UK Electricals Sector Report summary

October 2025

Period covered: Period covered: 31 August - 04 October 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Electricals sales

Electricals sales declined by xx% year-on-year in September, a marginal improvement on the xx% contraction recorded a year earlier but weaker than the three-month average of xx%.

Trading remained subdued, with no sustained uplift from either promotional activity or new product launches. The month marked a return to cautious purchasing patterns, as households weighed up big-ticket spend against the backdrop of a cooling jobs market and ongoing cost-of-living pressures.

Key drivers and category performance

Demand for electricals continued to diverge by category. Mobile, computing and wearables saw pockets of growth tied to product refreshes, but larger household appliances and TVs underperformed. Many shoppers postponed discretionary purchases, opting to extend the life of existing items unless promotional value or necessity prompted action.

Apple’s autumn launches generated interest but limited conversion. The iPhone 17 and Apple Watch Series 11 debuted in mid-September, with marketing focused on marginal gains in performance and design.

While footfall and online traffic increased around release dates, upgrades were largely confined to committed Apple users or those eligible for trade-in schemes. Broader demand remained restrained, with many households delaying device replacement in favour of cost management.

Demand remained stable for smaller domestic appliances, like kitchen gadgets and health-led appliances such as air fryers and blenders. These products continued to benefit from gifting and self-improvement narratives.

Footfall patterns

Footfall in electronics stores remained patchy. Retail parks offered more resilience due to their convenience, but overall traffic was subdued. Online activity lifted modestly around Apple’s launch window, but conversion remained lower than expected.

Retailers continued to see success with hybrid journeys with online research followed by in-store assessment or click-and-collect while reviews, product comparisons and video content played a growing role in customer decision-making.

Underlying environment

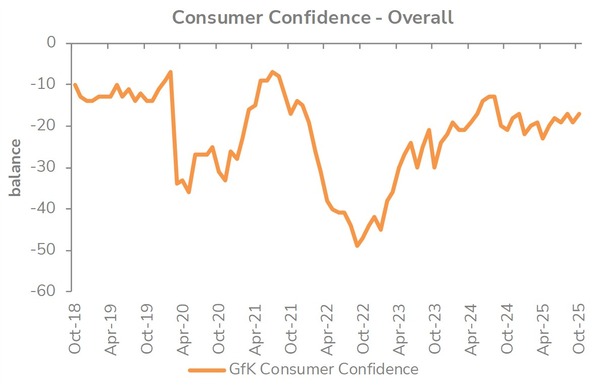

The broader economic picture offered little short-term encouragement. Consumer confidence fell to -xx, with the cost of essentials and concerns over future tax increases in next month’s Autumn Budget continuing to dampen household sentiment.

Wage growth of xx% remained above inflation, which was unchanged at xx%, offering some real income relief, but this was countered by a rise in unemployment to xx% and declining job vacancies.

Credit conditions remained tight. Interest rates on consumer borrowing stayed elevated, which added further caution to high-ticket purchasing. For many households, electricals continues to be planned and often delayed expenditure.

Take out a FREE 30 day membership trial to read the full report.

Consumer confidence increased by two points in October

Source: GFK, Retail Economics analysis

Source: GFK, Retail Economics analysis