UK DIY & Gardening Sector Report summary

September 2024

Period covered: Period covered: 28 July – 24 August 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

DIY & Gardening Sales

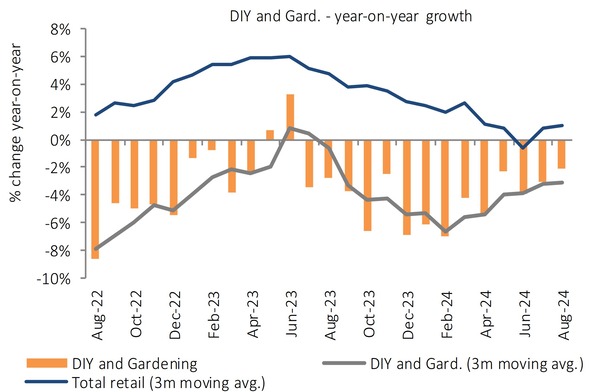

DIY & Gardening sales declined by xx% YoY in August, according to the Retail Economics Retail Sales Index (value, non-seasonally adjusted).

Sunny August sparks gardening: In August, garden centre sales increased by xx% compared to the same month last year, with garden category sales specifically up by xx%, according to an HTA Market Update.Despite a year of unpredictable weather, strong sales in non-plant categories such as catering and farm shops helped offset weaker demand for core gardening products.

Consumer confidence crumbles: Overall consumer confidence remained stable in August at xx points, improvements were seen in personal financial expectations and the Major Purchase Index, which rose by three points (GfK).However, this sentiment sharply reversed in September when consumer confidence dropped to xx.

Weak real wages: It comes as real wages remain weak at around xx% for regular pay, with hiring intentions impacted by political uncertainty. Both households and businesses express concerns over rising costs, particularly energy bills and potential tax increases in the upcoming budget. Consequently, households’ willingness to spend on retail is being choked, with consumers prioritising experiences missed out on during the pandemic.

Experiences steal the spotlight: Although warmer weather boosted sales for garden centres, the overall spending trend shifted away from home-related purchases.

Price cuts to entice spending: Fragile spending intentions are leading retailers to discount to drive sales. Price cuts have now led to deflation in non-food across various inflation measures. Consumers are prioritising escapism, leading to increased spending on travel agents by xx%, bars, pubs, and clubs by xx%, and digital content and subscriptions by xx% (Barclays).

Consumers focus on debt repayment: The gradual decline in household debt from £xx in Q1 2023 to £xx in Q1 2024 indicates that consumers are prioritising debt repayment over discretionary spending.

Housing activity picks up: Following the Bank rate drop to 5% at the start of August, housing market activity picked up in the month as mortgage rates fell for a second month and sentiment among estate agents improved.

Take out a FREE 30 day membership trial to read the full report.

Sunny Weather bolstered Garden Sales

Source: Retail Economics, ONS

Source: Retail Economics, ONS