UK Electricals Sector Report summary

October 2024

Period covered: Period covered: 25 August – 28 September 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Electricals sales

Electricals sales rose by xx% YoY in September, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted) against a xx% decline a year ago.

After more than three years of consecutive declines, Electricals turned to growth (+xx% YoY in September). Back-to-school purchases of laptops and accessories, coupled with Apple’s iPhone 16 launch, helped drive a recovery.

Underlying environment

Inflation eased to xx% in September, marking the lowest rate in over three years. This faster-than-expected drop has bolstered confidence that interest rate cuts are on the horizon, with markets expecting a reduction in November. While consumer confidence dipped to -xx, driven by concerns over personal finances and the upcoming Budget, inflation’s decline and the prospect of lower borrowing costs could help restore optimism in the months ahead.

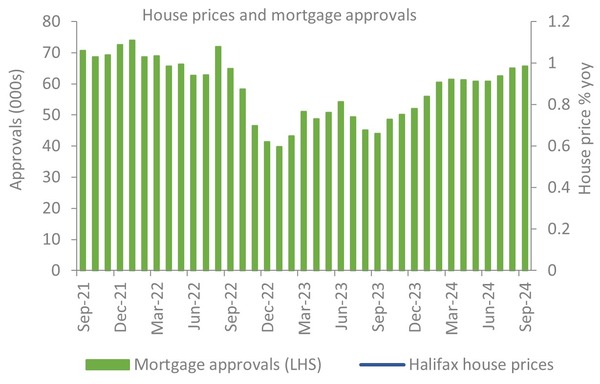

The housing market continues its recovery, with prices rising for the third consecutive month, supported by falling mortgage rates and improving buyer sentiment. This steady growth in the housing sector offers some reassurance as other parts of the economy adjust.

In the labour market, earnings growth has slowed, falling below xx% for the first time in more than two years. However, real wage growth is now outpacing inflation, offering households some respite from the cost of living pressures.

As businesses await clarity on potential National Insurance changes in the upcoming Budget, the outlook remains cautiously optimistic, with improving conditions likely to support a rebound in consumer spending in the near term.

Flexible payment options

Earlier this month Currys revamped its credit offering, now branded as Flexpay, in response to increasing demand for more flexible payment solutions. Previously known as Your Plan, Flexpay allows customers to spread the cost of their purchases through fixed monthly payments or a buy now, pay later option, available both in-store and online.

The service has been extended to cover a wider range of categories, offering customers greater flexibility and clearer visibility of their credit balances across multiple purchases.

This change follows the retailer’s revelation that one in every five pounds spent with them now uses their flexible payment option, surpassing the amount spent via traditional credit cards.

Currys Flexpay, powered by BNP Paribas Personal Finance, provides access to various low-rate and interest-free credit promotions on selected products, making it easier for customers to purchase the latest technology.

Take out a FREE 30 day membership trial to read the full report.

House prices up

Source: Retail Economics, ONS

Source: Retail Economics, ONS