C in Kent, which drove strong sales of BBQ foods, salads, chilled drinks and frozen treats.

Event-led spending: England’s victory in the UEFA Women’s Euro 2025 created big match occasions that lifted alcohol, snacks and party food.

Shift in missions: NielsenIQ reported a xx% rise in store visits in the four weeks to 9 August, but average basket spend dropped xx% as shoppers spread budgets across smaller, more frequent trips. “Dinner for tonight” missions are now the fastest-growing trip type, accounting for one in five supermarket visits.

Value-conscious behaviour: Worldpanel data shows xx% of total grocery spend in July was made on promotion, with shoppers actively cherry-picking deals, shifting to own-label in many categories, and using loyalty-linked discounts to control spend.

Multiple sources track UK Food & Grocery sales, each using different methodologies, sample sizes, and reporting periods. Retail Economics provides a consolidated view by aggregating data from key sources, supported by panel insights (see here for more).

Category performance

Seasonal categories were the clear winners. Fresh fruit and salad lines also benefitted, alongside strong demand for chilled meats and BBQ essentials. Premium own-label ranges gained ground in categories like ice cream and desserts, where shoppers allowed small indulgences.

In core grocery, shoppers showed a preference for convenience and simplicity. Ready meals grew by xx% YoY and chilled pizza sales rose xx%, with average dinner preparation times dropping below xx minutes for the first time on record (Worldpanel).

Frozen products also advanced, with frozen fruit up xx% in value. These shifts suggest consumers are cutting complexity and prioritising affordability, speed and treat-led value at home.

Macroeconomic backdrop

July’s food retailing unfolded against sticky inflation and fragile sentiment. Inflation edged up to xx% as food inflation surged to a xx% driven by beef, chocolate, coffee, and fruit juices. While these levels are far lower than the double-digit peaks of 2022-23, they remain a defining pressure on household budgets.

GfK’s consumer confidence index dipped to -xx, with shoppers reporting more comfort managing their own finances than the national outlook, but precautionary saving hit its highest level since 2007.

Wage growth, at xx%, continued to deliver modest real income gains for many, but unevenly. Households with secure jobs or higher incomes were more likely to keep buying premium groceries or branded treats, while others stayed anchored to value ranges. This polarisation is becoming a structural feature of the market.

Operating pressures

Retailers continued to navigate margin strain in July. Rising business costs, from higher employer national insurance to logistics, were compounded by the political debate over a potential supermarket rates surcharge.

Large grocers warned that any additional burden could translate into higher prices or store closures, emphasising how cost inflation remains a critical risk for the sector.

Take out a FREE 30 day membership trial to read the full report.

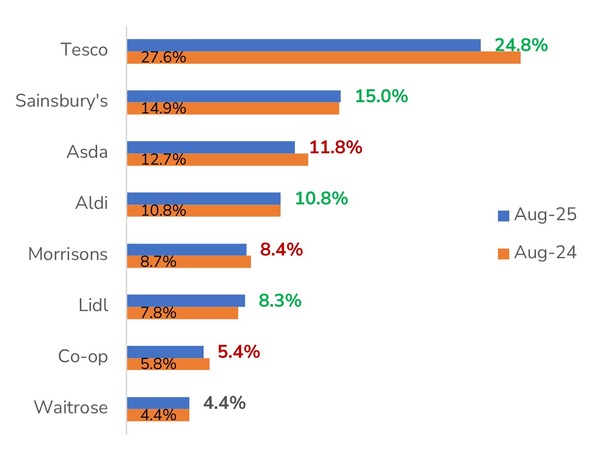

UK Grocery Market Share (12 weeks to 10 August) | Note: green denotes share gain, red denotes share loss.

Source: Kantar, Retail Economics

Source: Kantar, Retail Economics