UK Electricals Sector Report summary

September 2025

Period covered: Period covered: 03 August - 30 August 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Electricals sales

Electricals sales rose by xx% year-on-year in August, ahead of the xx% decline a year ago.

Growth came in slightly above the three-month average of xx%, confirming a stabilisation in demand in recent months.

Key drivers and category performance

The back-to-school season was the dominant driver of demand. Computing equipment, peripherals, and tablets all saw a lift as parents and students shopped for new academic terms. Promotional activity around student bundles helped concentrate sales in the second half of the month.

Gaming held up well as households looked for affordable at-home entertainment during the summer holidays.

Elsewhere, trade was patchier. Mobile phones recorded incremental growth, supported by mid-tier launches and clearance activity, but many shoppers waited for flagship releases in September.

Audio-visual and large domestic appliances were more subdued, with purchases focused on lower price points or replacement-led missions.

Large domestic appliances delivered steady but unspectacular sales. Purchases were primarily replacement-led, with consumers reluctant to commit to costly upgrades.

Seasonal cooling products, which sold strongly in July, carried through briefly into early August before tapering off.

Footfall patterns

Retail parks, the traditional stronghold for electricals, saw footfall fall by xx% year-on-year in August, limiting physical store sales.

High street chains benefitted from higher summer footfall, particularly in city centres outside London, but conversion remained dependent on aggressive discounting.

Online channels continued to play a crucial role, particularly for computing and gaming, where digital convenience and price transparency gave online specialists an edge.

Outlook

The electricals sector enters autumn with steadier momentum, but growth is fragile. Seasonal demand around new tech launches in September should provide a further boost, though margins will remain tight as retailers lean on promotions. Large domestic appliances and premium audio-visual categories will be slower to recover, with purchases dictated by replacement cycles rather than desire.

Retailers with a sharp value proposition, clear promotions, and compelling online experiences will be best placed to capture demand. As real incomes edge higher, electricals should gradually shift from stabilisation to modest growth, though the sector remains highly sensitive to shifts in consumer confidence and broader economic pressures.

Take out a FREE 30 day membership trial to read the full report.

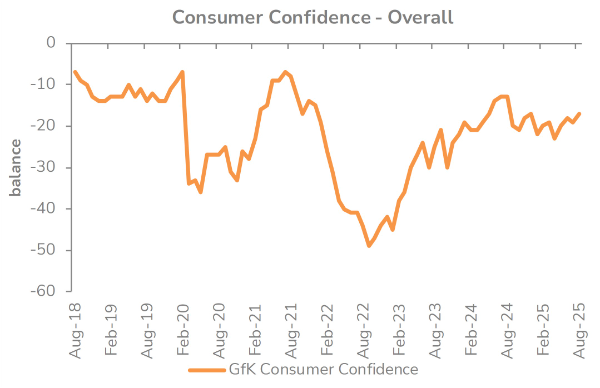

Consumer confidence increased by two points in August

Source: GFK, Retail Economics analysis

Source: GFK, Retail Economics analysis